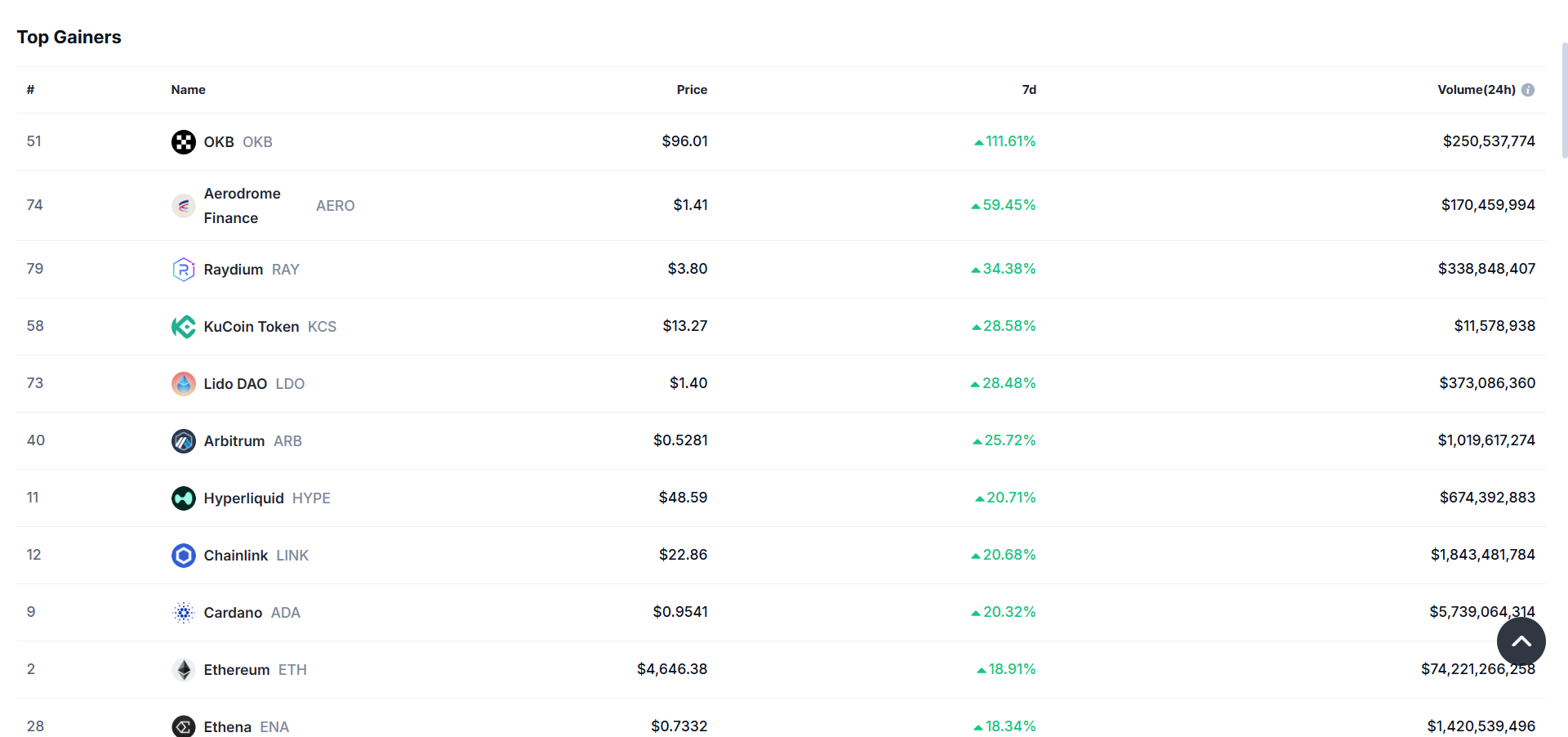

The Top 10 Crypto Gainers for Week 33

With ETH ETF inflows reaching new numbers, this might just be the push that sends Ethereum knocking on its all-time high.

Every now and then, the crypto market takes a turn when you least expect it, even with the technicals pointing you in another direction.

For weeks, speculation said there might be no smart money rotating to Ethereum and the alts. Yet here we are, the market moving in ways that leave us with mouths open.

ETH ETFs are pulling remarkable numbers, just like Bitcoin did earlier this year before it hit an all-time high.

Now Ethereum is seeing the same spike, climbing to $4,646, just shy of its $4,800 record. On August 14 alone, $729.1 million worth of ETH ETFs were bought, pushing the demand to over $2.3 billion in six days.

Bitcoin dominance has dropped from 65% to 59% while the altcoin market cap has hit $1.4 trillion, and that shift is clear in this week’s gainers.

OKB led with a massive 111% jump to $96.01 after OKX announced plans for a one-time burn of over 65 million tokens, cutting its fixed supply down to 21 million. Aerodrome Finance followed with a 59% rise to $1.41, while Raydium gained 34%.

KuCoin Token climbed 28%, and as always, when Ethereum gains momentum, its ecosystem doesn’t take a back seat—Lido DAO also rose 28%, with Arbitrum up 25%. Hyperliquid, Chainlink, and Cardano each gained around 20%, while Ethereum itself was up nearly 19%, and Ethena added 18%.

Conclusion

While it’s possible this leg up might not hold for long, especially in a market where momentum can flip in hours, the recent rotation of smart money tells its story.

Capital is moving with intent, targeting sectors and assets that fit the current narrative, much like we’ve seen in past cycles. The playbook hasn’t been thrown out, but it’s being adjusted in real time, with certain rules bent to fit new market conditions.

That balance between familiarity and unpredictability is precisely what keeps the crypto market both frustrating and fascinating for those watching closely.