📊 Nigeria's Moniepoint records $170 billion in annualized total payments volume

Nigerian fintech company TeamApt is beginning the year with a brand new identity, as it adopts the name of its flagship product – Moniepoint. The company which launched in 2015, describes itself as an all-in-one digital financial services platform for businesses.

Since 2019, Moniepoint’s technology has powered over 600,000 businesses, offering all the payment, banking, credit and business management tools they need to succeed. The company claims to be processing the majority of the POS transactions in Nigeria, with over $170 billion in annualized Total Payments Volume (TPV), and more than doubled its annual revenues in 2022. The platform also launched a credit offering in 2022, which has already disbursed over $1.4 billion in working capital loans.

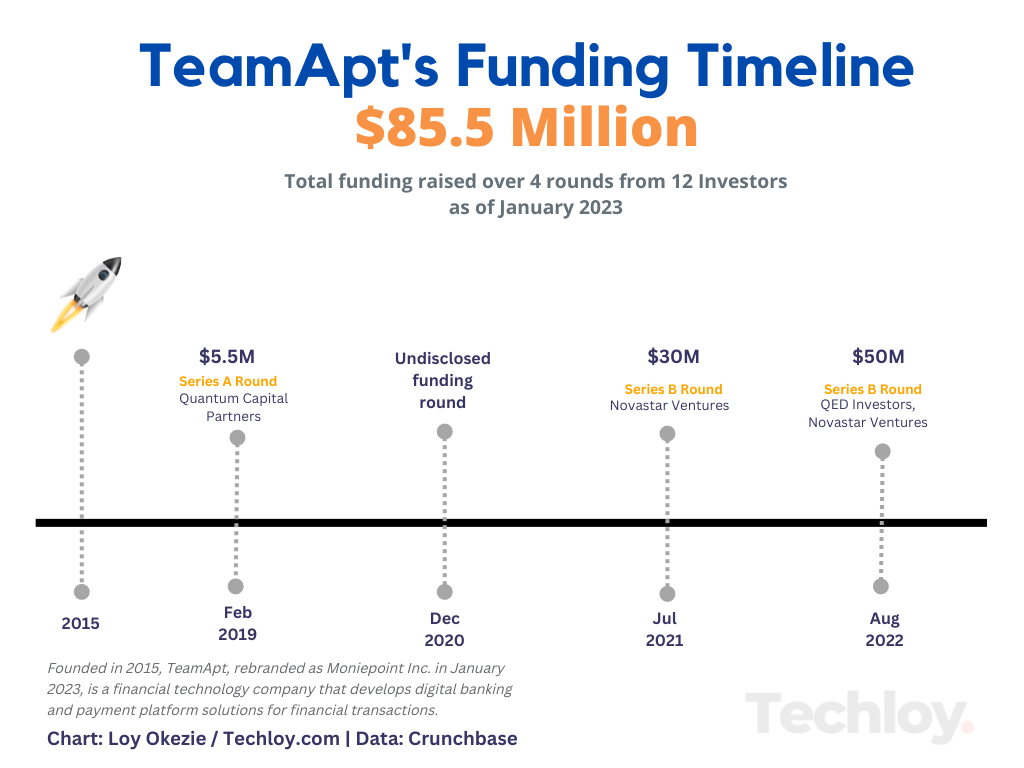

Having reached profitability in 2020, the company is backed by world-leading institutional investors, including QED Investors, Novastar, Lightrock, BII, FMO, Global Ventures, Endeavour Catalyst and New Voices Fund. In this Techloy chart, we take a look at TeamApt's (now Moniepoint) funding timeline from 2019 to date, which has seen it raise over $85 million in venture funding.