📉 South Africa’s funding setback impacted the Southern Africa region in 2022

In 2022, South Africa, one of the African continent's "Big 4", suffered a funding setback from the mouthwatering fundraising environment in the previous year.

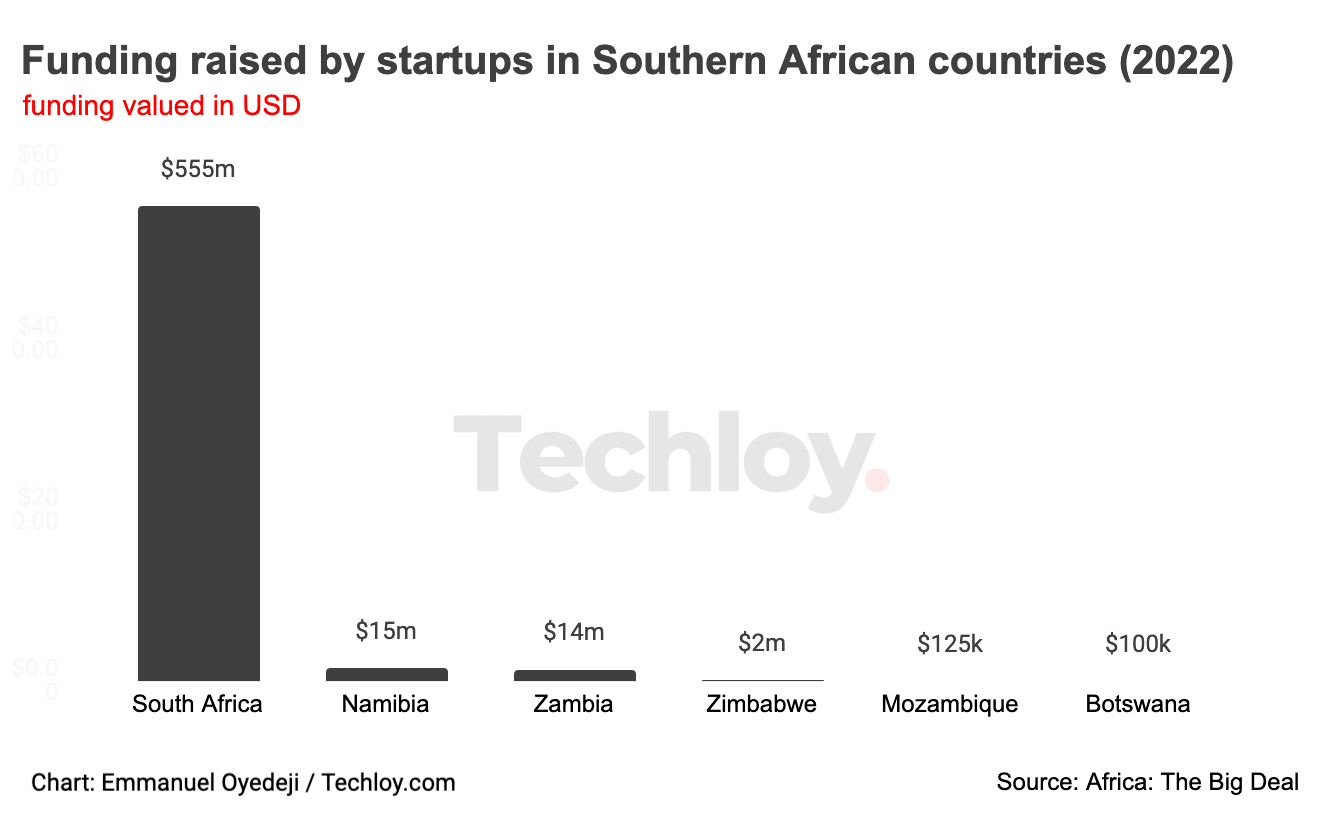

Funding raised in the country sank nearly -50% YoY from $1.1 billion in 2021 to $555 million in 2022, according to data from Africa: The Big Deal. The number of $100k+ deals also dropped -14% YoY.

The significant drop in overall investor deals in the country, set back total funding volume in the Southern African region, given the Big Four’s heavy share of the regional funding (over 90% since 2020).

The country however still maintained its dominance with a 95% share of the regional funding in 2022. Zambia and Namibia attracted 40x less funding each (~$15m). Zimbabwe recorded only three $100k+ deals (down from 6 in 2021), while Botswana and Mozambique each had one. Four countries in the region recorded no deal at all over $100k in 2022.

The largest 2022 deals in the country were the $100 million top-up to MFS Africa’s Series C and Clickatell’s $90 million Series C.

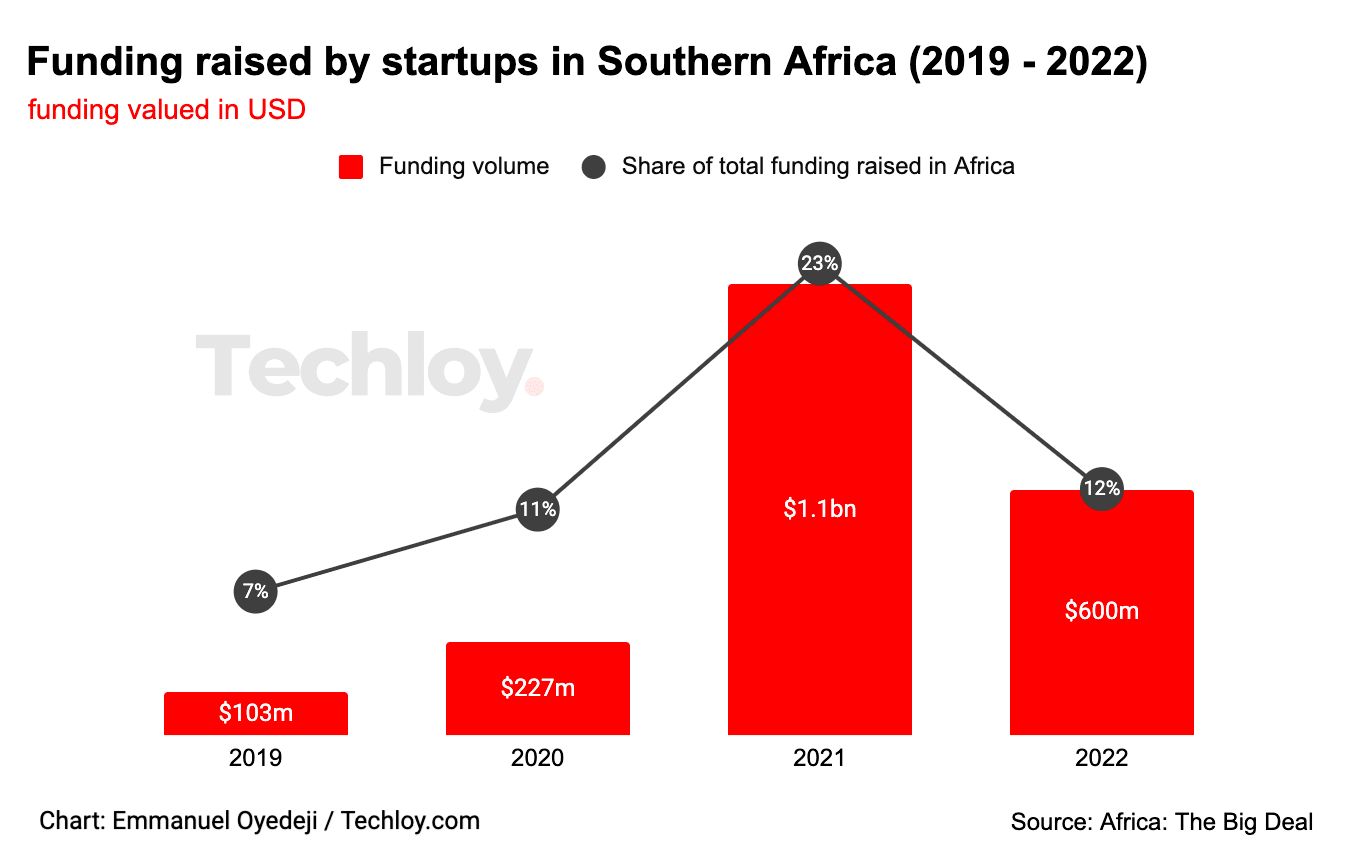

The below-average performance of Southern Africa is very closely linked to South Africa’s as just under $600 million was raised in 2022. The region now ranks fourth, falling far behind the other three main regions; back in 2021, it had ranked second.

Its share of continental funding dropped from 23% in 2021 to 12% in 2022 (-11pp). Worryingly, it is the only region where the number of $100k+ deals disclosed in 2022 was lower than in 2021 (131 vs. 160, -18% YoY), while all other regions recorded double-digit growth in this space.