e& Egypt launches first instant global transfer service in Egypt

Fast, seamless cross-border transactions—eliminating delays for Egyptian users sending money worldwide may now be possible in Egypt

We’ve all been there—the frustration of waiting for days or even hours for a money transfer to go through. But for Egyptians, that frustration may soon be a thing of the past.

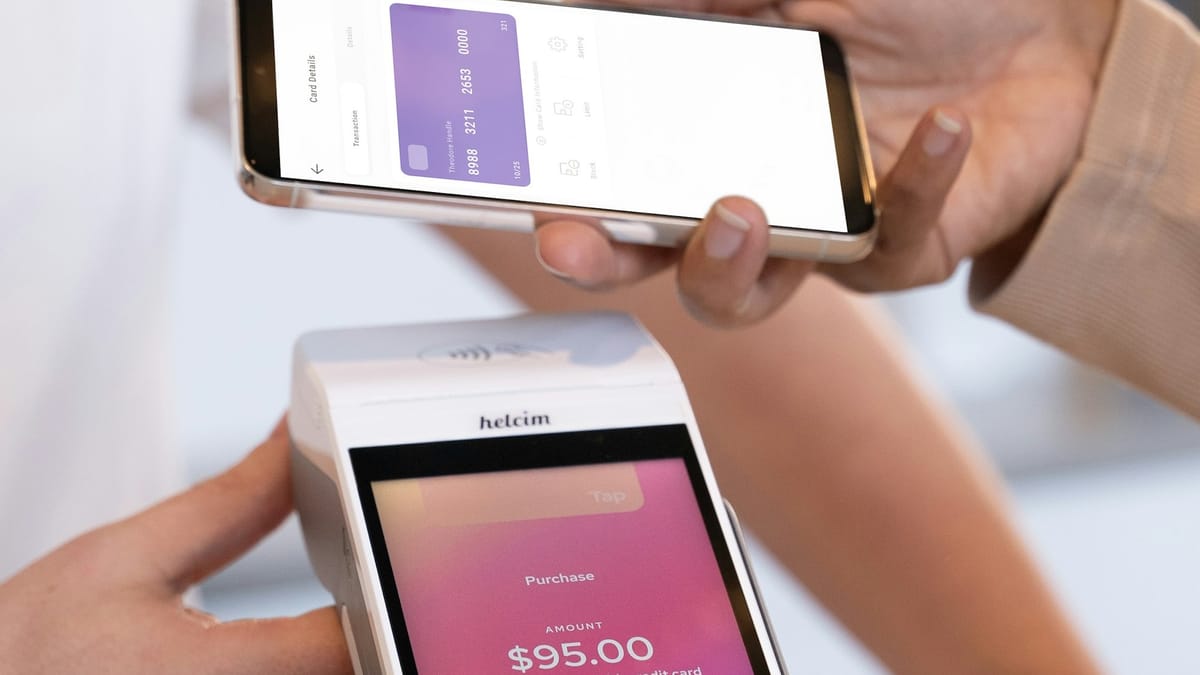

e& Egypt, a mobile operator in Egypt, has introduced the first international mobile transfer service in the country that lets users send and receive funds instantly through its e& Cash wallet app—without visiting a physical branch or dealing with third-party agents.

The service currently supports transfers between Egypt, the UAE,, and Saudi Arabia, with plans for expansion to more countries in the near future. By using its regional infrastructure, e& Egypt aims to simplify cross-border remittances and improve access to financial services for its users. For example, someone abroad can send money to their family in Egypt, who can then access it instantly on their phone—no waiting, no queues, just a simple notification and the funds are ready to be used.

The launch shows a broader change in Egypt’s financial technology sector. Over the past decade, the country has steadily embraced digital tools as part of its economic transformation. According to the Central Bank of Egypt, account ownership has jumped by more than 200% between 2016 and 2024, with over 52 million Egyptians now holding transactional accounts, including mobile wallets, prepaid cards, and bank accounts—highlighting a move away from traditional banking and toward greater financial inclusion, especially in underserved communities.

Fintech activity in the country is also accelerating, with Egypt now considered one of North Africa’s more active fintech hubs, with over 177 fintech startups and payment service providers (PSPs) reported in 2022. Additionally, the digital payments market in Egypt is expected to reach a total transaction value of $31.31 billion by 2025, per Statista.

Other African nations are also moving in the same direction. Earlier in 2025, South Sudan and Somalia launched their first national instant payment systems—part of a wider trend across the continent embracing real-time, digital-first finance.

For Egyptians, the introduction of instant transfers may mark another step in closing the gap between financial access and financial inclusion. Whether for small business transactions, family support, or personal convenience, having more tools to move money securely and quickly could make daily financial life a little easier—and more efficient.