TSMC Could Face A $1 Billion Fine Over Export Control Violations

Investigations are still ongoing to find out how those chips wound up in Huawei's hands.

International trade has been a hot topic in the U.S. lately, especially with tariffs hitting countries across the board—most notably China and Taiwan.

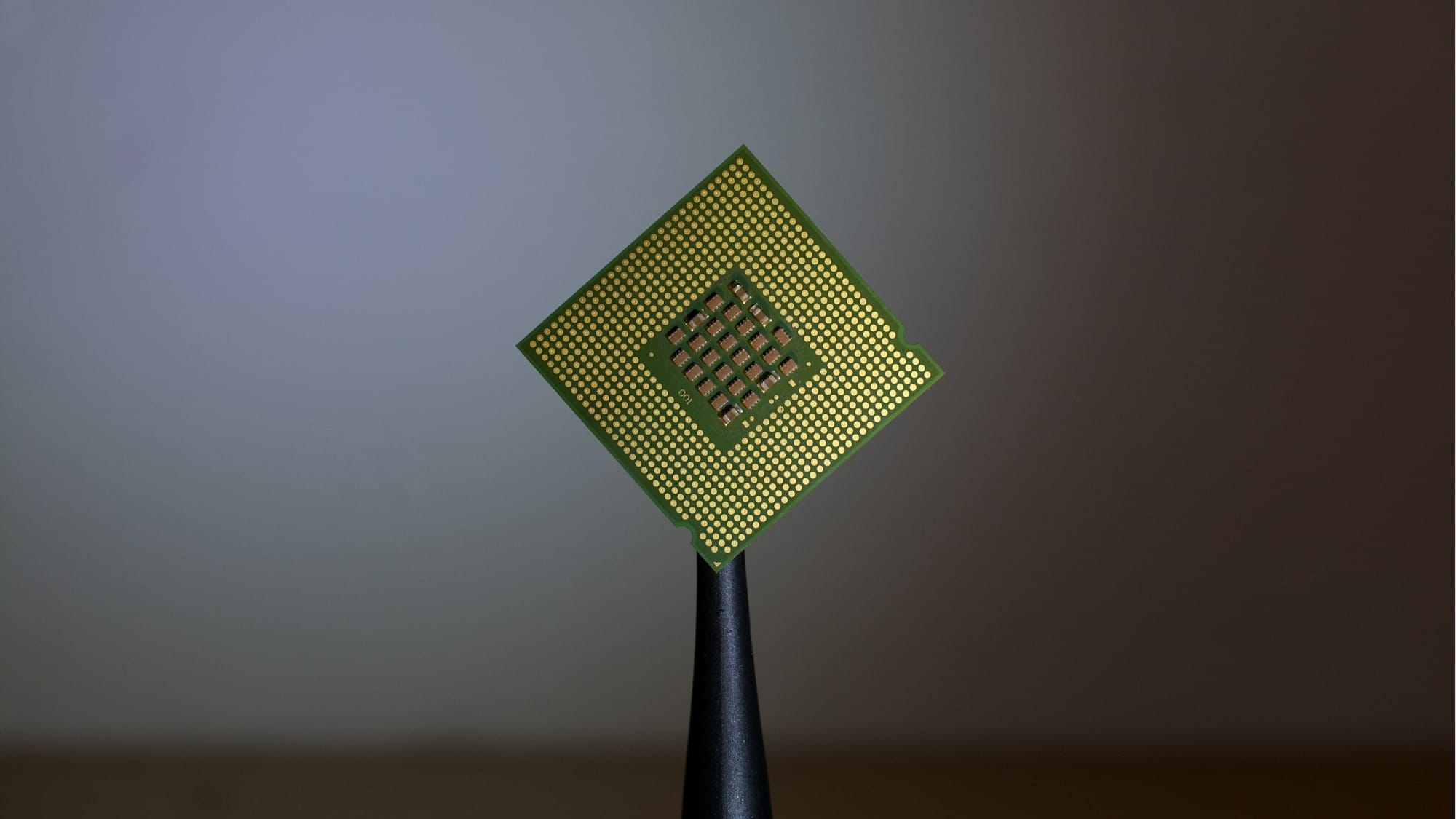

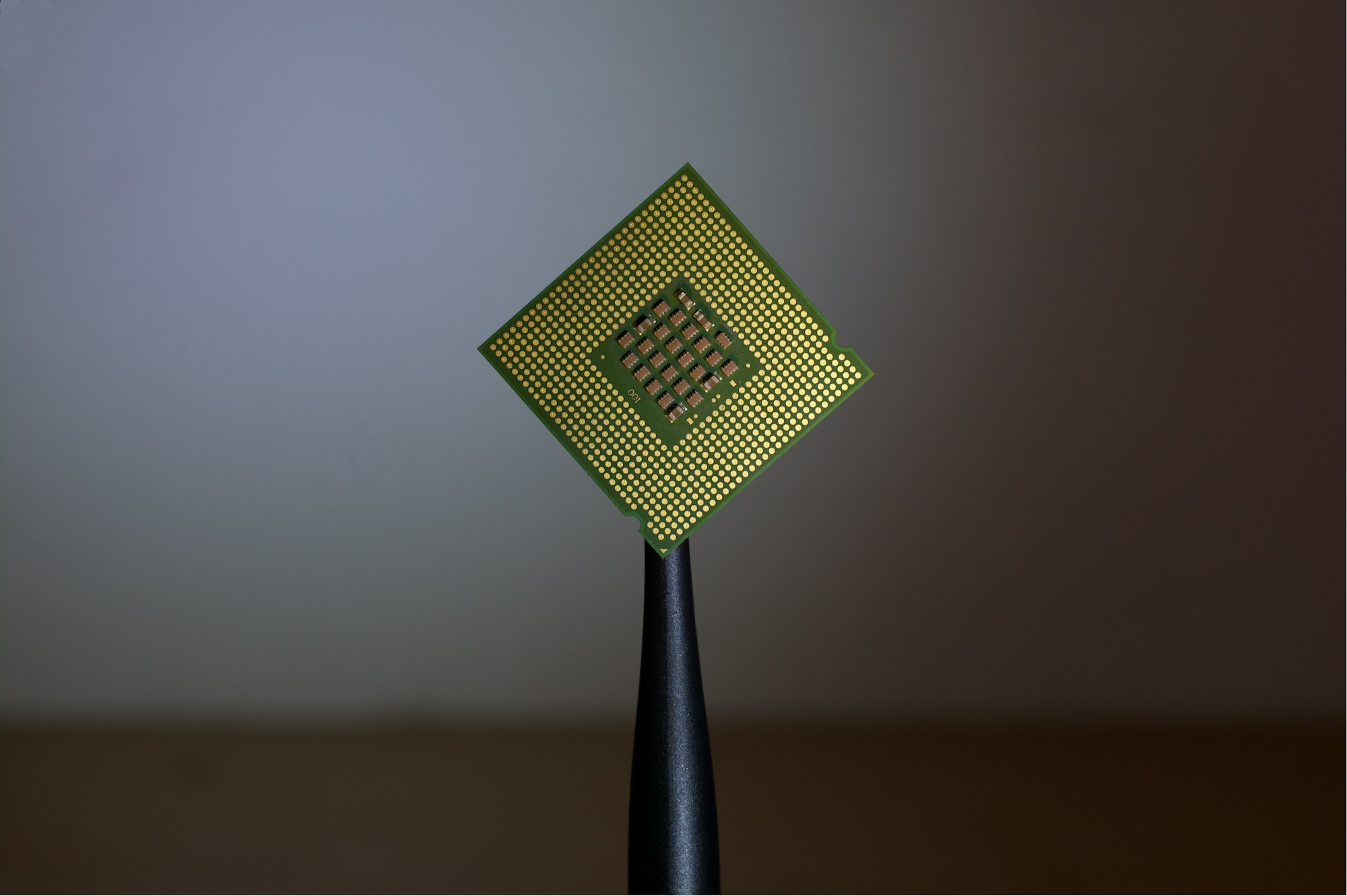

Amid these escalating tensions, Taiwan Semiconductor Manufacturing Company (TSMC)—the world's largest chipmaker— has found itself in hot water, not for dealing with tariffs, but for potentially violating export controls. TSMC is under investigation for its dealings with a Chinese company, and the stakes could be higher than anyone expected.

The case centers on allegations that TSMC supplied chips to Sophgo, a Chinese firm whose products may have ended up in Huawei’s Ascend 910B AI processor. Huawei has been on the Entity List, a U.S. trade blacklist since 2020. This means that chipmakers, including TSMC, Intel, and Qualcomm, are prohibited from selling chips to Huawei. If the chips TSMC manufactured were diverted to Huawei, it could constitute a breach of export laws.

TSMC, which relies heavily on U.S.-origin technology for its manufacturing equipment, could face steep penalties. Under current export control rules, fines can reach up to twice the value of the illegal transactions—potentially over $1 billion in TSMC’s case.

Since the investigation began, TSMC has taken action to clear its name. The company suspended shipments to Sophgo in late 2024 after discovering the chips may have been redirected. The company says it is cooperating with the U.S. Department of Commerce and remains committed to compliance.

The timing is crucial, as U.S.-Taiwan relations are already strained over trade disputes. Though semiconductors have largely been exempt from recent tariffs on Taiwanese imports, scrutiny over TSMC’s actions could further complicate relations, especially as the U.S. seeks to limit China’s access to advanced technologies like AI.

TSMC’s case underscores how complex enforcing export controls has become, especially when products pass through multiple hands. In 2023, Seagate Technology also faced similar fines of about $300 million for shipping hard drives to Huawei.

Despite the controversy, TSMC is deepening its investment in the U.S. It recently signed a $100 million deal that would go towards building five advanced chip factories in the U.S. in the coming years.

Looking ahead, TSMC’s response will likely set a precedent for how semiconductor companies navigate export controls. A single lapse in oversight is no longer just a compliance issue, it’s a matter of global trade and geopolitics.