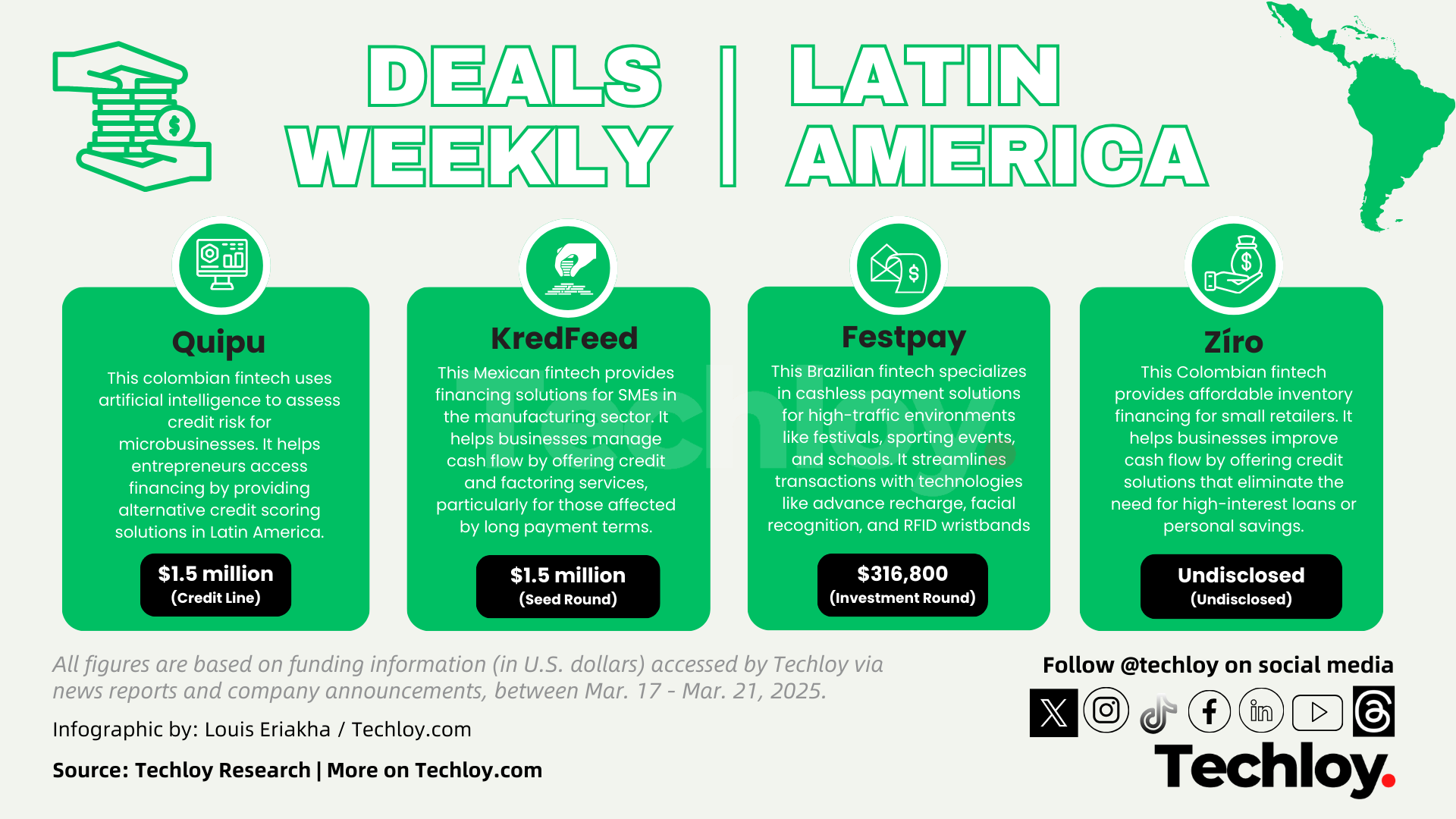

INFOGRAPHIC: LatAm's Top Weekly Startup Funding — Week 12, 2025

In this week's funding deals, we tracked Quipu, KredFeed, Festpay and Zíro in the LatAm region.

It was an active week for startup funding in Latin America, with key rounds in fintech, digital payments, and financial inclusion. These investments highlight continued confidence in the region’s digital transformation and its expanding fintech ecosystem.

Leading the week were Quipu and KredFeed, both securing $1.5 million in funding. Quipu, a Colombian fintech, received a $1.5 million line of credit from Addem Capital. The company leverages artificial intelligence to assess credit risk for microbusinesses, addressing financial inclusion challenges in Latin America. With this funding, Quipu aims to expand its reach and facilitate greater access to financing for thousands of entrepreneurs in Colombia.

Mexican fintech KredFeed closed a $1.5 million seed round to expand its financing platform for SMEs in the manufacturing sector. Investors include Carabela, Techstars, 2045 Ventures, The Pitch Fund, and other strategic backers. KredFeed aims to bridge the credit gap for SMEs integrating into global supply chains, particularly those affected by long payment terms.

Brazil’s Festpay raised $316,800 in an investment round led by Investidores.vc, with participation from 61 investors. Specializing in payment solutions for high-traffic environments, Festpay has expanded from festivals and sporting events to school cafeterias, offering cashless payment technologies such as advance recharge, facial recognition, and RFID wristbands. The funding will accelerate AI-driven functionalities, strengthen its brand, and enhance its school payment solutions.

Colombian fintech Zíro received an undisclosed investment from Mondelēz International’s impact investing platform, Sustainable Futures. Zíro provides affordable inventory financing for small retailers, helping them improve cash flow without resorting to high-interest loans. The company plans to reach 100,000 small businesses in Colombia over the next three years.

This week’s funding rounds reinforce Latin America’s growing role in fintech and financial inclusion, with startups focusing on bridging credit gaps, expanding payment solutions, and driving digital transformation.