How to Check Your Credit Score in Nigeria

With this, you can take control of your financial future.

Applying for a loan can feel like preparing for an exam you didn’t know you had to take. You fill out the forms, submit the required documents, and then—comes the surprise—you get rejected because of something called a credit score (SMARTScore). And you wonder, When did that become a thing?

For many Nigerians, the concept of a credit score is not as common as it is in developed economies, where credit scoring plays a crucial role in securing loans, renting apartments, or making major purchases. Yet, this little three-digit number can make or break your financial plans.

So, what exactly is a credit score, why does it matter, and—most importantly—how can you check yours? Let’s break it down.

What is a Credit Score?

A credit score is a three-digit number (ranging from 0 to 999) that shows how responsible you are with borrowed money. Lenders use this score to decide whether they should approve your loan, how much they should offer, and at what interest rate.

The higher your score, the more financially trustworthy you appear. A low score, on the other hand, signals a higher risk, which could lead to loan rejections or unfavorable terms.

Your credit score is calculated based on your borrowing history, repayment habits, and overall financial behavior. Think of it as a financial report card that summarizes how well you handle money.

Why is Your Credit Score Important?

Your credit score plays a crucial role in many financial decisions. Banks and lenders check it before approving loans, and a low score can mean higher interest rates or outright rejection. Some landlords and employers even use credit scores to assess trustworthiness.

If you want better financial opportunities, keeping track of your credit score—and improving it—is a smart move.

Credit Worthiness Scale

Here’s how credit scores are generally classified in Nigeria:

- 720 & above → Excellent (Strong financial history, low risk)

- 690 - 719 → Good (Reliable borrower, low risk)

- 630 - 689 → Fair (Some issues, but still eligible for loans)

- 300 - 629 → Poor (High risk, likely to face loan difficulties)

How to Check Your Credit Score in Nigeria

For a detailed credit report, you can visit any of the listed registered Nigerian credit bureaus for your credit score.

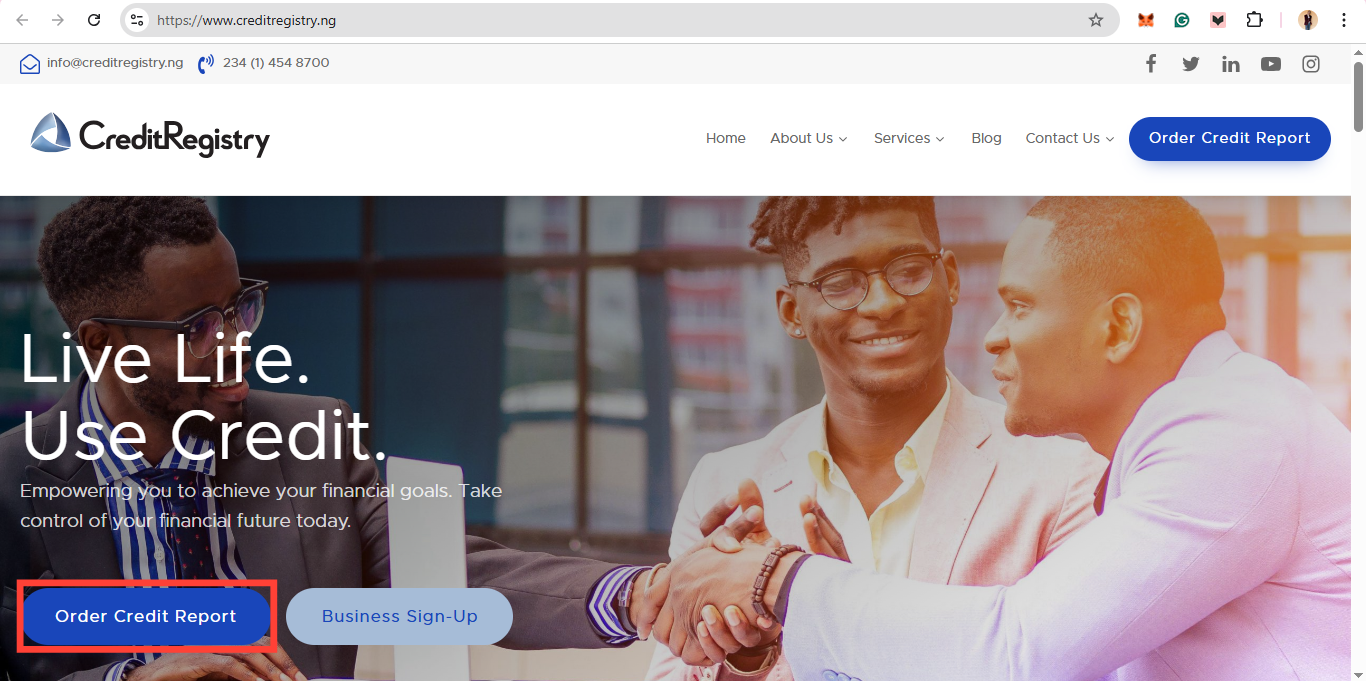

Step 1: Visit the CreditRegistry website and tap the "Order Credit Report" button.

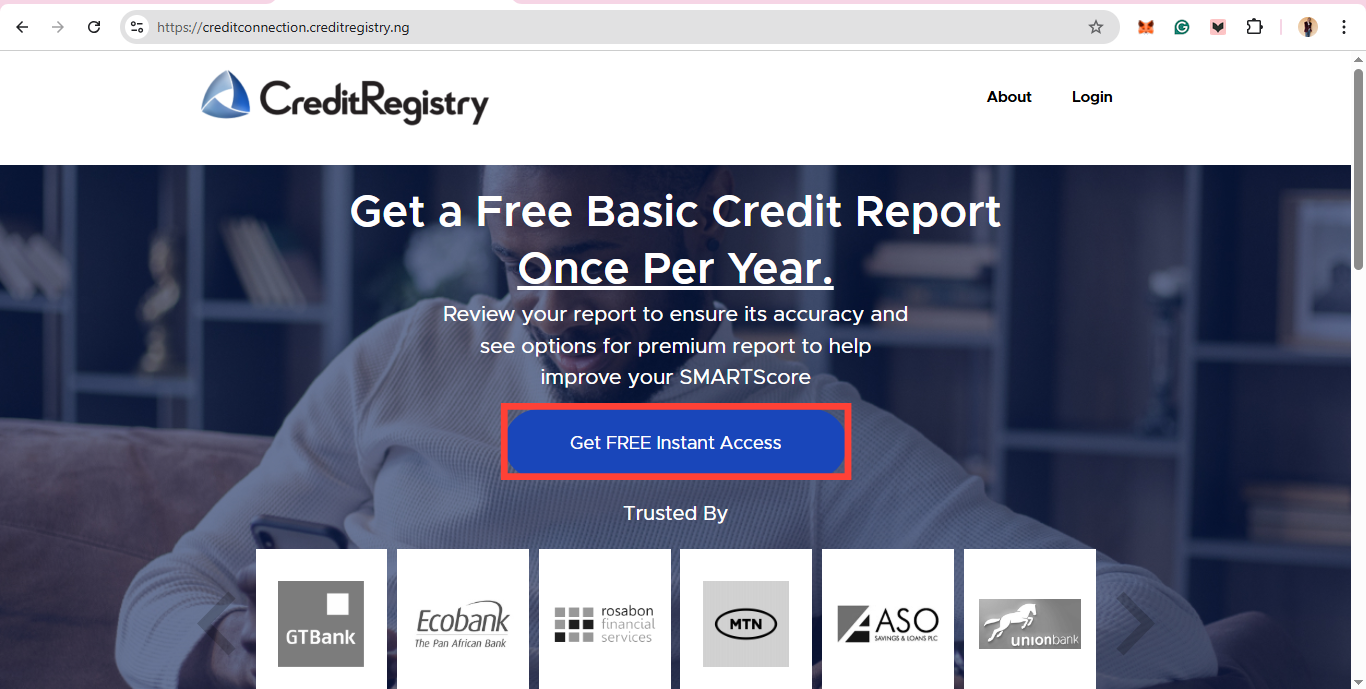

Step 2: Tap on "Get Free Instant Access"

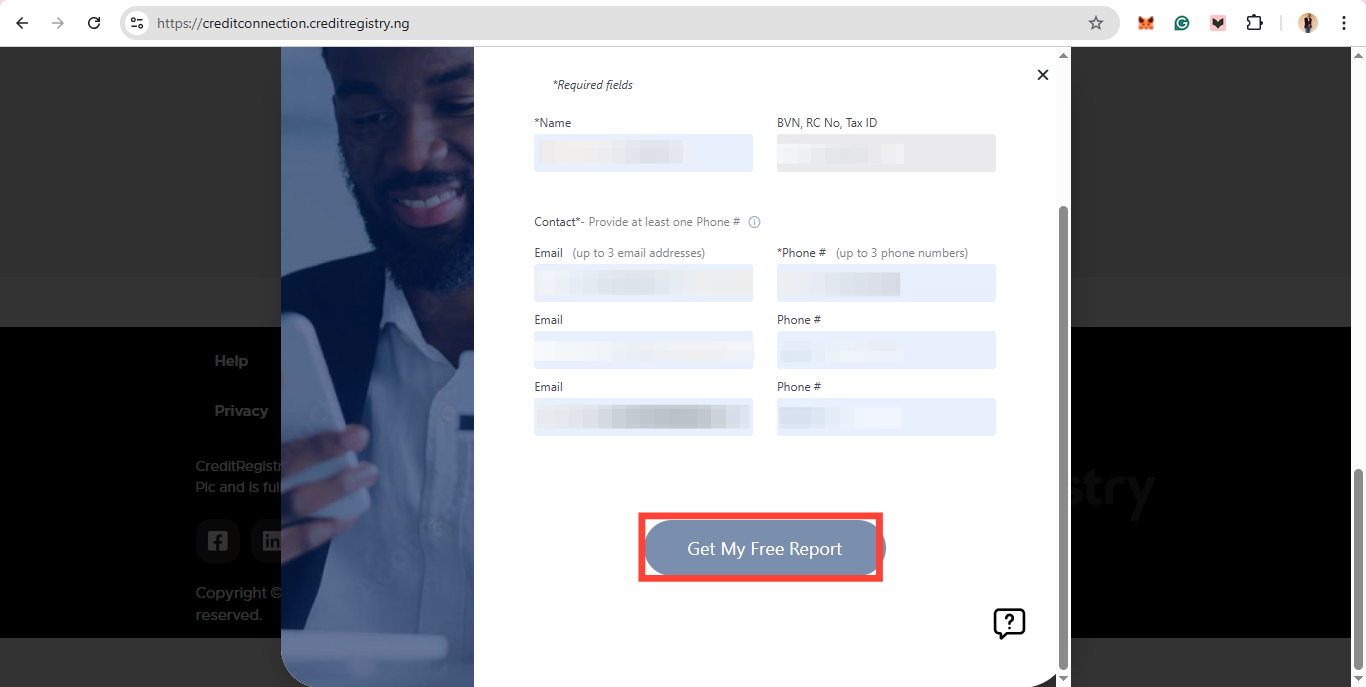

Step 3: Input your required details and click "Get My Report". Your report will be downloaded so you can review your score.

Conclusion

Overall, your credit score reflects how well you manage money and opens doors to opportunities. It’s not just about numbers—it’s about financial freedom and peace of mind. A strong credit score can mean lower interest rates, better loan approvals, and even easier approval for rentals or utilities. On the other hand, a poor score can make things more challenging, limiting your options when you need them most.

Whether you’re dreaming of buying a car, moving into a new apartment, or securing a better loan, your credit score plays a major role in making those things happen. If it’s been a while since you checked—or if you’ve never checked—you can follow the steps to check your credit score.

Image credit: David Adubiina/Techloy.com