TikTok’s global growth fuels ByteDance revenue despite a looming U.S. ban

It highlights how much TikTok is propping up ByteDance’s bottom line.

TikTok’s future in the U.S. may still be hanging by a thread, but that hasn’t stopped its parent company ByteDance from pulling off one of its biggest growth years yet.

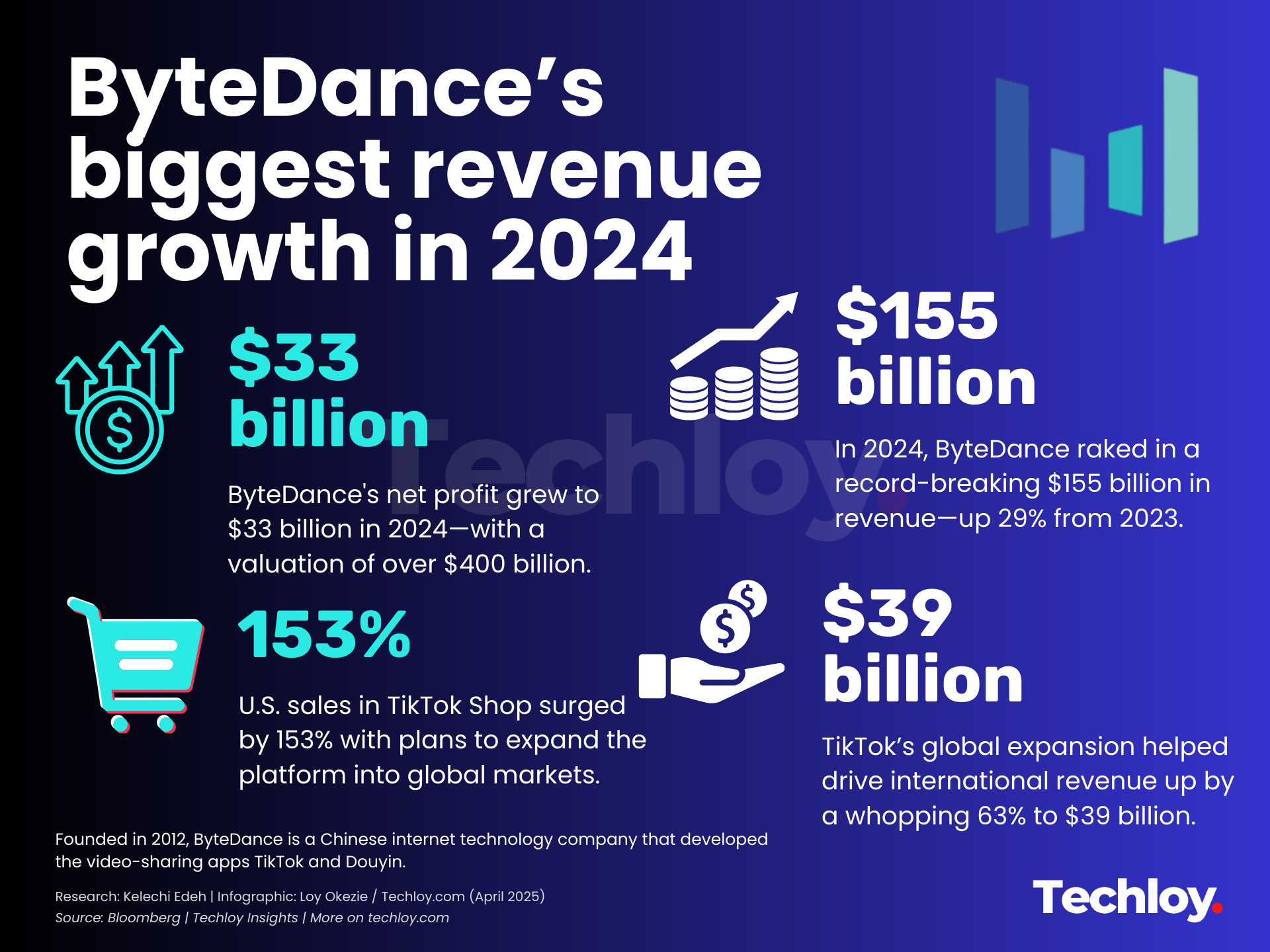

In 2024, ByteDance raked in a record-breaking $155 billion in revenue—up 29% from the previous year (via Bloomberg). That’s nearly double Tencent’s 2024 revenue ($91.9 billion) and just shy of Meta’s $164.5 billion.

The real MVP behind this growth was TikTok. The app’s global expansion helped drive international revenue up by a whopping 63% to $39 billion—the highest share of overseas revenue in the company’s history. Altogether, TikTok now makes up about a quarter of ByteDance’s total revenue.

Meanwhile, ByteDance's net profit also grew to $33 billion in 2024, with some investors now valuing the company at over $400 billion—up from $300 billion just months ago. That sharp rise highlights how much TikTok is propping up ByteDance’s bottom line, especially as its Chinese apps like Douyin show a slow down amid domestic economic pressures.

But even with the app staring down a potential U.S. ban, TikTok’s e-commerce and advertising engines doesn't seem to have let up. In January 2025, TikTok Shop’s U.S. sales surged by 153% with the tech giant now pushing the platform deeper into global markets—adding TikTok Shop in countries like Germany, France, and Italy.

ByteDance is also doubling down on AI through products like Doubao (now second only to Baidu’s Ernie Bot in China) and exploring video generation and developer tools to diversify its earnings.

So, while TikTok’s U.S. status remains up in the air, ByteDance is doing what it seems to do best: scaling fast, pushing globally, and staying one step ahead of the storm.