U.S. chips away at China's tech ambitions for advanced chips and chip-making equipment

As 140 Chinese companies have been added to the blacklist.

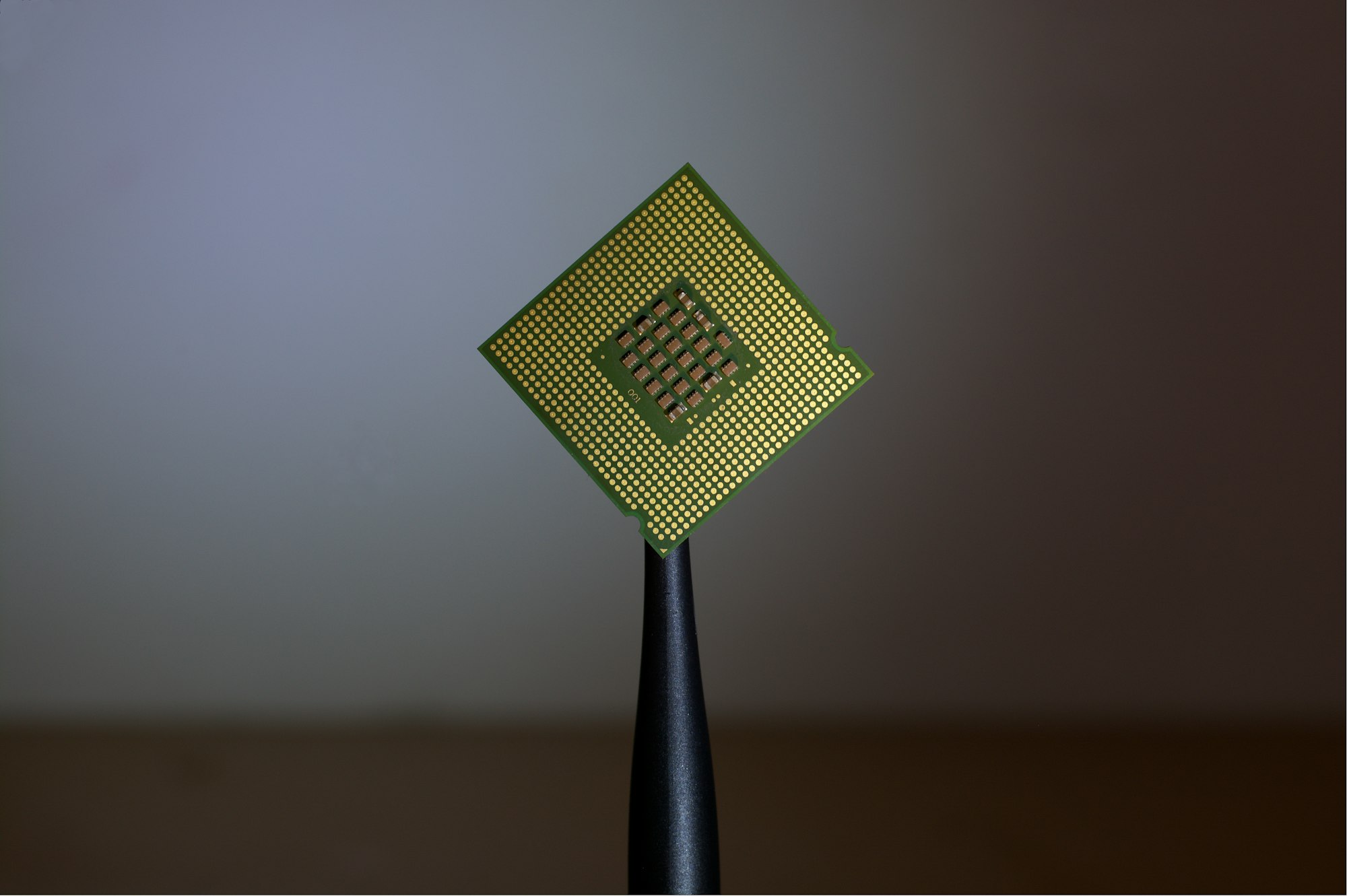

Tensions between the U.S. and China are flaring up again, and this time, they are fighting over semiconductors, yeah, those tiny gadgets that power laptops, phones et al.

In what might be described as the biggest crackdown yet on China’s chip industry, the Biden administration has added dozens of Chinese companies to its trade blacklist – with export bans targeting 140 Chinese companies, including big names like Naura Technology Group, Piotech, and SiCarrier Technology.

The crackdown, part of an ongoing effort to limit Beijing’s access to advanced technology, marks the third major intervention in three years with restrictions covering everything from high-bandwidth memory (HBM) chips to advanced manufacturing tools.

A significant focus of the restrictions is high-bandwidth memory (HBM) chips, which are essential for advanced computing tasks like AI training. The rules restrict shipments of chips corresponding to HBM2 and newer versions, effectively throttling China’s ability to power cutting-edge technologies. This is expected to hit companies like South Korea’s Samsung and SK hynix hard since China makes up a big chunk of their HBM chip sales. Samsung, for example, gets about 30% of its revenue from selling HBM chips to China, so the impact could be significant.

But the restrictions don’t stop at chips.

They also target tools needed to make them—etching machines, lithography equipment, and ion implantation tools, to name a few. The U.S. has banned exports of 24 types of chipmaking tools from key countries like Taiwan, South Korea, Malaysia, and Singapore. Interestingly, tools from the Netherlands and Japan have been exempted, at least for now. This move is expected to impact U.S. companies like Lam Research, KLA, and Applied Materials, as well as global players such as Dutch manufacturer ASML.

To make sure these rules stick, the Commerce Department has added 140 companies to its Entity List. This blacklist includes semiconductor makers, investment firms like Wise Road Capital and Wingtech Technology, and others accused of helping China advance its chipmaking goals. Some of these companies, like Swaysure Technology Co and Shenzhen Pensun Technology Co, have ties to Huawei—a firm already under heavy scrutiny in the U.S.

China’s leading chip foundry, SMIC, might also face tougher restrictions. While SMIC has been on the Entity List since 2020, it’s still been able to secure billions of dollars in licenses for U.S. exports. This could change with the latest crackdown, which signals a shift toward stricter enforcement.

The new rules represent a significant escalation in the U.S.-China tech rivalry. By cutting off access to key technologies and components, Washington seeks to stymie China’s progress in AI, high-performance computing, and other strategic sectors. However, the impact is likely to ripple across global supply chains, reshaping the semiconductor industry and deepening the divide between the world’s two largest economies.