Swiggy's valuation drops by 48.6% to $5.5 billion

US-based investment company Invesco has marked down the valuation of Indian food and grocery delivery platform Swiggy to $5.5 billion in January 2023, according to Invesco's latest filings with the Securities and Exchange Commission (SEC).

This is the second time that the Atlanta-headquartered firm which led the logistics company's $700 million funding round in January 2022 is marking down the company's valuation having previously marked it down to $8 billion in October 2022.

The revised valuation represents a significant 48.6% decrease from the $10.7 billion valuation previously attributed to the logistics startup as of January 2020 and puts it behind its listed competitor Zomato, which at one point had a market capitalization exceeding $13 billion but has since declined and closed at roughly $6.78 billion yesterday.

It is worth noting that Swiggy is not the only Indian startup to have its valuation reduced. BlackRock cut the valuation of Byju's, India's most valuable startup formerly to $11.5 billion in April, a sharp 50% markdown from the $22 billion at which the edtech startup was last valued in 2022.

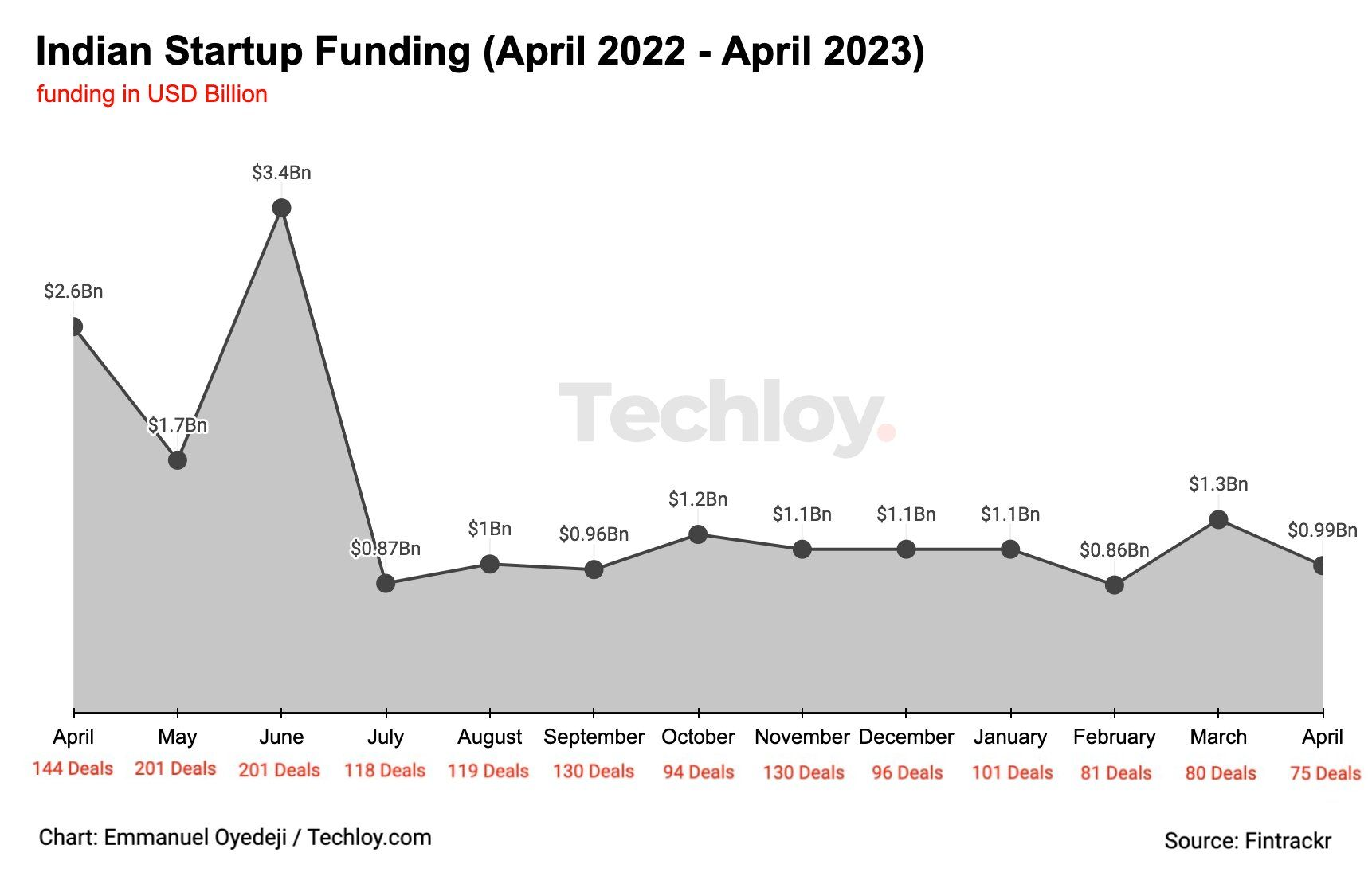

These recent valuation reductions highlight the impact of the global economic conditions on Indian startups. Since last year, startups within the Indian startup ecosystem have continued to witness a decline in funding activity, as the Techloy chart below further illustrates.