Africa’s top three retail banking markets will account for 50% of revenue growth by 2022

Africa’s banking markets is the second fastest-growing and second most-profitable of any global region, and a hotbed of innovation, according to a 2018 report by McKinsey&Company.

For example, between 2012 and 2017, banking revenue pools in Africa grew at a compound annual growth rate of 11 percent in constant 2017 exchange rates, and is expected to grow at a rate of 8.5 percent up until 2022, bringing the continent’s total banking revenues to $129 billion (before risk cost), based on the report. The report further notes that out of the total estimated banking revenues of $129 billion by 2022, about $53 billion will be in retail banking — up from $35 billion in 2017, an absolute growth of $18 billion, while three quarters of the $18 billion in absolute retail revenue growth will be concentrated in 10 countries.

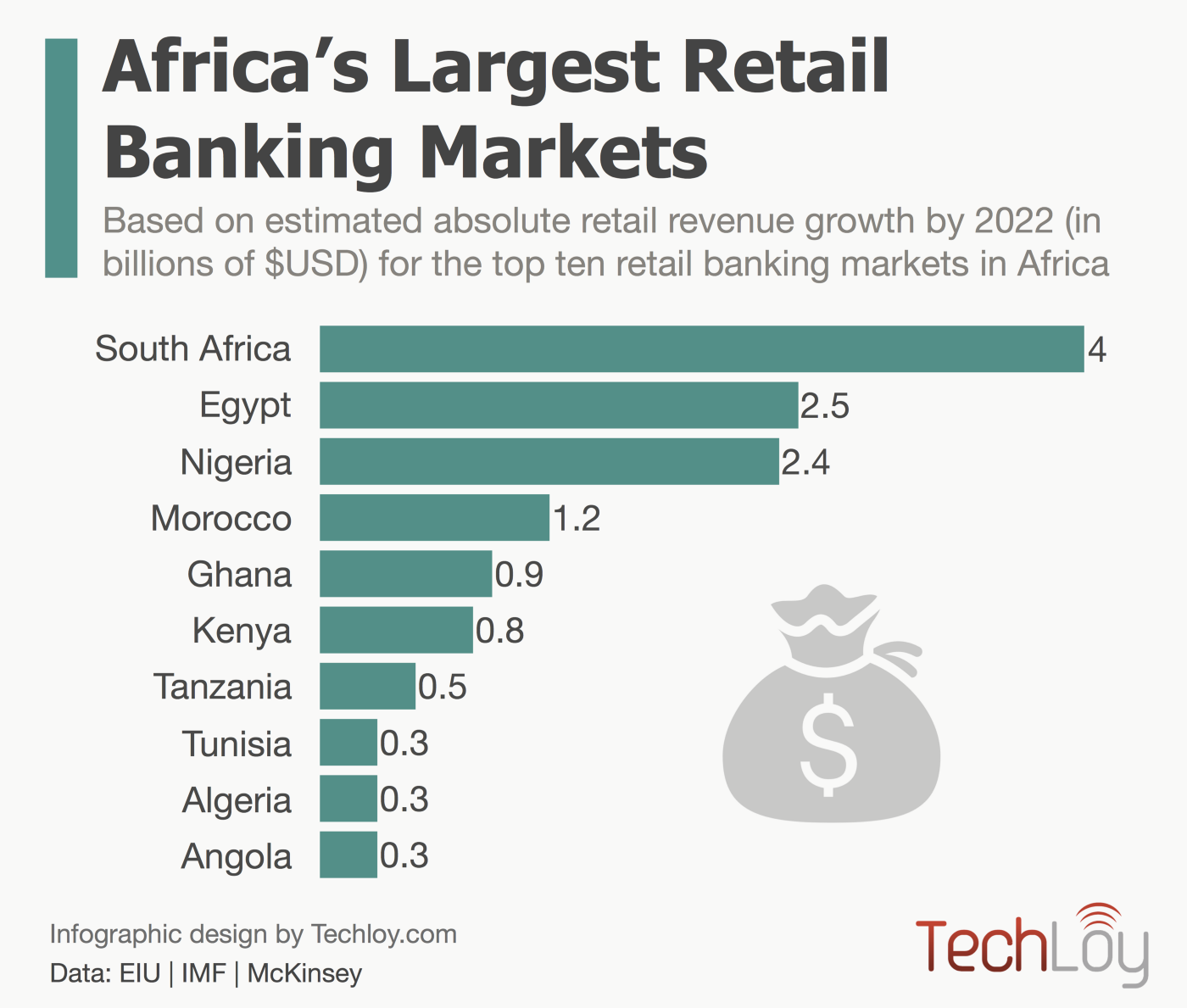

In absolute terms, the greatest growth will be in South Africa, which will account for $4 billion, or well over one-fifth of African retail banking growth, by 2022, while other leading growth markets will include Egypt, Nigeria, Morocco, Ghana, and Kenya — with the top five retail banking markets accounting for over 60% of growth up until 2022.

Techloy’s latest infographic highlights the largest retail banking markets in Africa, showing relatively mature markets, such as South Africa, Egypt and Nigeria accounting for 50% of the continent’s total revenue growth up to 2022.