Qualcomm is acquiring an Israeli-based auto chipmaker

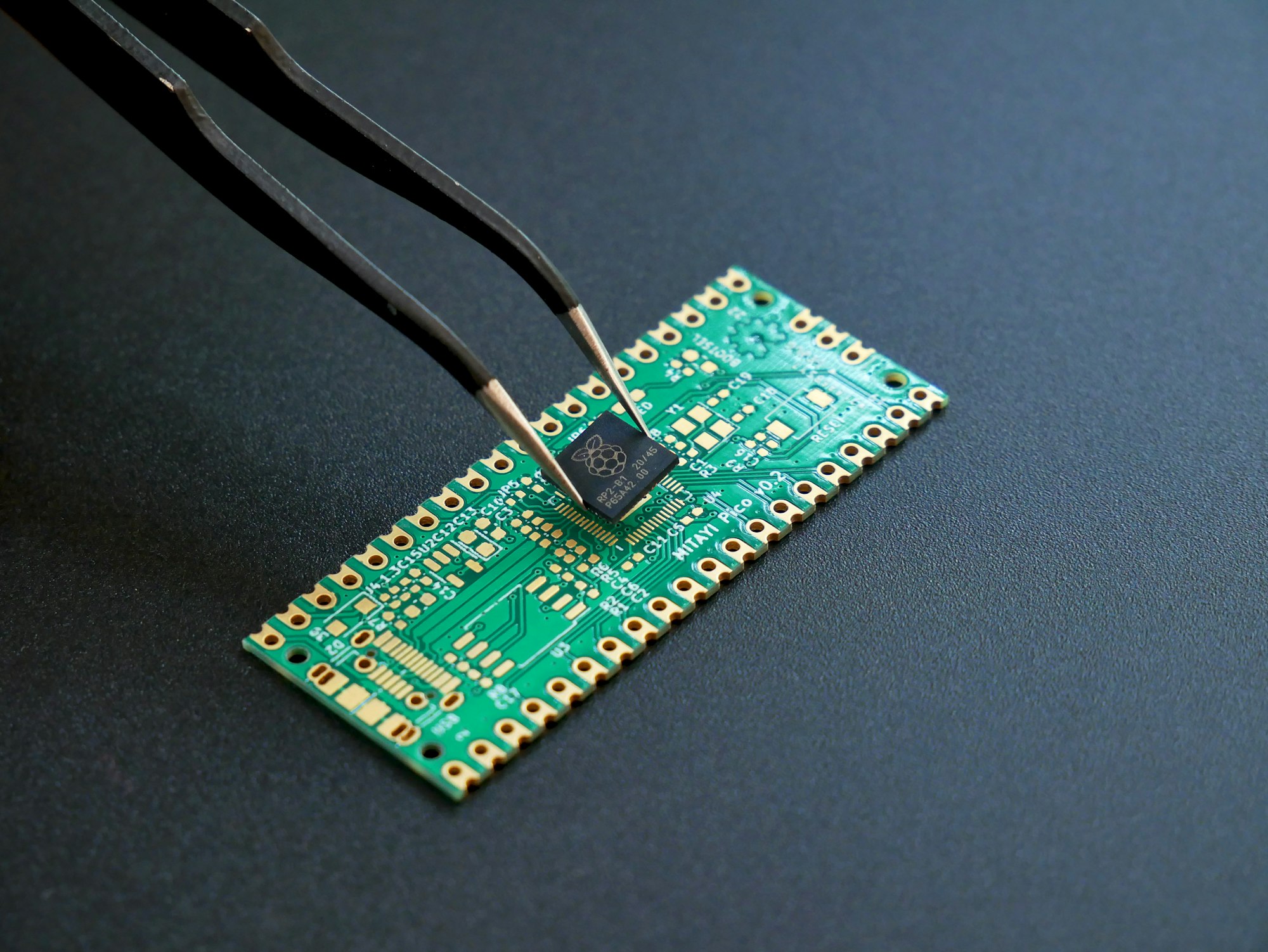

U.S.-based semiconductor and telecommunications equipment company Qualcomm has announced the acquisition of Autotalks, an Israeli chipmaker that produces chips for crash-prevention technology used in vehicles.

Autotalks is known for its dedicated chips that are used in the vehicle-to-everything (V2X) communications technology for both manned and driverless vehicles. This technology aims to improve road safety by enabling vehicles to communicate with one another and with the surrounding infrastructure.

With the deal, Autotalks' technology will be integrated into Qualcomm's assisted and autonomous driving product called Snapdragon Digital Chassis.

Although the financial details of the acquisition have not been disclosed, the acquisition price is estimated to be between $350 million and $400 million. Autotalks has so far raised $110 million from investors including Samsung, Toyota, and Hyundai, as well as financial backers Gemini Israel and Magma Venture Partners.

On the other hand, Qualcomm has gained momentum in its automotive business to date, counting General Motors, VW, Cadillac, Honda, Mercedes-Benz, and Stellantis among its customers. Its core CDMA business covering mobile and wireless chips and related tech saw automotive revenue of $975 million in FY21 and $1.3 billion in FY22.

Last year, the company's automotive business pipeline rose by over $10 billion to $30 billion which it credits to its Snapdragon Digital Chassis product. The chipmakers' revenue from its automotive business also increased by 20% to $447 million in its fiscal second quarter ended March 26.

With the acquisition, Qualcomm will now compete with Nvidia Corp and Intel's Mobileye Global for a share of the automotive chip market.