China’s BYD surpasses Tesla in EV sales and revenue amid intensifying global competition

BYD isn’t just a competitor anymore—it’s the new leader of the EV race.

For years, Tesla has been the name that dominated every conversation about electric vehicles. It was the company that made EVs cool, the one that put Elon Musk at the center of the clean-energy revolution. But in 2024, the balance shifted. China’s BYD has now officially pulled ahead—not just in car sales but in revenue too.

In 2024, BYD reported a massive 777 billion yuan ($107 billion) in revenue, a 29% jump from 2023. It delivered 4.27 million vehicles worldwide, including fully electric and hybrid models. Tesla, meanwhile, saw its first annual decline in deliveries, shipping 1.79 million cars and earning $97.7 billion in revenue.

BYD’s Winning Formula: More Cars, Lower Prices, Faster Charging

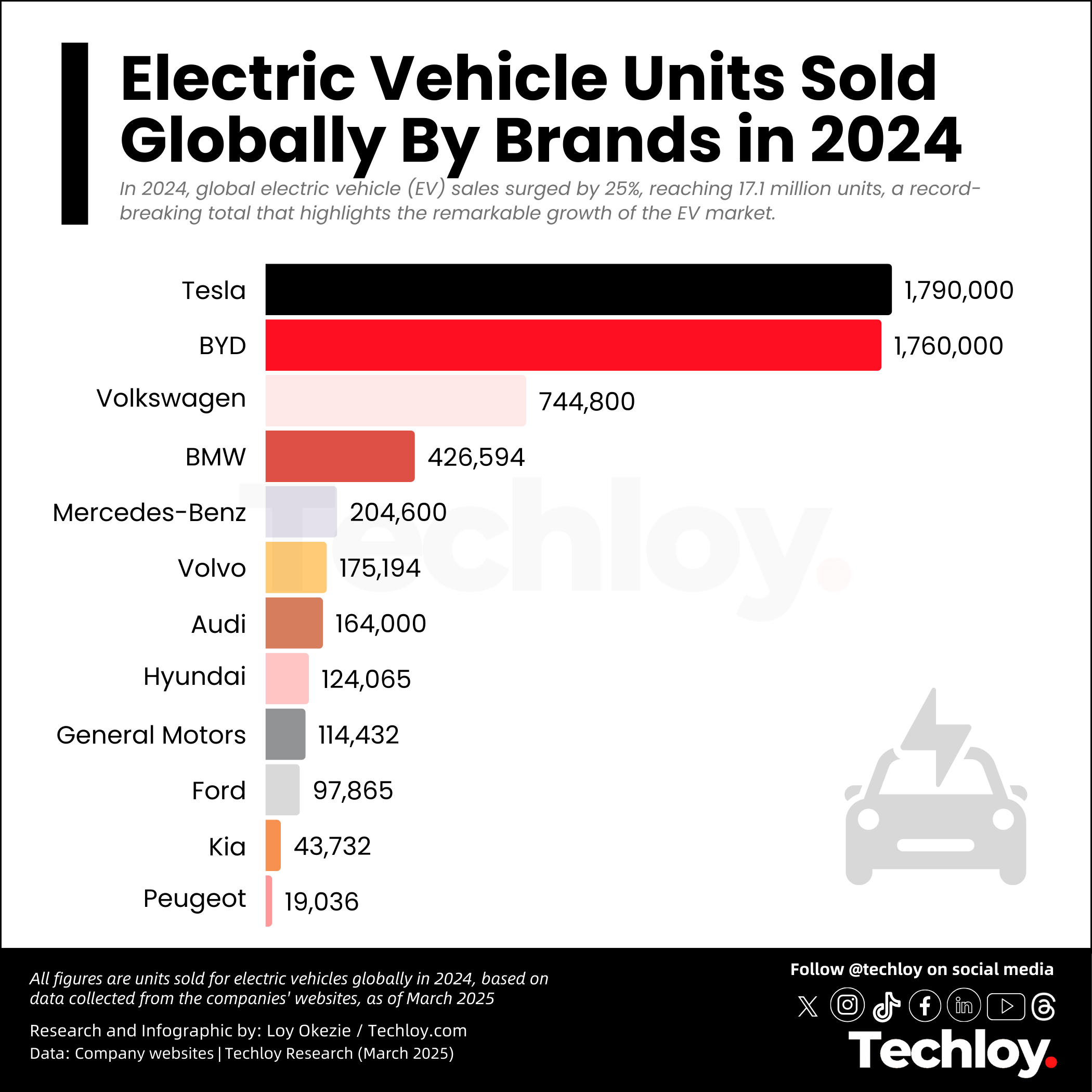

BYD is winning on volume, particularly because of its hybrids. While Tesla and BYD were nearly neck and neck in fully electric vehicle sales globally, recording 1.79 million and 1.76 million units, respectively, its hybrid lineup pushed total sales far beyond Tesla’s reach, as the Techloy chart below shows.

Then there’s the price war. BYD’s new Qin L model starts at just 119,800 yuan ($16,500) in China, compared to Tesla’s Model 3, which costs 235,500 yuan ($32,500). With China’s economy slowing and consumers more cautious with spending, affordability is a major factor.

Then, there’s technology. BYD recently unveiled an ultra-fast charging system that can add 250 miles of range in just five minutes—far quicker than Tesla’s Superchargers, which take about 15 minutes for 200 miles.

And if that wasn’t enough, BYD is undercutting Tesla in software too. It recently rolled out its “God’s Eye” advanced driver-assistance system across all models—for free, while Tesla’s Full Self-Driving (FSD) package costs U.S. customers $99 per month or $8,000 upfront.

BYD’s Wins and Challenges in the Global Market

Of course, Tesla still has its strengths. It’s a global brand with loyal fans and a head start in markets like the U.S. and Europe. But the numbers tell a clear story: BYD is winning in China, the world’s largest car market. It claimed a massive 32% share of new energy vehicle sales in 2024, while Tesla managed just 6.1%. And it’s not just China—Tesla’s sales in Europe fell 40% in February, marking the second straight month of declines.

Other automakers are fighting for a piece of the action, too. General Motors saw a huge jump in EV sales last year, delivering 114,432 electric vehicles, a 125% increase in the fourth quarter alone, as the Techloy chart above shows. Ford isn’t far behind, with 97,865 EVs sold in 2024. The competition is heating up fast.

However, the biggest challenge for Chinese EV makers, including BYD, is the global trade landscape. The U.S. market remains mostly off-limits due to high tariffs, and the European Union is also cracking down with new trade restrictions.

Despite this, BYD is proving that it doesn’t need the U.S. to dominate the EV world. It’s already winning in China, expanding rapidly in Europe, and outpacing Tesla in expansion to emerging markets.

For years, people have wondered who would finally take Tesla’s crown. Now, it’s starting to look like the answer has arrived. BYD isn’t just a competitor anymore—it’s the new leader of the EV race.