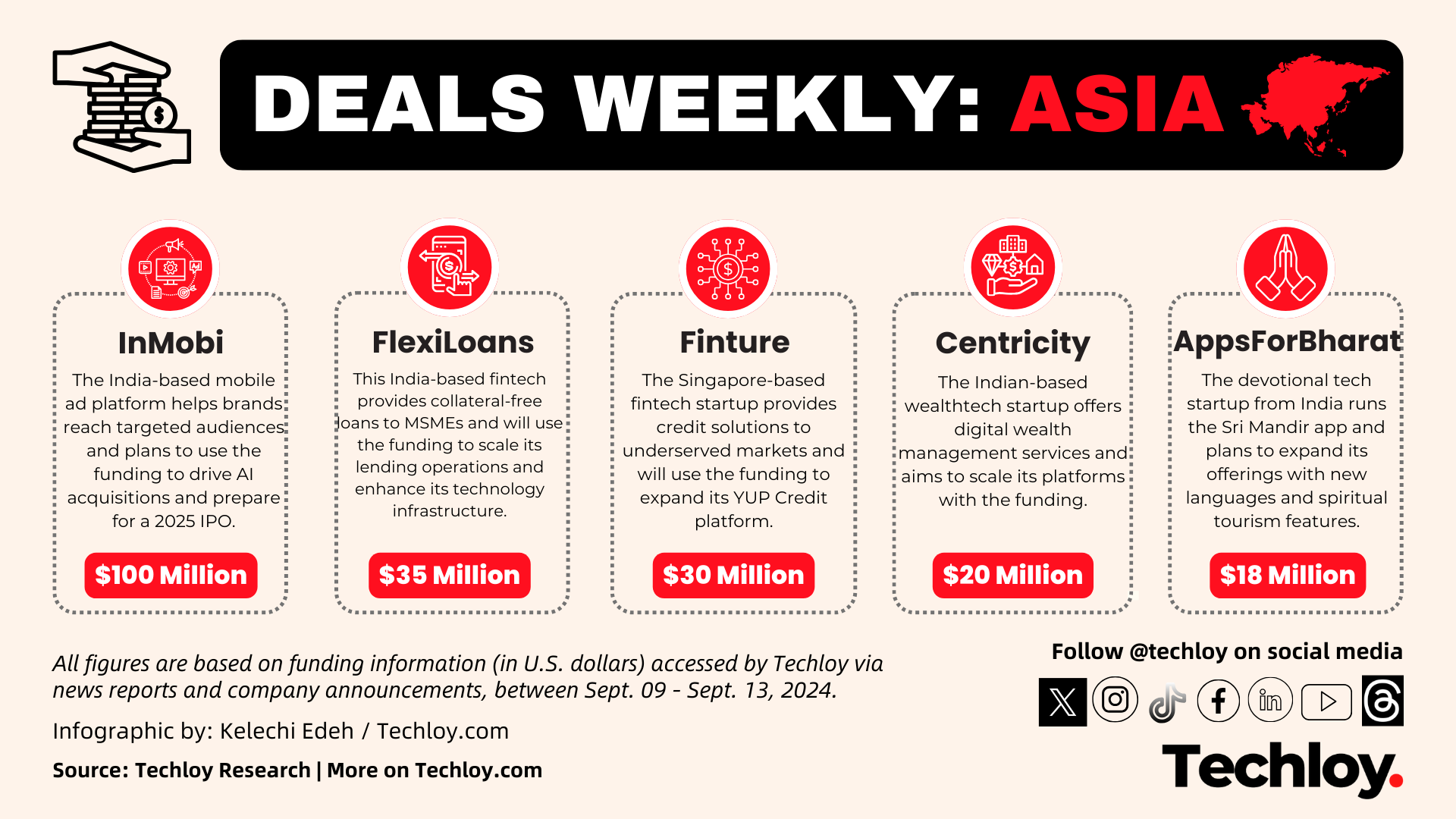

INFOGRAPHIC: Top Asian Startup Funding — Week 37

- India's InMobi Secures $100 Million in Debt Financing for AI Acquisitions

- India-based FlexiLoans Raises $35 Million in Series C to Expand MSME Lending Across 2,000 Indian Cities

- Singapore-based Finture Secures $30 Million in Series B to Grow YUP Credit Platform and Obtain Indonesian Banking License

- Indian Wealthtech Startup, Centricity Raises $20 Million in Seed Round to Scale AI-Driven Wealth Management Solutions

- India’s AppsForBharat Raises $18 Million in Series B to Add New Languages and Expand Sri Mandir App to Global Markets

InMobi Secures $100 Million in Debt Financing to Fuel AI Expansion

India’s mobile advertising leader and unicorn, InMobi, has just raised $100 million in debt financing from MARS Growth Capital, a strategic collaboration between MUFG and Liquidity Group. This round is a major milestone as the company ramps up its focus on artificial intelligence (AI) and continues its trajectory toward an IPO in 2025.

Founded in 2007, InMobi has become a powerhouse in mobile advertising, helping brands connect with their audiences through highly targeted, immersive ad experiences. With operations spanning 165 countries, InMobi has long been at the forefront of mobile-first marketing, utilizing AI and machine learning to drive effective ad campaigns for businesses worldwide.

This new funding will primarily support AI acquisitions, aimed at deepening the company’s technological edge and improving its offerings in digital advertising. With its eye on the future, InMobi is preparing to further cement its leadership in the ad tech space while moving its global headquarters from Singapore back to India.