Kenya imposes 1.5% tax on cryptocurrency exchanges

Bitcoin, the world's most popular cryptocurrency, is on the rise once again after experiencing a prolonged slump and Kenya wants to tap from this rise.

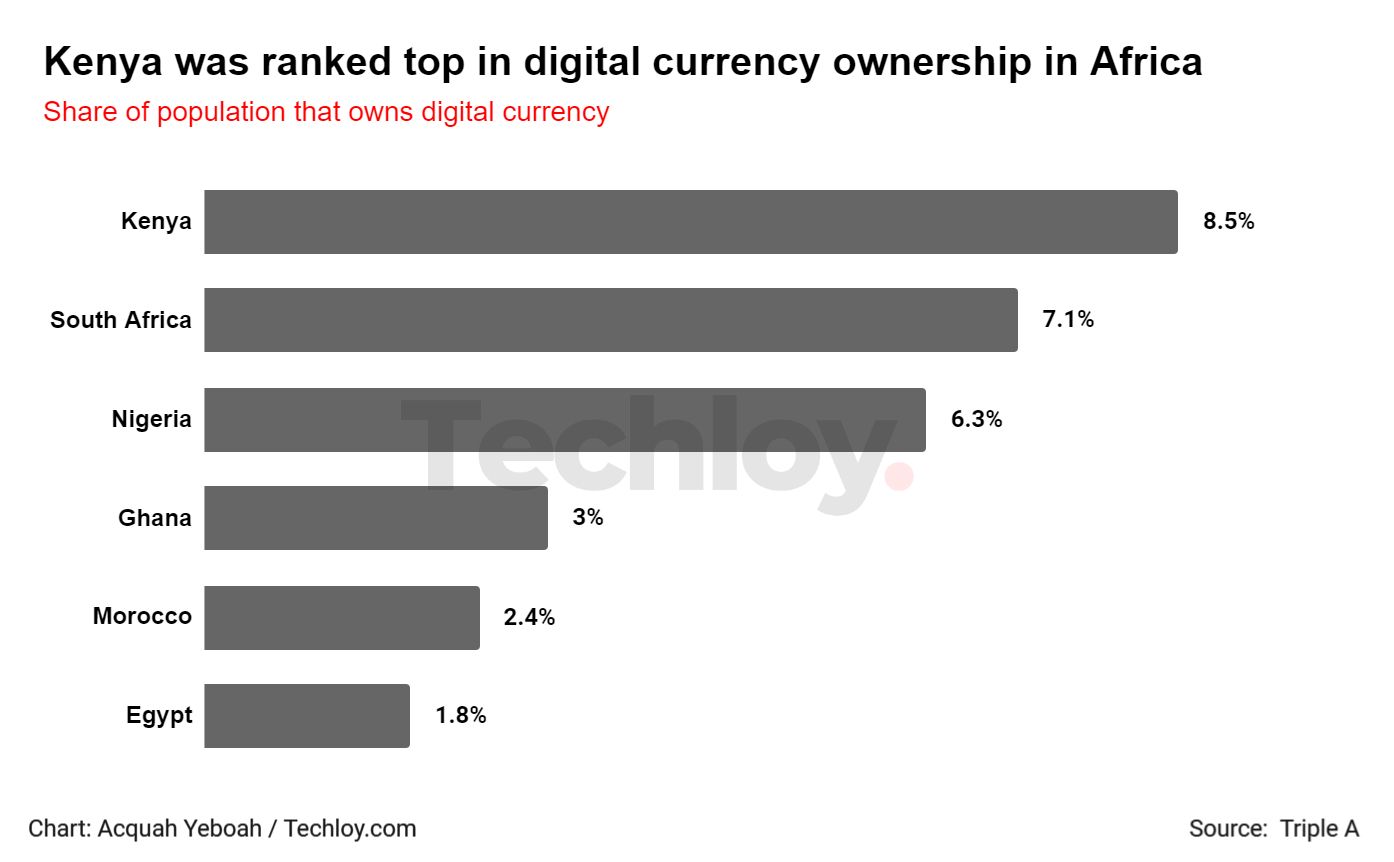

Kenya has just announced new regulations that require cryptocurrency exchanges to pay a 1.5% duty on commissions they receive from the over four million people dealing in digital currencies in the country.

The move aims to curb tax avoidance by multinational companies and is part of a wider effort to regulate and tax the cryptocurrency industry to limit exposure to the volatility of the crypto market and risks of financial instability.

Cryptocurrencies are largely unregulated in Kenya, making it difficult to establish the value of digital assets held by the mostly tech-savvy population, but the amount could run into billions of shillings.

The 1.5% digital service tax was implemented in January 2021 and is levied on foreign businesses not registered in Kenya but that offer services to Kenyans through a digital marketplace.

The new regulations guide the payment of the tax and apply to platforms that facilitate the buying and selling of cryptocurrencies and other digital assets. Digital assets include cryptocurrencies such as bitcoins, data, images, video, and written content.