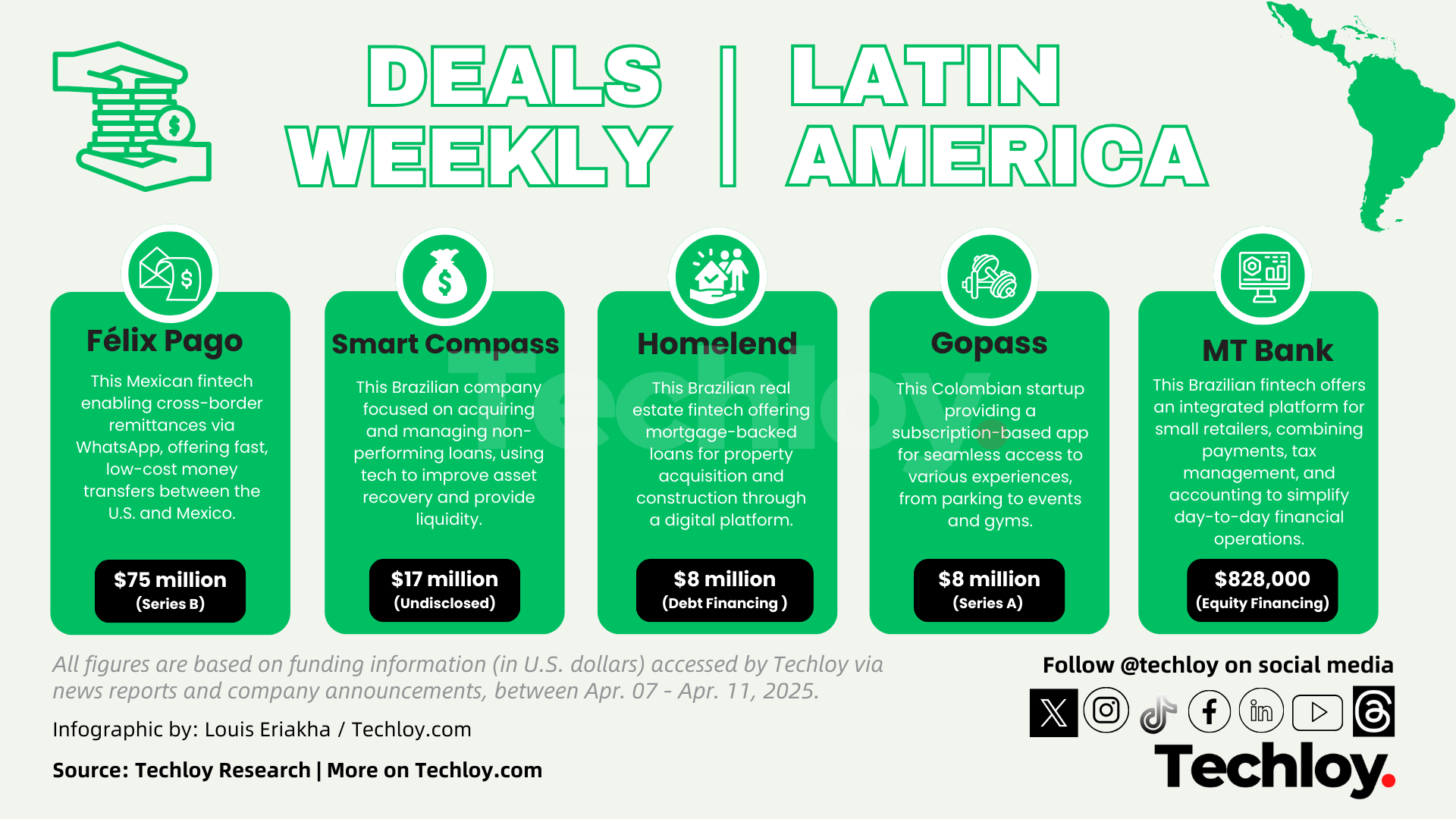

INFOGRAPHIC: LatAm's Top Weekly Startup Funding — Week 15, 2025

In this week's funding deals, we tracked Félix Pago, MT Bank, Smart Compass, Homelend, and Gopass in the LatAm region.

It was another active week for startup funding in Latin America, with fintech and digital infrastructure companies leading the way. From non-performing loan management to embedded finance and digital real estate, investors signaled confidence in the region’s evolving financial ecosystem.

Mexican fintech Félix Pago topped the funding activity this week, raising $75 million in a Series B round led by Avenir and with participation from Lightspeed Venture Partners. The company, which enables remittance payments via WhatsApp, plans to expand beyond its core U.S.-to-Mexico corridor into other Latin American markets. Its chat-based platform offers cross-border money transfers with a focus on speed, simplicity, and reduced transaction fees.

In Brazil, MT Bank secured an $828,000 investment from Hiker Ventures, the venture capital arm of AF Invest. The fintech is building an integrated platform that simplifies payments, tax management, and accounting for small and medium-sized retailers. With plans to reach 20,000 clients by 2026 and an expected annualized payment volume of $1.2 billion, MT Bank is positioning itself as a one-stop financial management solution for entrepreneurs. The funding will accelerate platform development and support the company's expansion in Brazil’s retail sector.

Brazilian non-performing loans manager Smart Compass also secured an investment of $17 million through a strategic partnership with Itajubá Capital. The São Paulo-based company specializes in acquiring and managing stressed assets, particularly from financial cooperatives and mid-sized banks. With this investment, Smart Compass plans to purchase up to R$1.5 billion in distressed assets by the end of 2025, expanding its asset recovery platform powered by internally developed technology and process automation.

Real estate fintech Homelend raised $8 million through the issuance of Real Estate Credit Certificates (RCCs), a debt instrument backed by mortgage loans. The Brazilian startup focuses on providing credit for property acquisition and construction, targeting clients underserved by traditional financial institutions. The funding will allow Homelend to expand its loan portfolio and accelerate its digital credit platform.

Finally, Colombian startup Gopass secured $8 million in a Series A extension round led by Ewa Capital, with participation from existing investors such as Marathon Ventures and Avalancha Ventures. Gopass offers an app-based platform that provides seamless access to experiences and venues — from parking and events to gyms and ski resorts — all through a single subscription and payment system. The new funding will help Gopass expand across Latin America and enhance its product offering.

This week’s investments reflect the growing diversification of Latin America’s fintech landscape — from credit recovery and SME financing to embedded finance and real estate. As digital adoption continues to accelerate across the region, investors are betting on specialized platforms designed to address long-standing inefficiencies in financial services.