How to set up an OPay account for your Business

This will help you gain the flexibility needed over transactions and fees.

If you frequently handle transactions, chances are you've felt the pinch of bank charges and transaction fees that pile up over time. Thankfully, OPay offers a solution – designed to simplify financial transactions and cut down on transaction costs.

With OPay, you can transfer funds at zero fees, save on costs, and access various business-oriented features—all through a mobile app. Plus, you can access loans, make payments, and streamline your financial operations.

This guide will walk you through the steps to set up an OPay account for your business with just your phone number, so you can handle transactions with ease and cost efficiency.

Steps to Set Up an OPay Account for Your Business

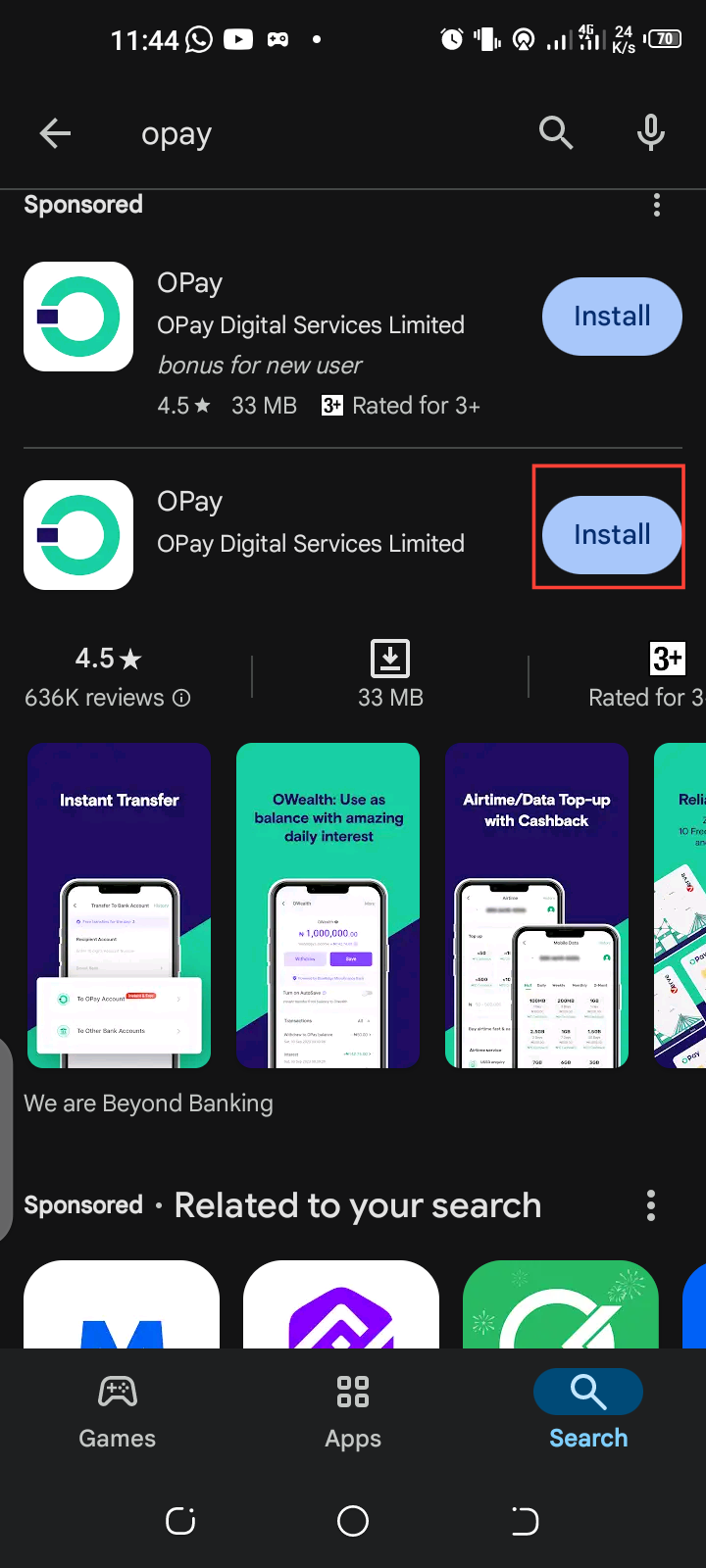

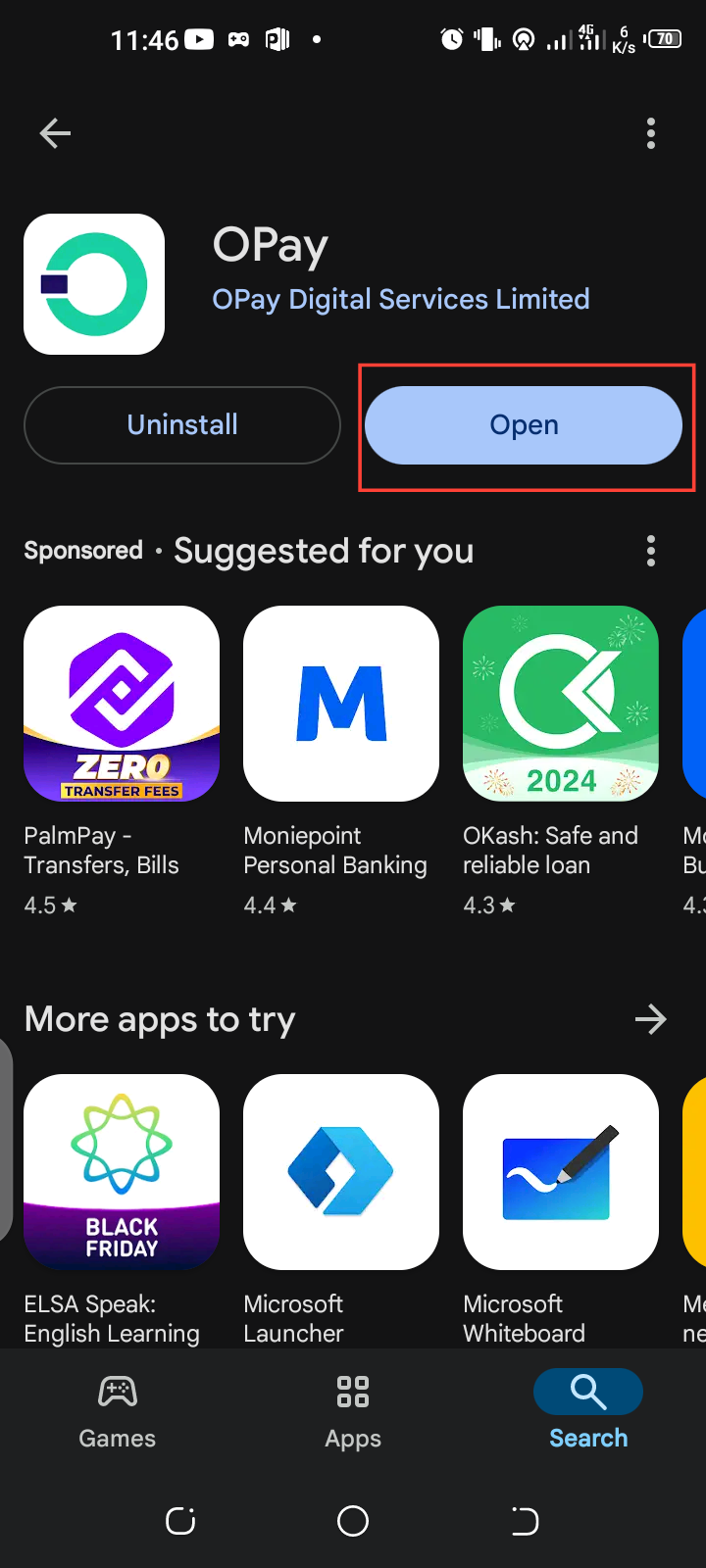

Step 1. Download the App

Search for "OPay" on the App Store (iOS) or Google Play Store (Android) and tap "Install." Once downloaded, open the app to get started.

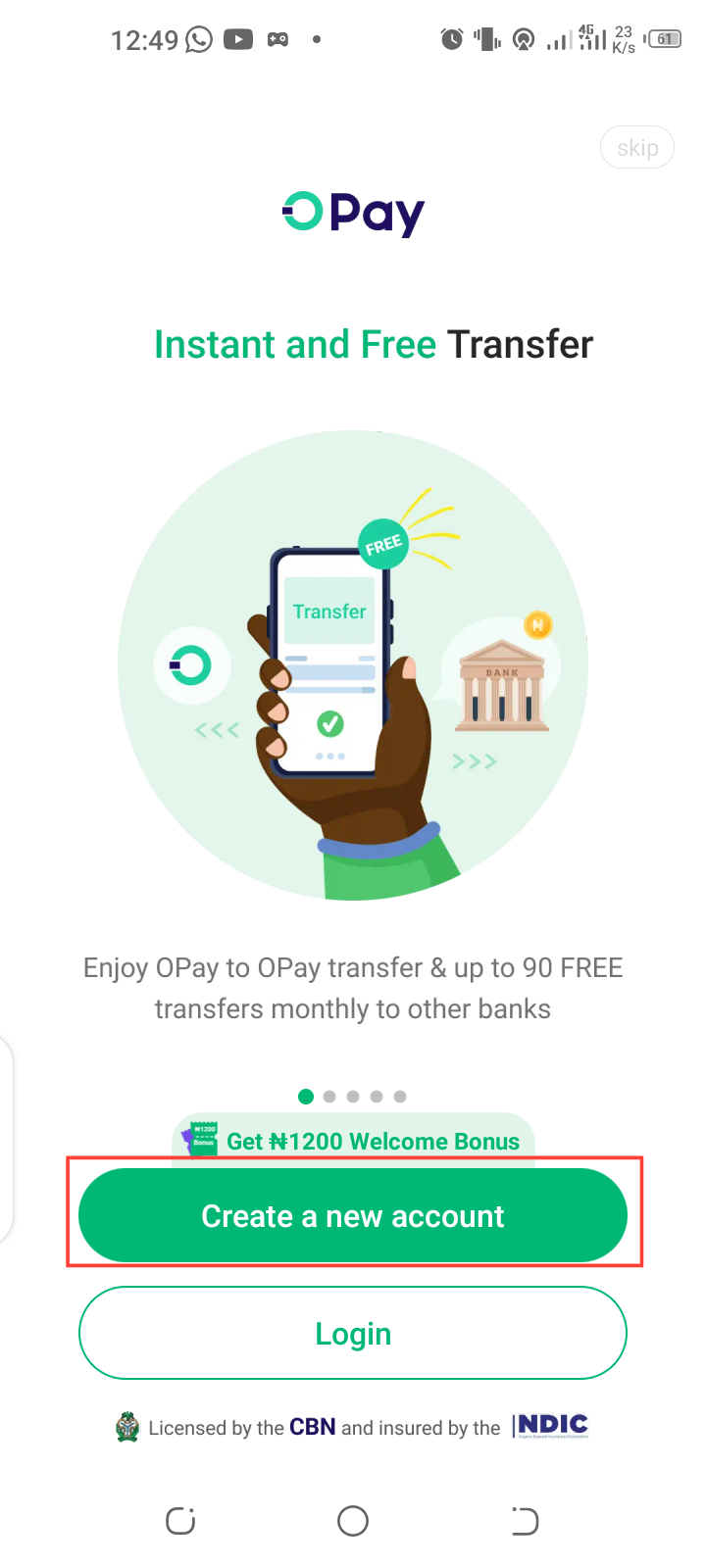

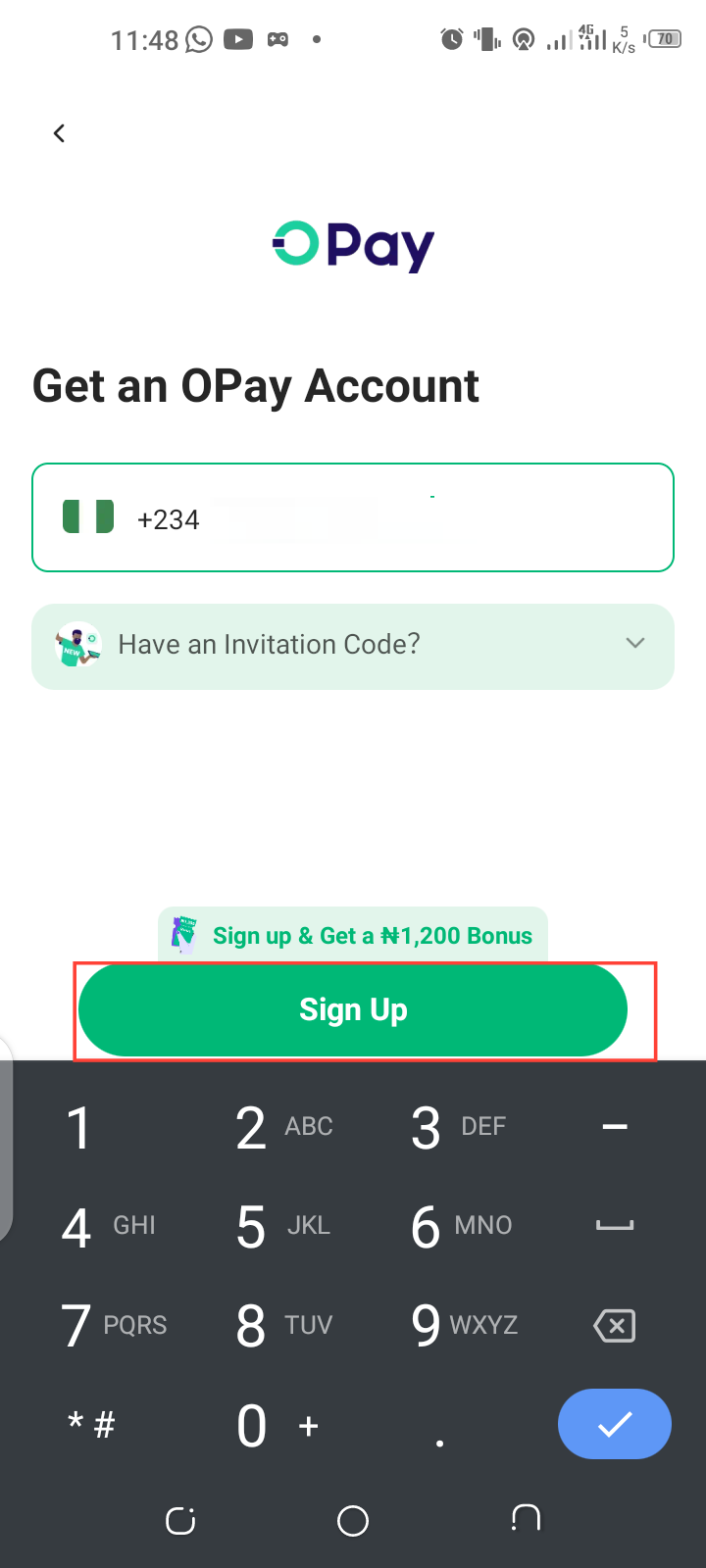

Step 2. Create Your Account

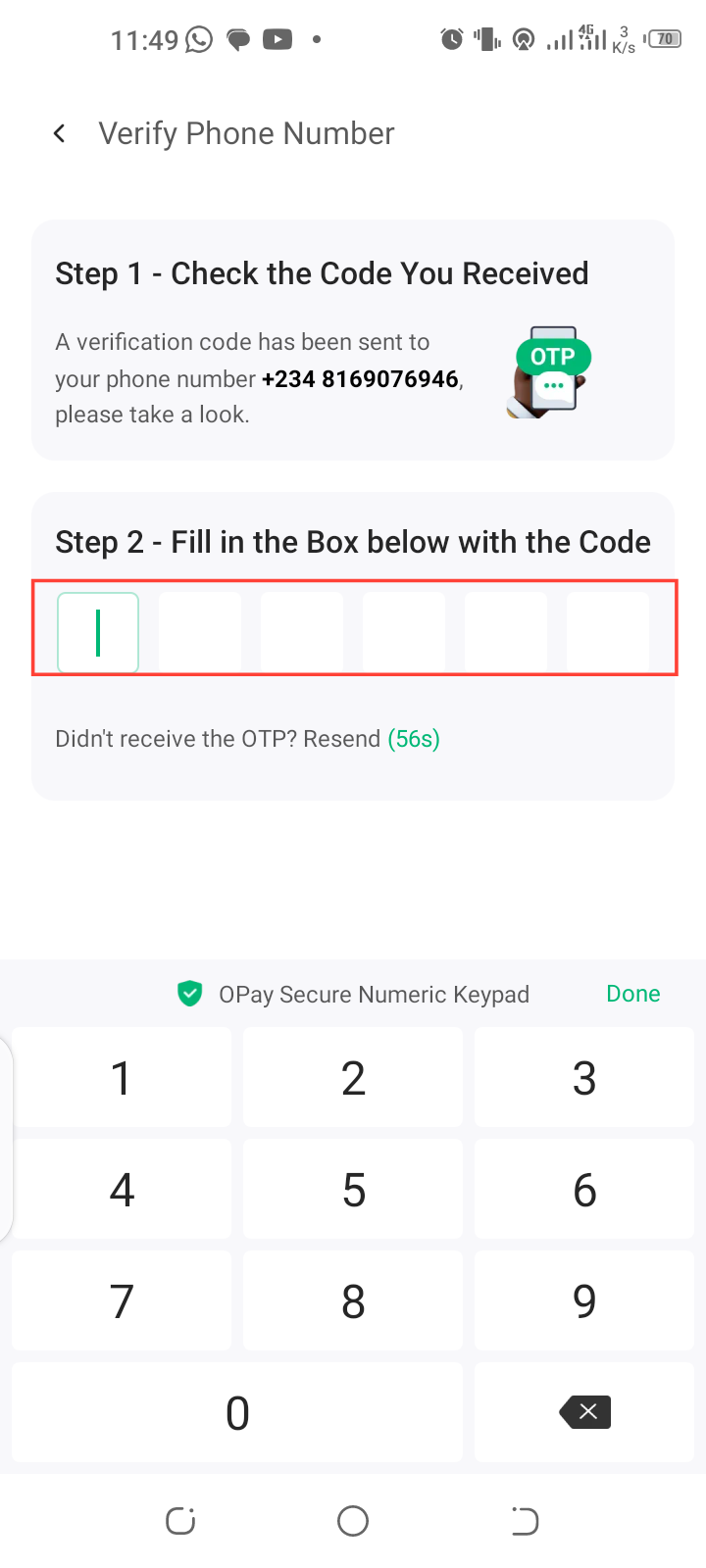

Tap "Create New Account" on the app's homepage. Enter your phone number and tap "Sign Up." OPay will send a verification code to your phone number. Enter this code to proceed.

Step 3. Verify Your Identity

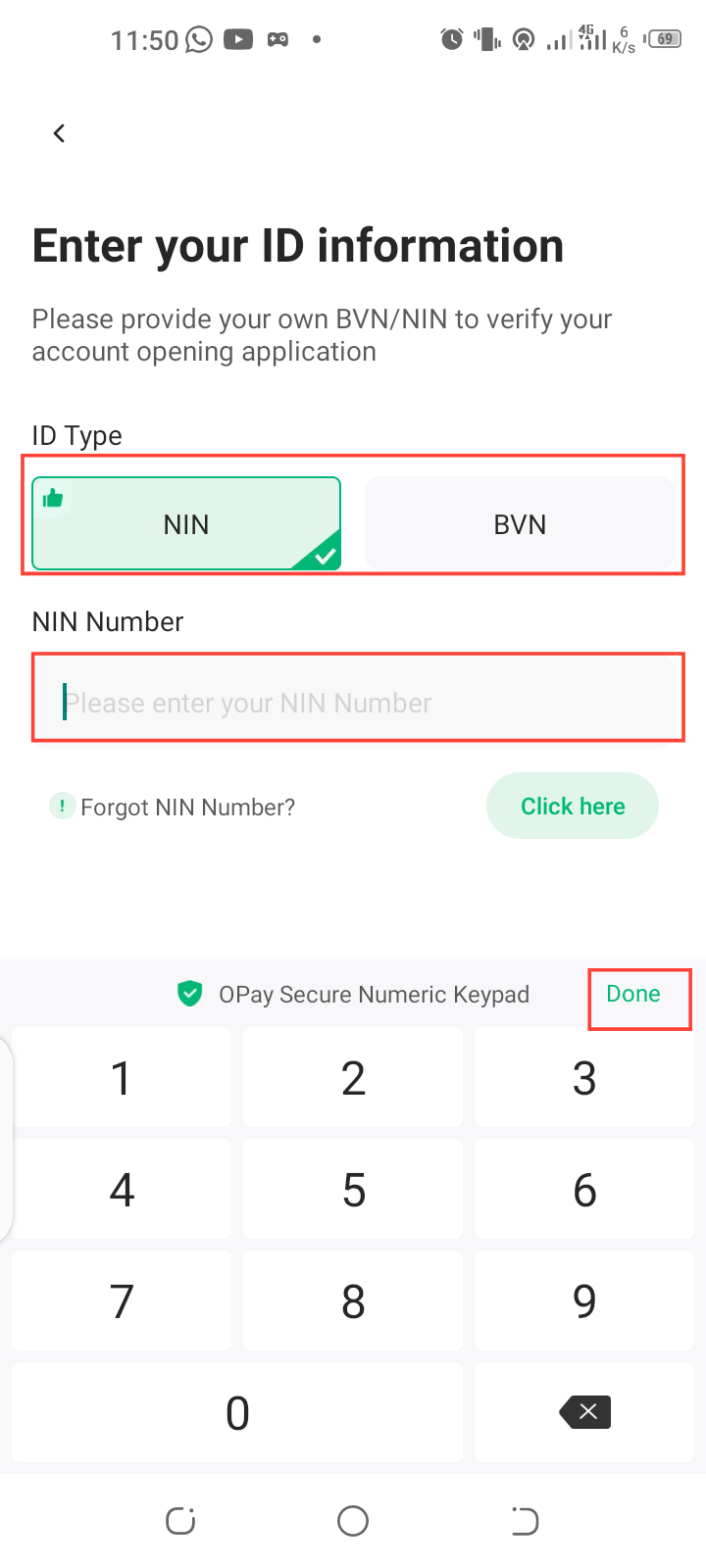

To comply with financial regulations, OPay will require you to provide your ID details. You can choose between using your National Identification Number (NIN) or Bank Verification Number (BVN). After entering your ID details, you will be prompted to take a photo for verification purposes.

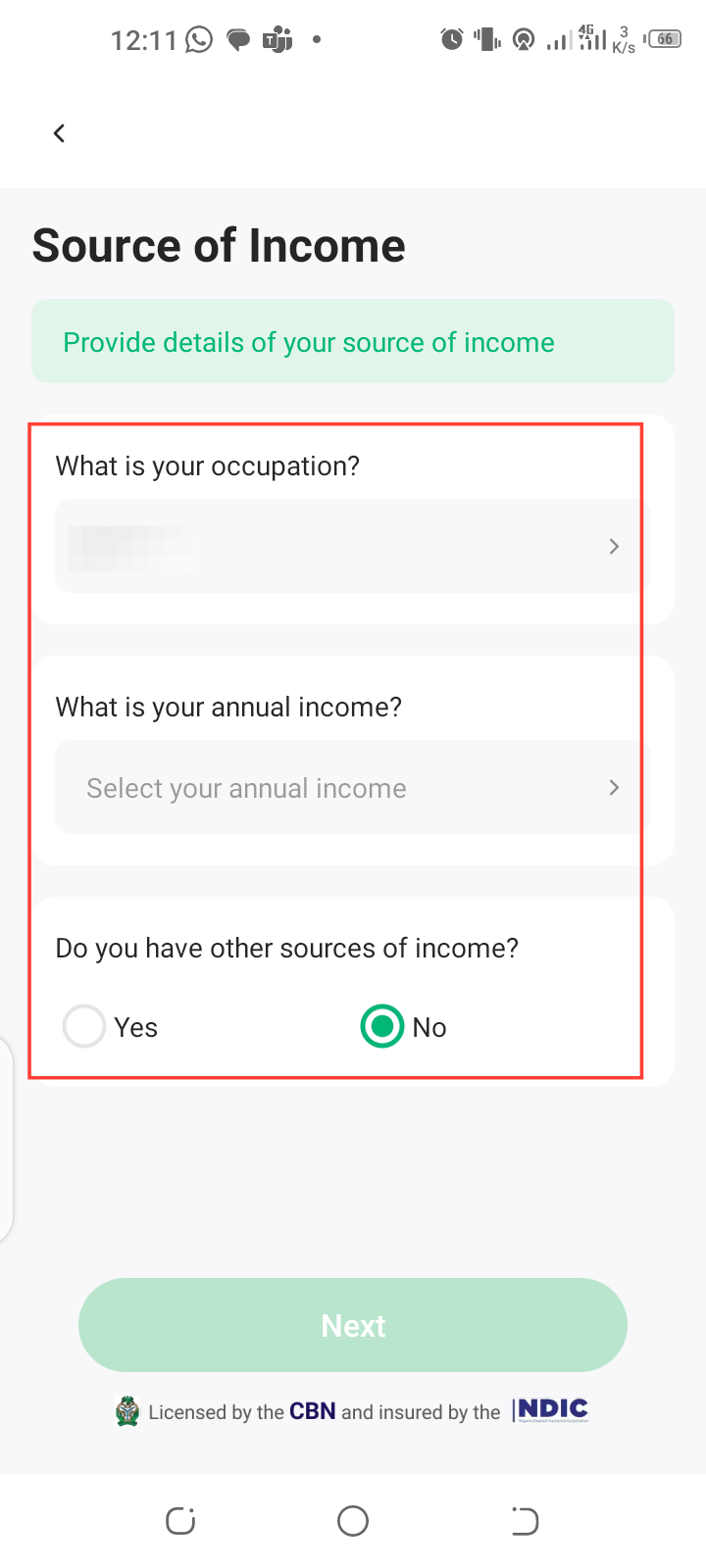

Step 4. Complete Profile Details

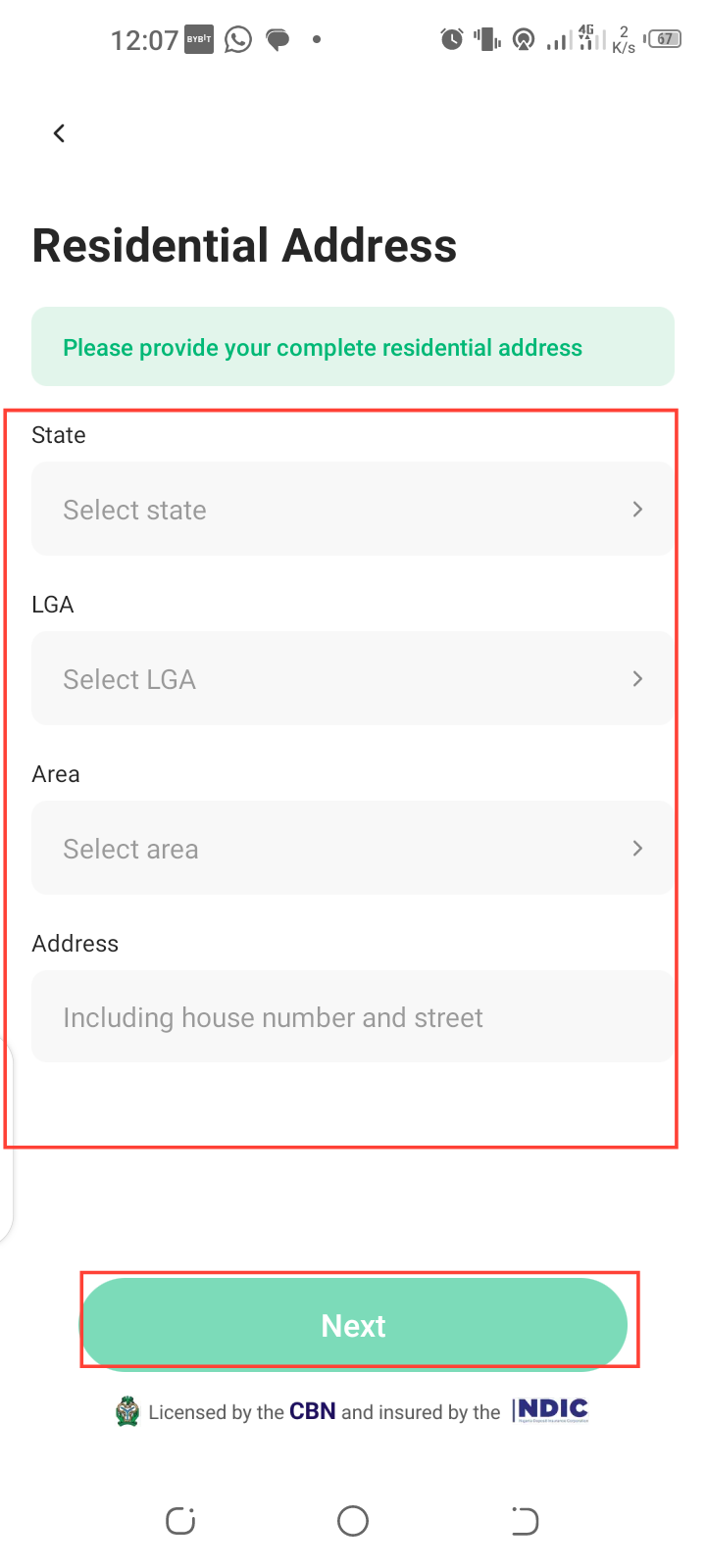

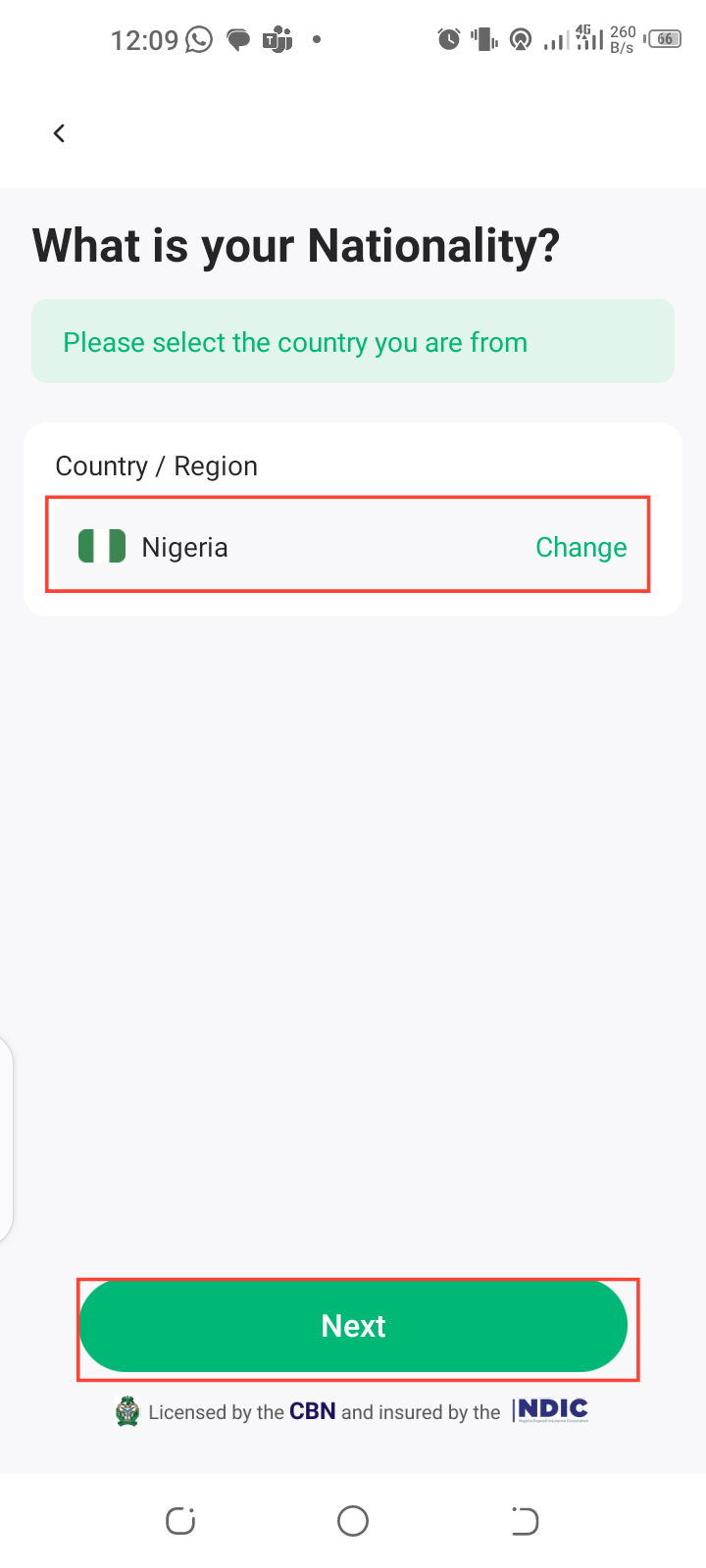

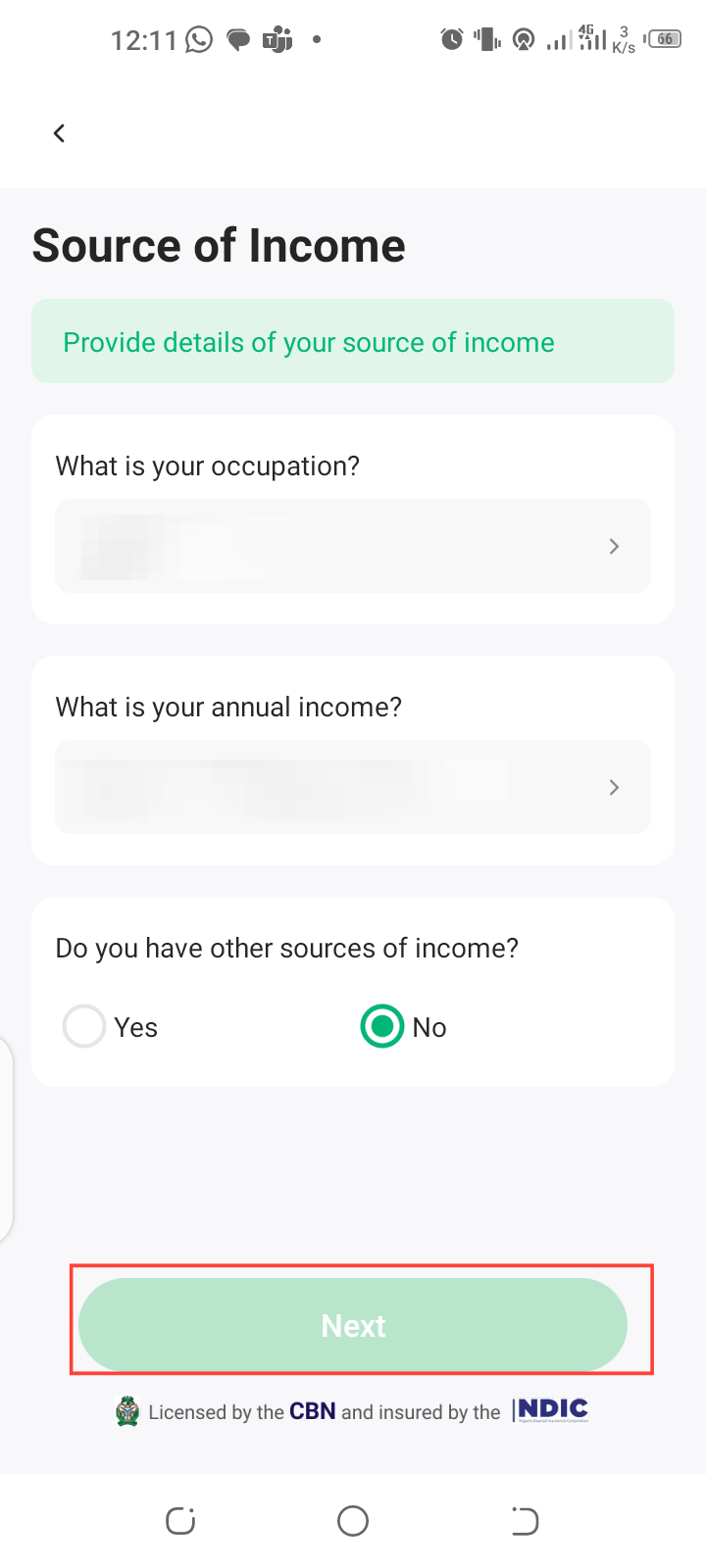

After the verification, enter your address and specify your nationality. Once you have specified your nationality, tap "Next." Next, OPay will ask you to provide details of your income source to ensure compliance with business account requirements.

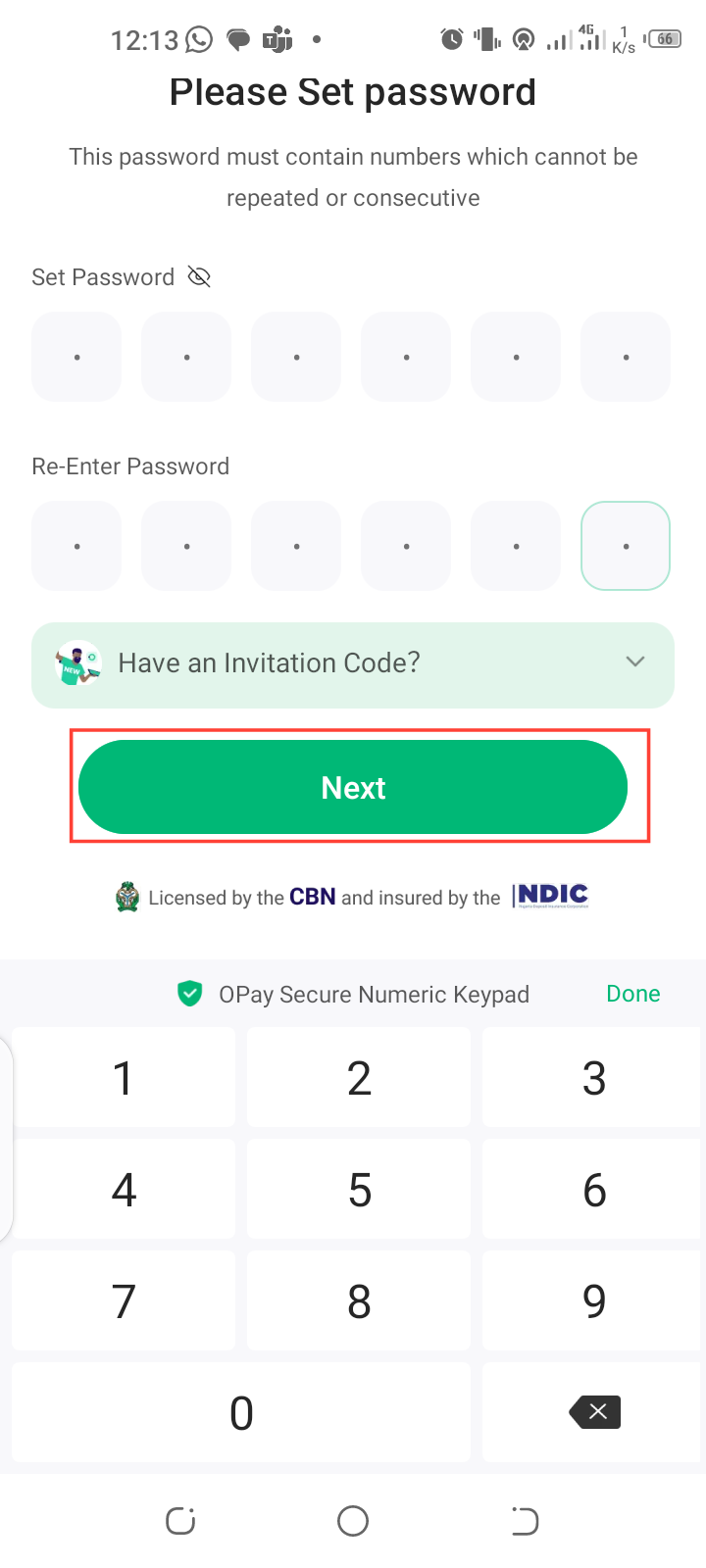

Step 5. Set Up a Strong Password

Once you have provided details on your income, tap "Next" and create a strong, secure password to protect your account. Once done, tap "Next" to activate your account.

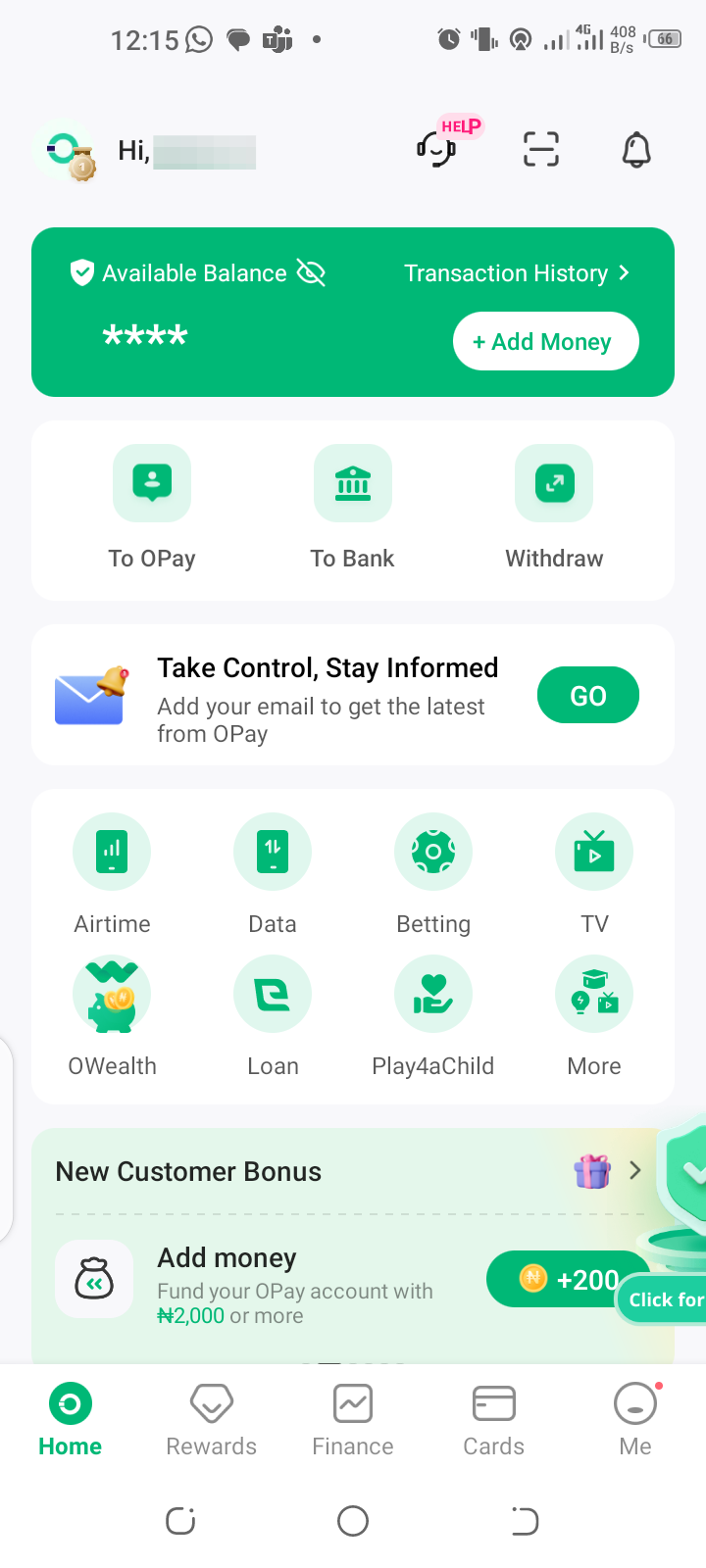

Conclusion

With the steps above, you can set up your OPay business account and handle large transactions at zero fees. Plus, you can avoid excessive banking fees and take advantage of a user-friendly platform designed to manage your business finances efficiently.

Image credit: David Adubiina/Techloy.com