INFOGRAPHIC: Startup Funding in Africa and the Middle East — Week 15, 2025

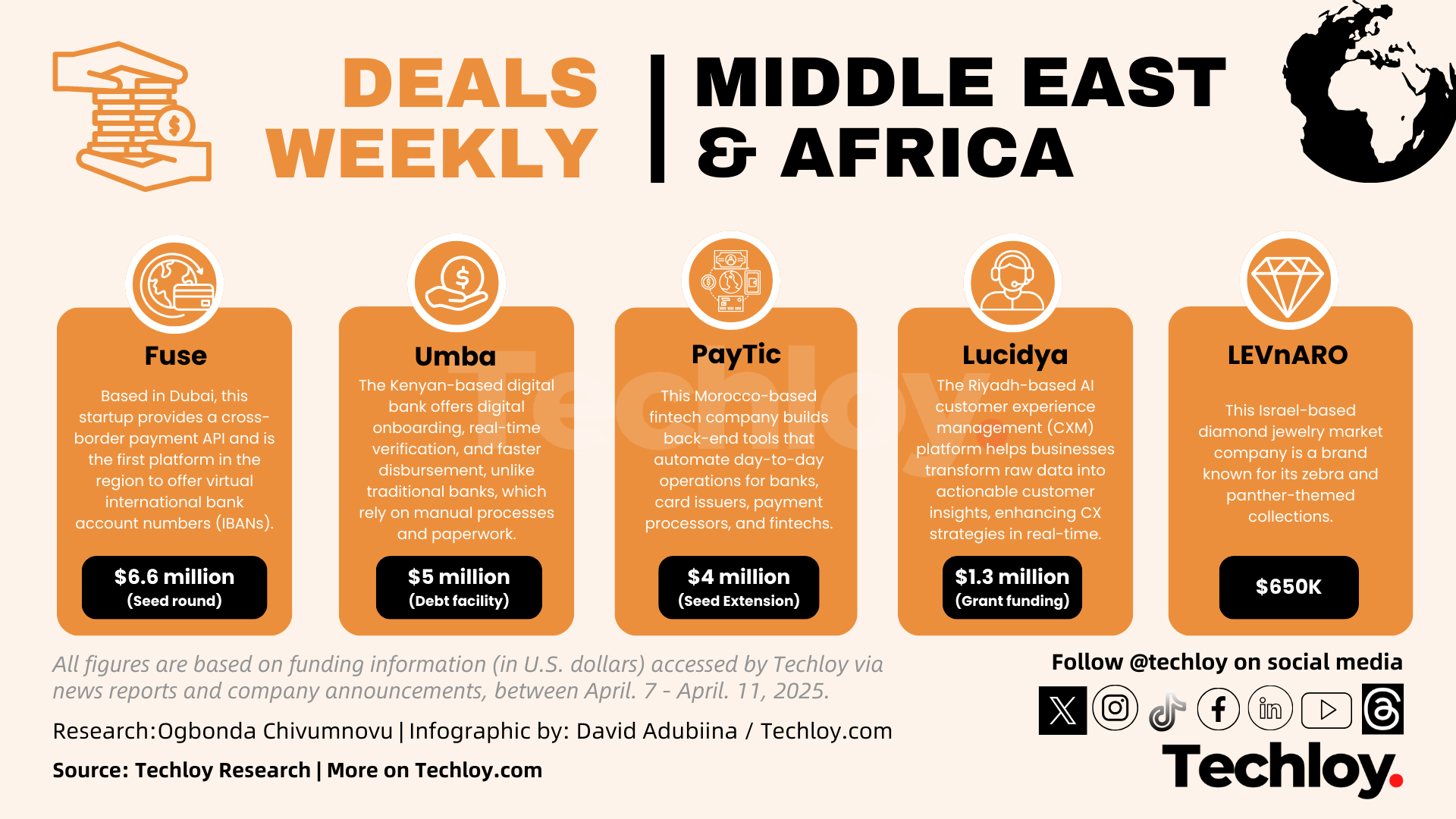

Here are the venture funding activities we tracked in the Middle East and African region this week – including Fuse, Umba, PayTic, Sellou, Lucidya, LEVnARO, and STUCK?.

In 2023, Dubai was home to nearly a quarter of all startup funding deals in the MENA region—a clear sign that the city is fast becoming a key player in regional fintech infrastructure. With its mix of supportive regulation, cross-border ambitions, and a rising appetite for digital payments, the UAE is steadily carving out a name for itself as a fintech powerhouse.

This momentum continues into 2025, as Fuse, a Dubai-based company building cross-border payment rails across MENA and the GCC, has just secured $6.6 million in a funding round. The raise was led by Northzone, with backers including Flourish Ventures, Alter Global, and angel investors such as the founder of Flutterwave. Fuse plans to use the funds to deepen its payment infrastructure across the region.

In East Africa, Umba, a credit-led digital bank headquartered in Nairobi focused on underserved markets, announced a $5 million debt facility from Star Strong Capital. The capital will help the company grow its loan book in Kenya, where demand for digital credit access continues to rise.

Further west, Moroccan fintech PayTic has raised a $4 million seed extension to enhance its platform for streamlining payment operations among financial institutions. The Casablanca-based startup is working on improving how banks and fintechs manage card programs and back-office processes.

Meanwhile, in Bahrain, an e-commerce startup, Sellou closed an undisclosed seed funding round at a $3 million valuation. The company, which enables video-powered selling, is tapping into the growing trend of creators and small sellers building direct-to-consumer businesses across the Middle East and North Africa.

Saudi Arabia also saw movement in its tech scene. Customer experience platform Lucidya received SAR 5 million (around $1.3 million) in grant funding from the National Technology Development Program—an initiative by the Ministry of Communications and Information Technology to support local innovation.

Israel isn’t also left out, as Tel Aviv-based LEVnARO Jewelry, which operates in the diamond jewelry market, raised $650,000 in fresh funding to expand its reach.

And rounding things off, STUCK?—a Saudi-based AI platform focused on language intelligence—announced a six-figure pre-seed round. The funding was led by UK-based Mena Tech Fund, with support from KAUST Innovation Fund and a group of Saudi angel investors.