Enterprise Cloud Spending Soared 21% YoY to Reach $61.6 Billion in Q4 2022

According to a recent report by Synergy Research Group, enterprise spending on cloud infrastructure services saw a 21% growth year-over-year (YoY) in the fourth quarter of 2022, reaching $61.6 billion worldwide.

Although this number is $10 billion more than the previous year's period, the growth rate was slower due to various economic factors such as the strong US dollar and a restricted Chinese market.

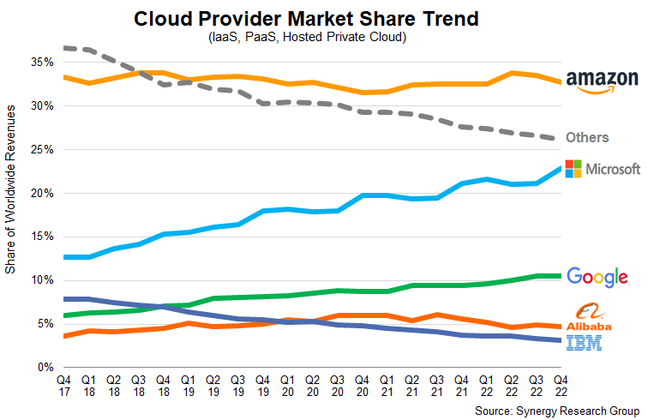

In the US market, the growth rate for Q4 was 27%, which is slightly lower than the average growth rate of 31% for the previous four quarters. The current economic climate has undoubtedly played a role in the slowing growth. Despite these challenges, the three largest cloud providers, Amazon's AWS, Microsoft Azure, and Google Cloud, continued to dominate the market, with a combined market share of 66%, up from 63% the previous year.

Azure was noted as the strongest performer, with a worldwide market share of 23%, while Amazon maintained a market share of 32-34%, and Google's share remained unchanged from the previous quarter at 11%. The other cloud platforms, including Alibaba, IBM, Salesforce, Oracle, and Tencent, held a global share of 5%, 3%, 2%, 2%, and 2% respectively.

Despite the challenges faced in the economy, the worldwide cloud market grew by $47 billion in 2022, almost matching the $49 billion growth seen in 2021. Synergy predicts that as economies improve and the foreign exchange market stabilizes, the global cloud market will continue to grow strongly in the coming years. The figures include cloud infrastructure service revenues for IaaS, PaaS, and hosted private cloud services.