CHART: Nigerians will require a proof of funds of up to ₦28.3 million to study in the UK in 2025

With the cost of living on the rise, the amount required to have saved for travel to study in the UK has been increased.

The cost of living has been steadily rising around the world, and the UK is no exception. With rent prices going up and everyday items becoming more expensive, students—both local and international—are feeling the financial strain more than ever. To help manage these rising costs, the UK government is making an important change for international students.

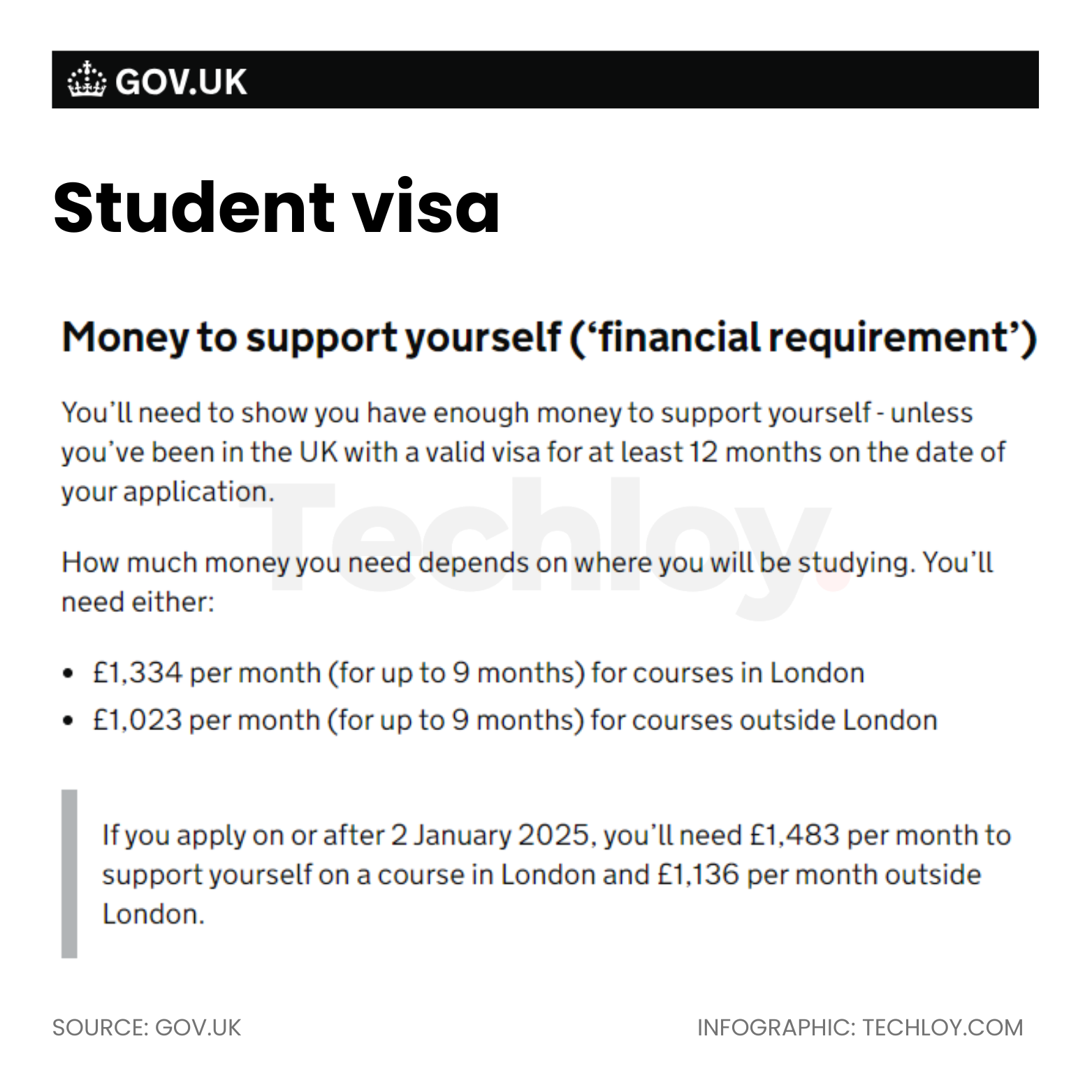

Starting on January 2, 2025, the amount of money students need to prove they have in order to study in the UK will go up. This "proof of funds" requirement is designed to make sure students can support themselves financially without needing to rely on loans or outside help. Essentially, the UK government wants to ensure students can cover living expenses, like accommodation, food, and transportation while studying.

Under the new rules, students planning to study in London will need to show they have £1,483 (about ₦3.1 million) per month, up from £1,334 ($16,908 around ₦2.8 million). For a 9-month study period, this comes to £13,348 (₦28.3 million). If students are studying outside of London, the monthly amount rises from £1,023 (₦2.1 million) to £1,136 (₦2.4 million), meaning they’ll need £10,224 ($12,949 or ₦21.5 million) for 9 months.

This increase in the UK’s proof of funds requirement is part of a wider trend. Other countries, like Canada, Germany, and Australia, have also raised the amount of money students must prove they have to study there, as the Techloy chart below shows.

In December 2023, Canada almost doubled its savings requirement, jumping from $7,163 (₦12 million) to $14,780 (₦25 million). In May 2024, Australia raised its minimum funds by 21%, from $15,974 (₦27 million) to $19,537 (₦33 million), making it Australia's second increment in less than ten months after raising the minimum from $13724 (₦23 million).

Germany also announced a 6% increase for the 2024/25 academic year, bringing its requirement to €11,904 (about $12,875 or ₦22 million).

The United States is a bit flexible with its requirements, claiming it only needs students to prove they have access to at least one year’s worth of living expenses. But this is what makes the US one of the countries with the highest requirements as, depending on the institution, students might need to provide proof of up to $60,000 or $70,000 (₦116 million) or more.

While these numbers may be discouraging to many, there are still many ways people can get past this stumbling block without necessarily having the full funds required.

Depending on the country or the institution, other ways to prove that you can financially take care of yourself range from providing a scholarship or grant offer, showing evidence of financial support from a sponsor, demonstrating income from part-time work or savings, or even offering a letter of financial guarantee from a family member.

Some institutions might also allow a combination of these options to meet the required amount.

These increases come as the cost of living rises around the world, especially in major cities like London, where rent, food, and other essentials have become much more expensive. The goal of these changes is to ensure students have enough money to comfortably cover their daily expenses while studying abroad.

For Nigerian students, these rising costs are especially challenging because the value of the Nigerian Naira has been dropping rapidly. Just over a year ago, £1 was worth ₦580, but now it’s ₦2,182—a massive 276.48% increase. This makes studying abroad even more expensive for students from Nigeria.

In addition to the increase in the required funds, there are also new rules for students who want to bring dependants, like spouses or children. Students will need to show additional proof of funds for each dependant, so students need to factor this into their financial planning.

All in all, these changes mean that international students will need to plan, budget carefully, and start saving earlier than they might have expected.