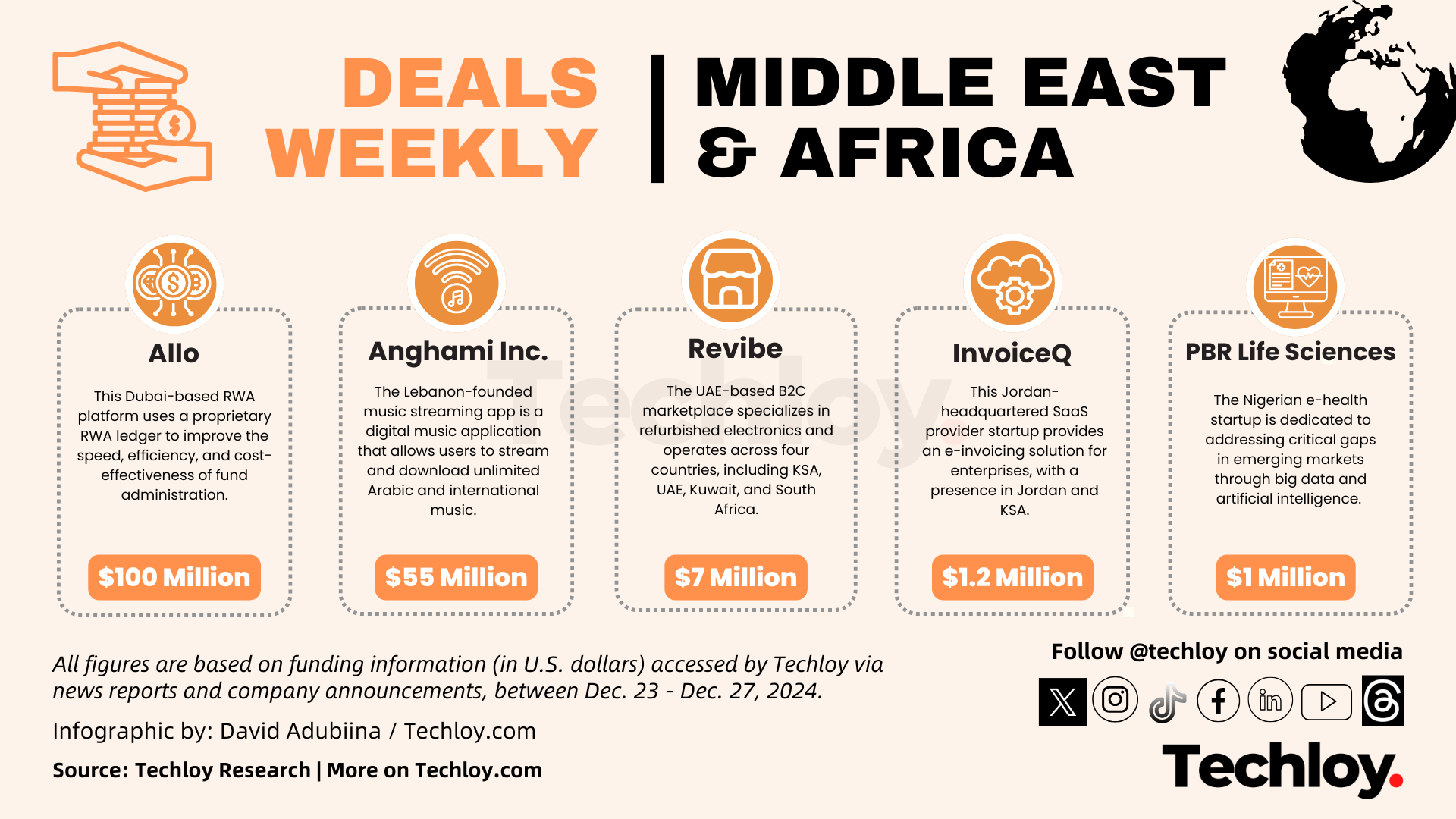

INFOGRAPHIC: Startup Funding in Africa and the Middle East — Week 52

Here are the venture funding activities we tracked in the Middle East and African region this week – including Allo, Anghami Inc, Revibe, InvoiceQ, PBR Life Sciences, SAYeTECH, and Talaty.

- Dubai real-world assets tokenization platform Allo gets $100M in debt financing to bolster its Bitcoin-backed lending business

- Lebanon-founded music streaming app Anghami Inc. closes a $55 million investment to expand its content library

- UAE B2C marketplace Revibe receives $7M Series A to expand into emerging markets

- Jordan SaaS provider startup InvoiceQ banks $1.2M pre-Series A round to accelerate GCC expansion

- Nigerian e-health startup PBR Life Sciences secures $1M pre-seed funding round to scale innovations

- Ghanaian agritech startup SAYeTECH wins $50k MEST Africa Challenge to expand its operations

- Moroccan fintech startup Talaty raises undisclosed funding to further expansion plans

Allo gets $100M in debt financing to bolster its Bitcoin-backed lending business

Dubai-based platform Allo.xyz, known for its expertise in real-world asset (RWA) tokenization and lending, has raised $100 million in debt financing from a group of lenders, including Greengage and a well-established U.S. financial institution, to support its Bitcoin-backed lending business.

To build its presence in the Bitcoin ecosystem, Allo has staked over 544 BTC (valued at $50 million) using the Babylon Bitcoin Staking Protocol, allowing the platform to issue its $alloBTC token– featured prominently on platforms like DeFiLlama.

In addition to its Bitcoin initiatives, Allo received up to $750,000 in investment from participating in the Binance Labs and BNB Chain MVB Accelerator program with plans to launch its native cryptocurrency, $RWA, which will add new functionality to its ecosystem.

Presently, the company has $2.2 billion in Total Value Locked (TVL) across various assets on the BNB Chain and a $50 million term sheet to provide lending solutions against SpaceX stock– an initiative to offer efficient borrowing options for private market shareholders.

Founded in 2019 by Kingsley Advani, as shared in the company’s Instagram post, Allo uses a proprietary RWA ledger to improve the speed, efficiency, and cost-effectiveness of fund administration. Its innovative on-chain RWA fund solution allows users to create funds in under 60 seconds, making asset management more accessible.

With this new credit facility, Allo plans to strengthen its BTC-backed lending services to meet the needs of both institutional and individual clients.