DStv and GOtv's constant price increases in Nigeria are a recurring theme

Here’s why that's happening.

If you thought DStv and GOtv were already expensive, brace yourself, as MultiChoice, its parent company is raising prices in Nigeria. Again.

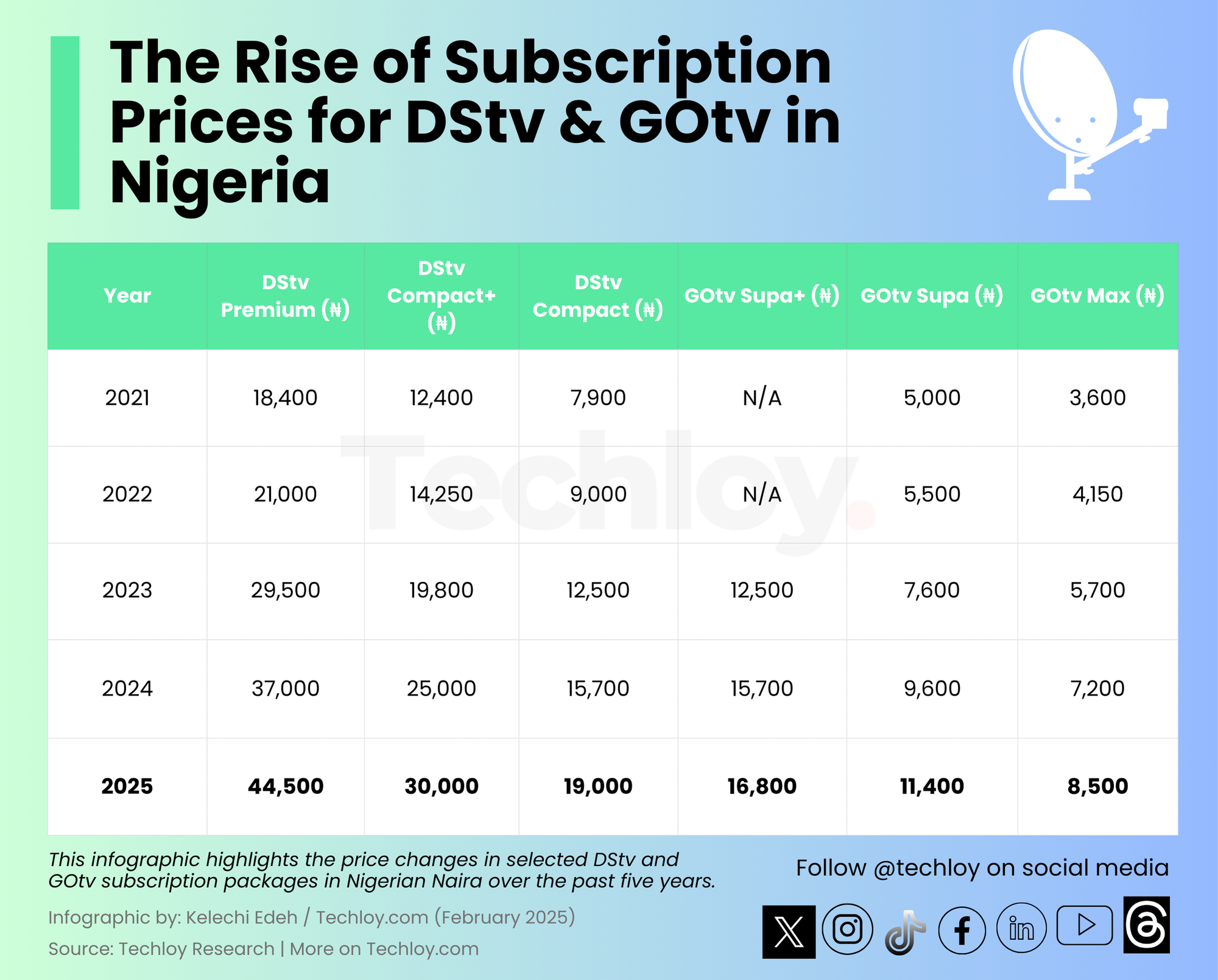

Starting March 1, DStv Premium subscribers will now pay ₦44,500 instead of ₦37,000, Compact Plus will jump to ₦30,000, and Compact subscribers will now pay ₦19,000 (up from ₦15,700). GOtv Supa Plus is also seeing one of the biggest jumps, moving from ₦12,500 to ₦16,800 in just a few months.

But the kicker is: this isn’t the first or even the second price hike in recent years. In 2023 alone, MultiChoice increased prices twice—first in May and then again in November. Last year, they did it again in May 2024. Now, just nine months later, yet another hike.

So why does MultiChoice keep raising prices? The short answer is: it is losing money.

Between April and September 2024, the company lost 243,000 Nigerian subscribers and 298,000 in Zambia—two of its biggest markets. And that’s a big problem because subscription fees make up 81.6% of MultiChoice’s revenue. Fewer subscribers mean less money.

Then there’s Nigeria’s currency crisis. The naira crashed from ₦464/$1 in 2023 to over ₦1,300/$1 in 2024, wiping out 32% of MultiChoice’s revenue in dollar terms. On top of that, in November, MultiChoice wrote off $21 million when the Central Bank of Nigeria shut down Heritage Bank, leaving its funds trapped.

By the end of 2024, the company had racked up a 2.1 billion rand (~$114 million) forex loss, thanks to Nigeria’s economic meltdown. To make up for these losses, MultiChoice says it's adopting "inflationary pricing" to keep its business afloat.

But MultiChoice isn’t alone in struggling with Nigeria’s economy. MTN Nigeria reported ₦904.9 billion in losses in 2024 due to currency devaluation. While 'Pick n Pay' pulled out in October 2024, selling off its stake in the country.

With rising costs, foreign exchange challenges, and a shrinking subscriber base, South Africa's MultiChoice is now trying to save $113 million through cost-cutting while increasing prices. But after four hikes in two years, the real question is: Will more subscribers leave?

So far, Nigeria’s regulators haven’t stepped in—but if history is any indication, the backlash might not be far behind.