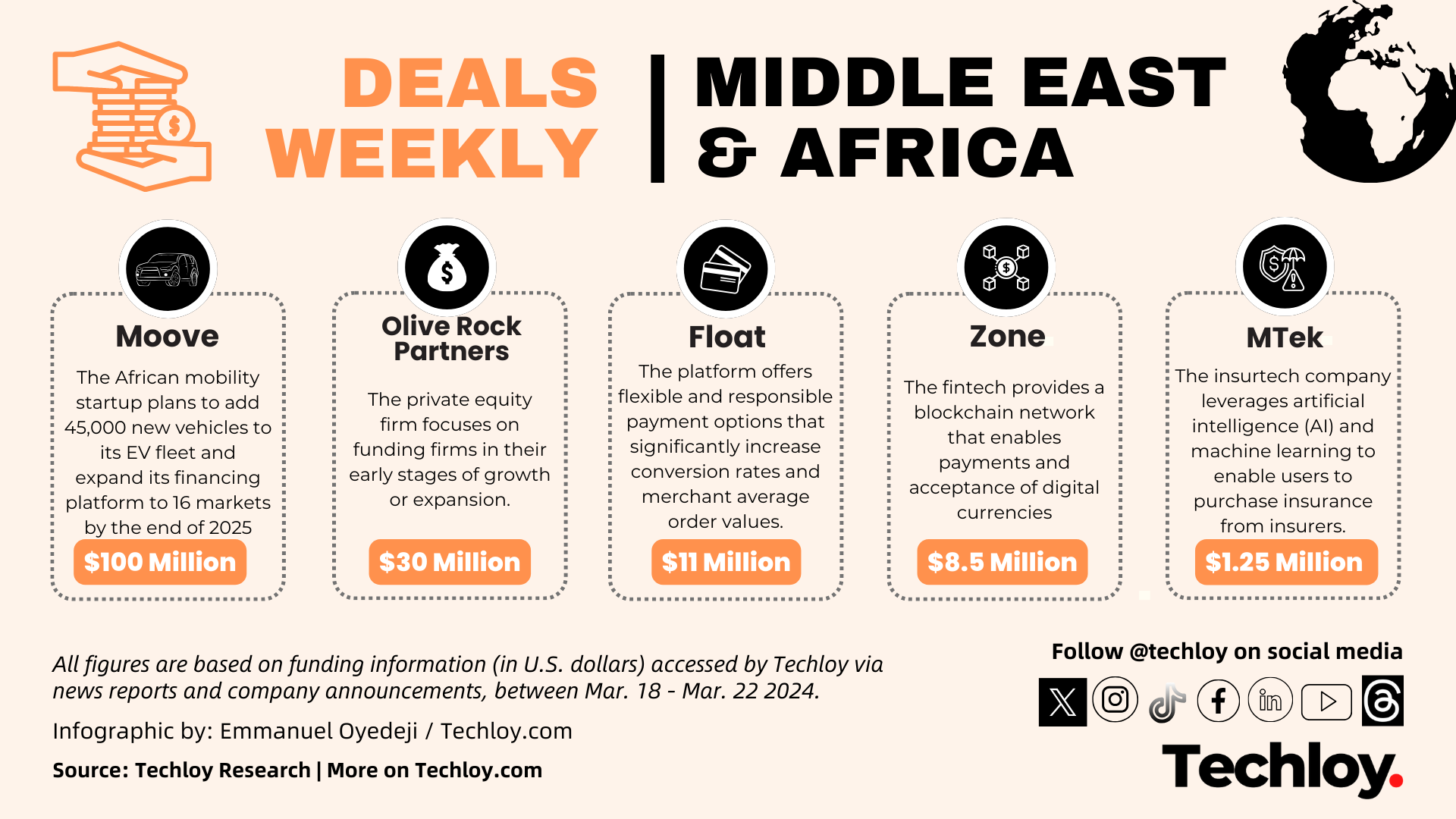

INFOGRAPHIC: Startup Funding in Africa and the Middle East — Week 12

Here are the venture funding activities we tracked in the Middle East and African region this week – including Nigeria’s Moove, Olive Rock Partners, Float, zone, and MTek.

- Moove raises $100 million in a Series B round for new market expansion.

- Olive Rock Partners fund secures $30 million to support Saudi SMEs.

- South Africa’s Float, gets $11 million to launch card-linked instalment platform

- Nigerian fintech Zone raises $8.5 million to scale decentralized payment infrastructure

- Kenya's MTek secures $1.25 million to integrate AI processes

Moove raises $100 million in a Series B round for new market expansion

- Moove, a Nigerian mobility fintech company has raised $100 million to add 45,000 new vehicles to its fleet and expand its financing platform to 16 markets.

- The investment was led by ride-hailing leader Uber and wealth fund Mubadala who led the previous round.

- This funding ensures a reliable pool of drivers for the Uber platform while getting access to a vast network of customers.

Olive Rock Partners secures $30 million to support Saudi SMEs

- UAE-based private equity firm Olive Rock Partners Fund I has secured $30 million from Saudi Venture Capital Company (SVC) in its first round of funding.

- Olive Rock is an independent private equity firm based in the Abu Dhabi Global Market (ADGM). This is aimed to encourage and assist in funding firms in their early stages of growth or expansion.

- In investing, SVC demonstrates its dedication to fostering innovation and entrepreneurship in Saudi Arabia.

South Africa’s Float gets $11 million to launch a card-linked instalment platform

- South African-based fintech Float, gets $11 million in funding facility to launch card-linked instalment platform. This is done to accelerate their growth plans over the next four years.

- The funding was led by Standard Bank, as a means to structure Float’s credit facility while providing it with long-term security and flexibility.

- Since launching in November 2021, the platform has proven to be a game-changer for merchants, offering flexible and responsible payment options that significantly increase conversion rates and merchant average order values.

Nigerian fintech Zone raises $8.5 million to scale decentralized payment infrastructure

- Nigeria's blockchain-powered zone has raised $8.5 million to scale its layer one blockchain for financial service providers across the continent.

- In a seed funding round led by Flourish Ventures, TLcom Capital, and also featuring Digital Currency Group (DCG), Verod-Kepple Africa Ventures (VKAV), Alter Global, and Endeavor Catalyst.

- Infusing this capital will enable Zone to develop its network coverage and connect more banks and financial services companies by 2025.

Kenya's MTek secures $1.25 million to integrate AI processes

- Kenyan-based Insurtech company MTech has raised $1.25 million to boost its expansion efforts within Kenya and the East African insurance markets.

- This investment was spearheaded by Verod-Kepple Africa Ventures and Founders Factory Africa following the previous $3 million from the Finclusion Group investment round in 2022.

- With a vision to increase insurance penetration across the continent, MTek is leveraging artificial intelligence (AI) and machine learning to enable users to purchase insurance from insurers and facilitate policy comparisons.

Follow our full coverage of the Middle East and African startup and technology scene and get up to date with what's happening in the key markets within the region.