Why every Nigerian bank should learn from Fidelity Bank to empower young people with technology skills

Young people, they say, are future leaders.

While some may argue to the contrary, especially in politics, there’s no doubt that young people are leading in the technology, entertainment and fashion sectors.

Despite the ravaging economic recession, resulting in the second highest unemployment rate ever in Nigeria within the past ten years (18.8% as of Q3, 2017) and the little or no educational training on the skills and careers of the future, the youth have continued to be resilient and determined to go against the tide and buck the trend.

Over 27 million Nigerian youths were unemployed, according to the National Bureau of Statistics (NBS) as of September 2017.

While youth empowerment programmes by the government and non-governmental organisations have attempted to provide young people with the necessary skills to thrive, there’s an urgent need for such programmes to adequately prepare young people for the careers of the future and thus create the most significant impact for the economy: job creation.

That’s where the Nigerian banks come in.

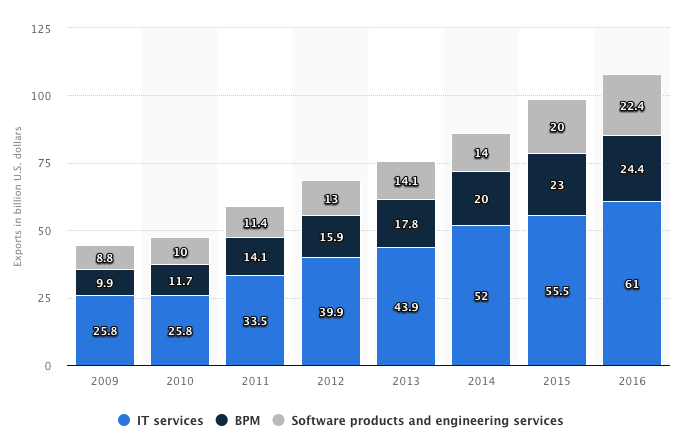

But while Nigerian banks have arguably become the largest employer of young people, especially fresh graduates between the ages of 21 and 28 years, at least for the past 15 years, they have continued to rely on foreign technology (hello, India) to power their banking software.

This should change.

Interestingly, some banks like Fidelity Bank are now organising coding camps for pre-teen and teenagers, in partnership with local software development companies (and yes, run by young Nigerians) to teach them how to code for free and potentially prepare them for future careers in software development.

This initiative could further be introduced to Universities and Polytechnics, especially targeting students in Computing or any other discipline but with a keen interest in programming. The banks could organise coding camps either during sessions on campus or during holidays in the summer, across the six geo-political zones in Nigeria.

Banks could also partner with a youth-focused government agency such as the Nigerian Youth Service Corps (NYSC), to help corp members who have basic coding skills to harness those skills during camp and throughout their 1-year compulsory service.

Of course, these would be considered ‘baby steps’, but in the long run, they could result in the creation and adoption of local software, reduction of the unemployment rate, tackling the failings of the educational system, creation of jobs and the building of technology solutions that would solve Nigeria’s teeming problems.

Although technology skills are not the only skills needed to thrive in a 21st century economy; there are entrepreneurial and financial skills needed also, but if banks could train young people now in software design and development, we could see a future where the youth are truly the leaders of tomorrow.

Indeed, banks can play a key role in bridging the gap in the digital skills of Nigeria’s future leaders, making them compete not just locally, but globally.