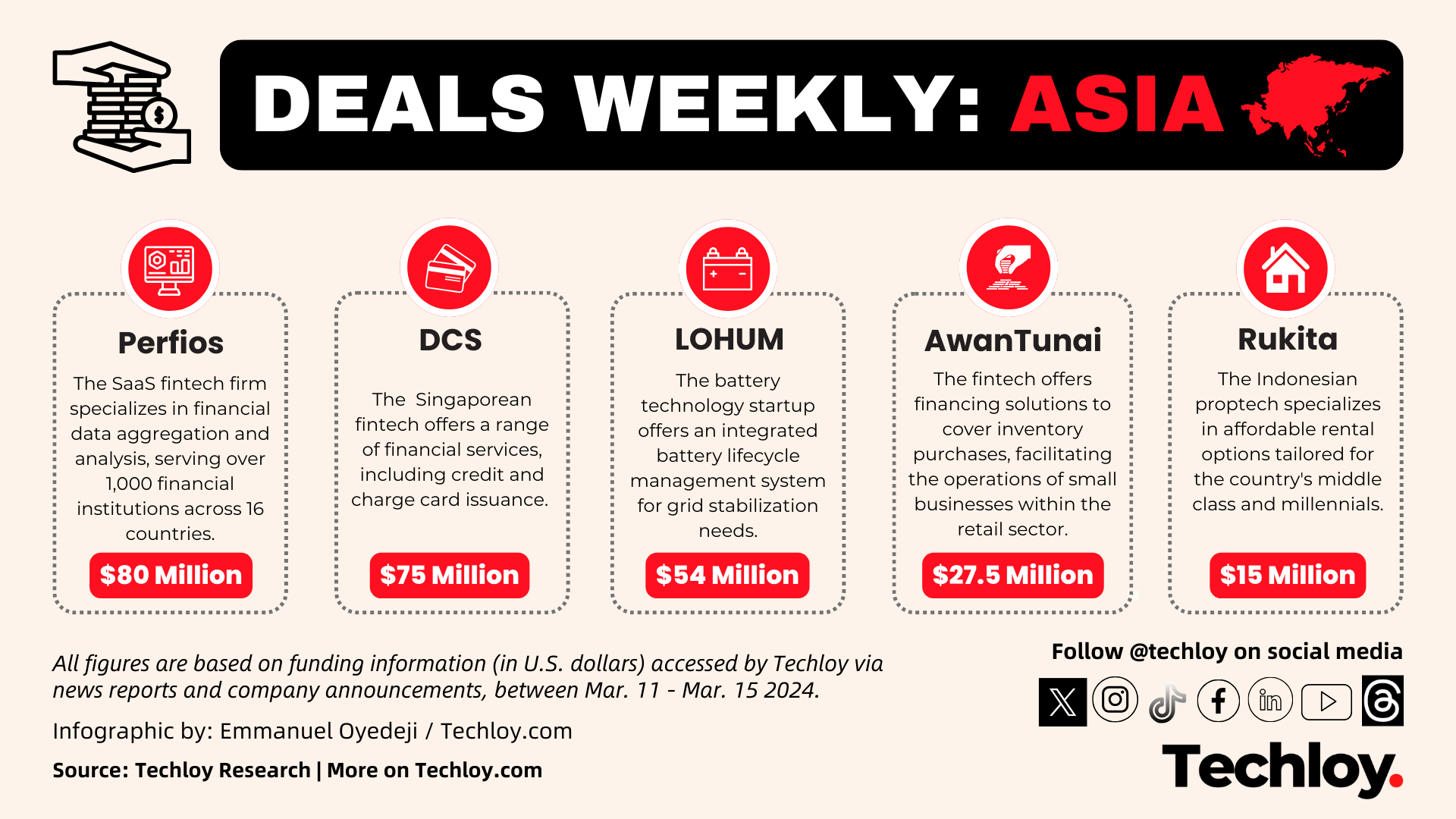

INFOGRAPHIC: Top Asian Startup Funding — Week 11

These are the funding deals we tracked in the Asian region this week – including Perfios, LOHUM, AwanTunai, DCS, Rukita and FREED.

- Perfios Raises $80M Led by TVG, Joins Unicorn Club

- Singaporean Fintech Firm DCS Raises $75M in Funding

- LOHUM Raises $54M in Series B to Drive Sustainable Energy Solutions

- AwanTunai Secures $27.5M to Expand Lending Facilities

- Rukita Secures $15M Funding as Profitability Continues

- FREED Secures $7.5M in Series A Funding for Debt Relief Platform

Perfios Raises $80M Led by TVG, Joins Unicorn Club

- Bengaluru-based B2B Saas fintech firm Perfios has secured $80 million in a new funding round led by Teachers’ Venture Growth (TVG), becoming the second Indian unicorn with a $1 billion valuation in 2024.

- This comes just six months after its $229 million Series D round. The funds will drive international expansion, tech stack enhancement, and exploration of inorganic growth opportunities.

- Perfios, specializing in financial data aggregation and analysis, serves over 1,000 financial institutions across 16 countries. Additionally, Perfios offers lending solutions tailored for small and medium businesses processing 1.7 billion transactions annually with an AUM of $36 billion. With recent profitability achieved in FY23 and exponential 200% revenue growth, the funding further cements its position as a key player in the fintech ecosystem.

Singaporean Fintech Firm DCS Raises $75M in Funding

- Singapore fintech giant, DCS, secures $75 million through asset-backed notes, boosting its funding round to $300 million in a round that continued from last year when it raised $225 million.

- Formerly known as Diners Club Singapore, DCS has been a pioneer in cashless payments and credit card services since the 1970s and holds licenses for credit and charge cards, making it one of Singapore's two non-bank financial institutions.

- Moving beyond its traditional card issuance, the company plans to diversify its offerings and manage receivables from retail and corporate customers using its credit facilities. The company has expanded its portfolio by collaborating with major payment schemes including MasterCard, UnionPay, and Visa, which is expected soon to provide co-branded cashback cards.

LOHUM Raises $54M in Series B to Drive Sustainable Energy Solutions

- Battery technology startup LOHUM has secured $54 million in a Series B funding round from investors including Singularity Growth, Baring Private Equity, Cactus Venture Partners, and Venture East.

- Founded in 2017, LOHUM's innovative approach includes integrated battery lifecycle management, raw material refining, and repurposing EV batteries for second-life energy storage systems and grid stabilization needs.

- The funding will be channeled towards expanding market presence scaling recycling operations across India and venturing into new energy markets in North America, the EU, and the MENA region. With previous rounds raising over $37 million, LOHUM now boasts a valuation of approximately $422 million.

AwanTunai Secures $27.5M to Expand Lending Facilities

- Indonesia-based fintech AwanTunai has secured $27.5 million in a series B funding round led by Norwegian sovereign fund Norfund, MUFG Innovation Partners, and OP Finnfund, following its recent achievement of positive EBITDA.

- Co-founded by ex-Gojek executives, Dino Setiawan, Windy Natriavi, and Rama Notowidigdo, AwanTunai provides loans to grocery suppliers and traders in Indonesia. It offers financing solutions to cover inventory purchases, facilitating the operations of small businesses within the retail sector.

- The funding will bolster AwanTunai's equity base and expand lending capital facilities, aiming to cover over $2 billion worth of annualized inventory purchase financing by year-end. With a total disclosed funding of $71.5 million, this round marks a significant milestone for AwanTunai's growth and expansion plans.

Rukita Secures $15 Million Funding as Profitability Continues

- Indonesia's proptech player, Rukita, celebrates profitability after four years in operation. Founded in 2019, Rukita specializes in affordable rental options tailored for the country's middle class and millennials, managing over 1.4 million rooms and attracting 3 million unique users monthly.

- In a recent Series B1 funding round, Rukita raised $15 million, with new investors such as MPower Partners, BNI Ventures, and Openspace Ventures joining the company. The funding will fuel further tech development, service expansion, and talent acquisition.

- The funding follows the company's acquisition of room rental marketplace Infokost in March 2022. Rukita aims to bolster its position in Indonesia's proptech landscape. This move aligns with broader developments in the sector, including the launch of the BTN Fund by Bank BTN and Mandiri Capital Indonesia, signalling increasing interest and investment in property-related technologies.

FREED Secures $7.5M in Series A Funding for Debt Relief Platform

- FREED, a leading debt relief platform has successfully closed its Series A funding round, raising Rs 60 crore ($7.5 million). The investment was spearheaded by Sorin Investments and Multiply Ventures, with additional participation from Piper Serica and other institutional funds.

- Established in August 2020 by Ritesh Srivastava, FREED is dedicated to helping individuals navigate debt challenges effectively across India. With a user base exceeding 25,000 customers, FREED has effectively managed over 1,200 crore in stressed retail debt.

- This follows a pre-Series A round in May 2022, where FREED raised $2.8 million led by Inflection Point Ventures. The latest capital injection is poised to propel FREED's growth trajectory and bolster its ongoing efforts to innovate within the debt relief landscape.

Follow our full coverage of the Asian startup and technology scene and get up to date with what's happening in the key markets within the region.