How to use the spend and save feature on PalmPay

This will help you reach your savings goal without the worry of not having to spend.

You know how last year you planned to save ₦100,000 but couldn’t manage it because expenses kept piling up? You’re not alone. We all start the year with big goals, but somehow, the money always seems to slip through our fingers. Now it’s 2025, and those goals are still there, but the financial hurdles haven’t gone anywhere.

If you’ve been struggling to save, PalmPay offers a solution– Spend and Save. This feature helps you save automatically while you go about your daily expenses. Here in this article, we’ll show you how to access it and use it to reach your savings goal.

Steps to Use PalmPay’s Spend and Save Feature

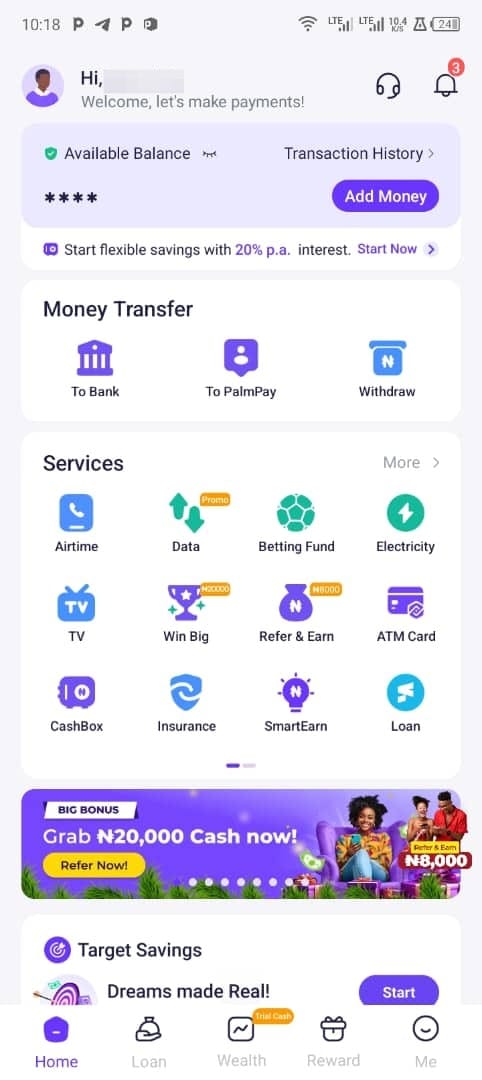

Step 1: Log in to Your PalmPay Account

Open your PalmPay app and sign in to your account. If you don’t have an account yet, check here to create one first.

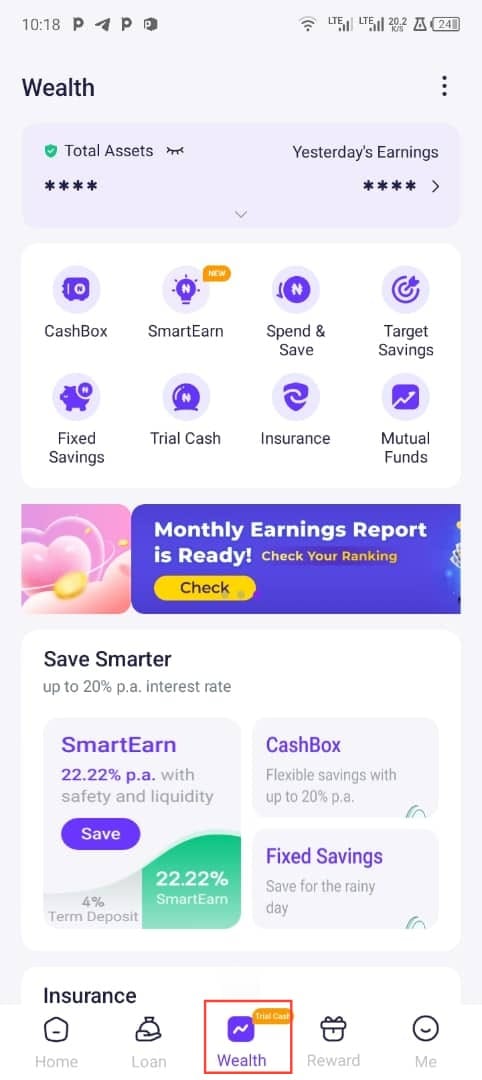

Step 2: Navigate to the Wealth Tab

From the app’s home page, look for the Wealth tab and tap on it. This is where you’ll find various tools for managing and growing your finances.

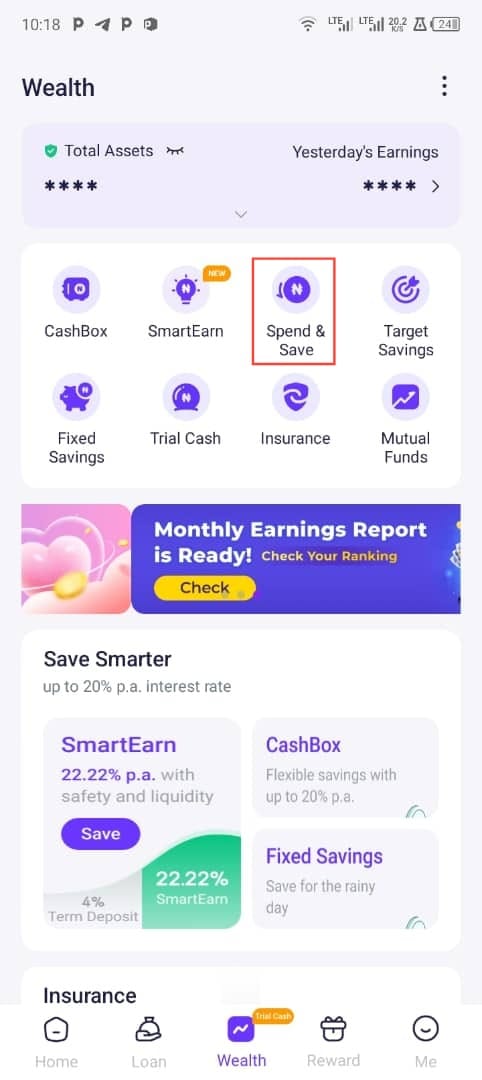

Step 3: Select the Spend and Save Option

On the Wealth tab page, locate the Spend and Save feature and tap on it. This will take you to the setup page where you can configure how much you want to save.

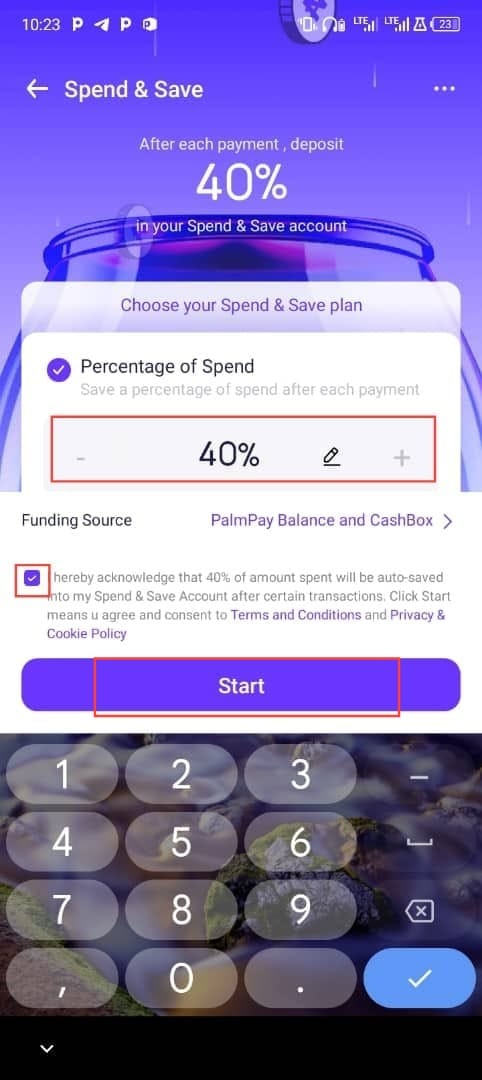

Step 4: Set Your Savings Percentage

Decide what percentage of your daily spending you’d like to save. Enter that percentage into the designated field and check the agreement box to confirm your participation in the program. Once done, tap Start to activate the feature.

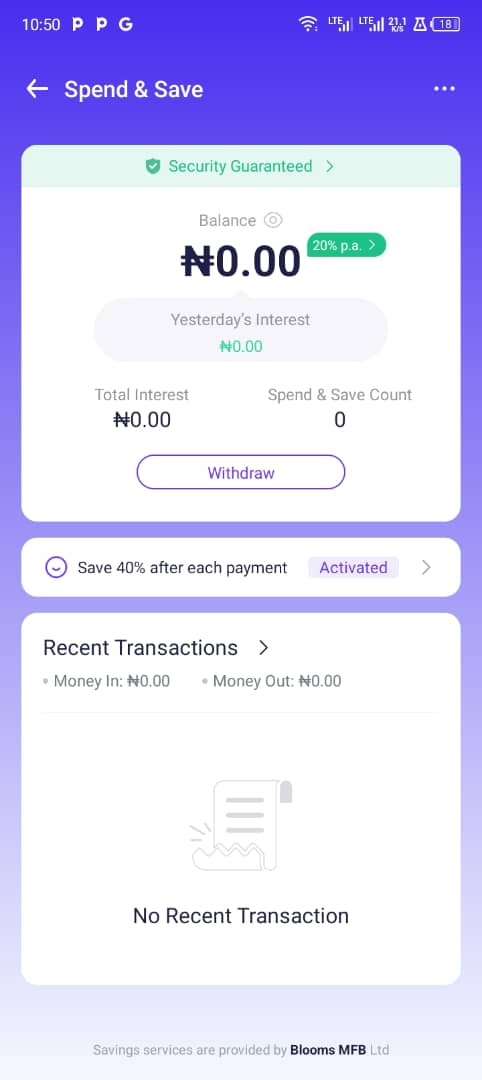

After activating the Spend and Save feature, you can monitor your savings progress directly from the Wealth tab. For any transaction carried out, the saving percentage will be deducted and saved to your "Spend and Save" account.

Conclusion

Saving money doesn’t have to feel like a constant uphill battle. With the steps outlined above, you can make small, consistent progress toward your ₦100,000 goal—or whatever amount you’re aiming for—without overthinking it. Plus, you don't have to operate it as it is automatic and works in the background while you focus on your daily life.

Image credit: David Adubiina/Techloy.com