Nigerian fintech Nomba is integrating Mastercard’s payment gateway into its Checkout tool

The collaboration could make it easier for users in Nigeria to pay securely, whether with international cards or QR codes.

As someone who regularly uses digital payment options in Nigeria, I’ve seen how much things have changed—from the early days of Point-of-Sale (POS) machines around 2013 to the rise of digital banking apps in recent years. Now, it feels like we’re stepping into a new phase, thanks to a recent partnership between Mastercard and Nomba.

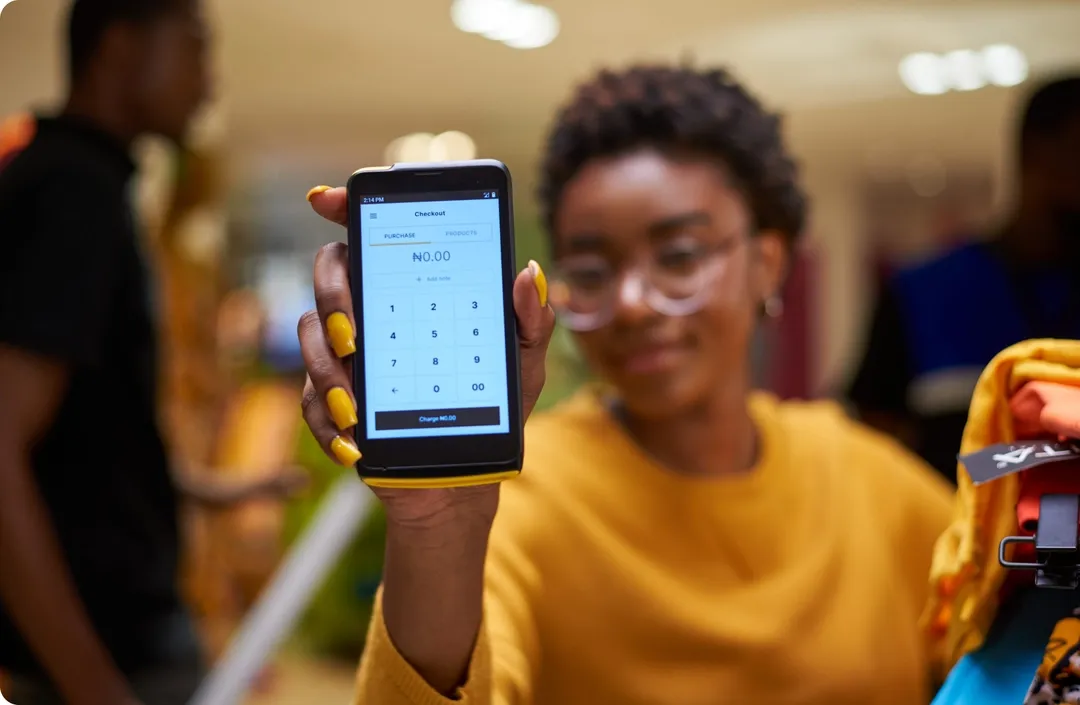

Nomba, a Nigerian fintech focused on helping businesses accept payments, is integrating Mastercard’s payment gateway into its Checkout tool. While that may sound technical, it simply means more options for us as users—whether we’re paying with an international card, scanning a QR code, or using mobile wallets at a local store. For example, you can use your international card when traveling or quickly scan a QR code to pay directly from your mobile wallet, making transactions smoother and more flexible.

But it isn’t just about making payments easier for businesses. As a user, I can see real benefits. Think about better speed, more secure transactions, and fewer chances of fraud. The kind of reliability that gives me more confidence to use digital payments more often—especially when making bigger purchases or using unfamiliar platforms.

Of course, Nomba isn’t the only one in the game. Companies like Paystack, Flutterwave, OPay, and Moniepoint are also offering strong digital payment solutions. While Paystack and Flutterwave have leaned into online APIs, and OPay focuses on mobile-first consumer payments, Nomba’s strength seems to be in blending software and hardware tools, which can accept payments in person, and also manage sales, track transactions, or generate reports through their software.

The move reflects the broader trend of increase in digital transactions in Nigeria, with the Worldpay Global Payment Report of 2024 stating, cash transactions in Nigeria are expected to drop by 32% by 2030, while digital payments are growing fast. In fact, the total value of electronic payments hit ₦1.07 quadrillion in 2024, which is a huge 79.6% jump from the year before. Clearly, more people are going digital—and for good reason.

In a world where almost everything is moving online, Mastercard and Nomba’s partnership may ensure smoother and safer transactions. By offering more payment options and better security, this collaboration makes it easier for users in Nigeria to pay securely, whether with international cards or QR codes.