Providing Liquidity to Exchanges: The Role of Market Makers

In this article, we’re going to take a closer look at market makers' tools.

Exchanges operating within cryptocurrency markets face unique challenges associated with high market volatility and liquidity needs. Market-making is a fundamental mechanism to address these challenges, ensuring the seamless functioning of trading platforms.

By continuously setting buy and sell prices, market makers facilitate a consistent and efficient trading environment. Institutional crypto exchanges rely heavily on market makers that ensure liquidity provision and market stability, especially during times of swift price movements. This makes the role of market makers crucial for the smooth operation of these exchanges. For that purpose, exchanges cooperate with or hire a specialized company or a financial entity tasked to ensure that liquidity is always sufficient. In return, exchanges provide low fees and additional trading tools for market makers.

An example may be crypto exchange market making on WhiteBIT, where makers enjoy the lowest trading fees and rebates, as well as tools like VIP support and flexible APIs. In this article, we’re going to take a closer look at market makers' tools.

Tools and Platforms Employed

Market makers use a variety of sophisticated tools and platforms to navigate the complex landscape of cryptocurrency markets. These include automated trading systems, algorithmic trading strategies, market-making software, and APIs. Each of these components plays an important role in enabling market makers to perform their functions effectively. Let’s take a closer look:

- Automated trading systems. These are bots and algorithms used by market makers, allowing for the execution of trades at unparalleled speed and accuracy. These systems can process extensive datasets and monitor multiple markets simultaneously, enabling market makers to swiftly react to market changes. Automated systems eliminate manual trading work.

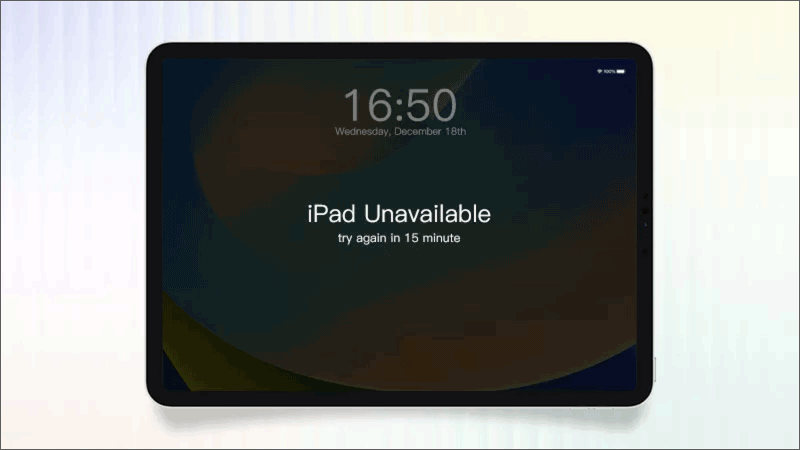

- Exchange APIs. Application programming interfaces (APIs) facilitate a direct channel for market makers to interact with institutional exchanges. These APIs are critical for automating trading activities, ensuring timely order placement, and accessing liquidity across different trading platforms.

- Algorithmic trading strategies. Serving as the foundation of market making operations, these strategies leverage quantitative methods to identify trading opportunities. Strategies such as mean reversion and statistical arbitrage help manage risk and optimize trades. It is essential for sustaining profitability in the face of high volatility.

- Market-making software. This software provides a suite of tools necessary for executing trading strategies effectively. Features like real-time data analysis, risk management, and automated order execution are integral for market makers to adapt and succeed in fluctuating market conditions.

For institutional exchanges in the crypto markets, market-making is not just a beneficial practice but a necessity. Through the use of advanced tools and platforms, market makers can efficiently manage the risks of high volatility, benefiting not just themselves but the entire ecosystem, including crypto investors.