Why You Need to Check Your Credit Score in India

Think of your credit score as a performance tracker that reflects your financial habits and stability.

On a scale of one to ten, how would you rate your financial stability? If you hesitated for even a second, then it might be time to take a closer look at one crucial number that influences your financial health—your credit score.

In India, regularly checking your credit score (such as your CIBIL score) is essential to manage your finances, identifying potential errors, and improving your chances of securing loans or credit cards on favorable terms. But what exactly is a CIBIL score, how does it relate to your credit score, and why should you make checking it a habit? Let’s break it down.

What Exactly is a CIBIL Score?

The CIBIL score, issued by TransUnion CIBIL, is a three-digit number ranging from 300 to 900 that represents your creditworthiness. It is calculated based on your credit history, repayment behavior, credit utilization, and other financial activities. A higher CIBIL score indicates responsible credit behavior and makes it easier for you to obtain loans or credit cards at lower interest rates.

CIBIL Score Range and What It Indicates

- 750 – 900: Excellent - Strong creditworthiness; high chances of loan and credit approval with favorable interest rates.

- 700 – 749: Good - Eligible for loans and credit cards with competitive interest rates.

- 650 – 699: Fair - May qualify for loans, but possibly with higher interest rates and stricter terms.

- 550 – 649: Poor - Limited credit options, higher interest rates, and potential difficulty in securing loans.

- 300 – 549: Very Poor - High risk for lenders; loans are rarely approved.

How Does It Relate to Your Credit Score?

Your CIBIL score is one of several credit scores you can have. While CIBIL is the most widely recognized credit bureau in India, other agencies like Experian and Equifax also generate credit scores based on similar parameters. All these scores serve the same purpose—helping lenders assess your reliability as a borrower. Having a good CIBIL score typically means you’ll have a strong credit score with other bureaus as well.

Why Should You Make Checking Your Credit Score a Habit?

1. Assess Your Creditworthiness

Your credit score is a reflection of your financial reliability. Lenders use it to determine how trustworthy you are as a borrower. A high score increases your chances of loan approval and allows you to access lower interest rates, which saves you money in the long run.

2. Spot and Correct Errors

Mistakes in your credit report—like incorrect account details or unaccounted-for loans—can lower your score unfairly. Regularly checking of your report will help you spot these inaccuracies and get them corrected before they impact your financial opportunities.

3. Detect and Prevent Fraud

Identity theft and unauthorized financial transactions are growing concerns. By keeping an eye on your credit report, you can catch any suspicious activity—such as fraudulent loan applications or credit card misuse—before they cause serious damage to your financial profile.

4. Effective Financial Planning

For effective financial plans, your credit score isn’t just about loans; it’s a powerful financial tool. When you understand where you stand in your credit score, it allows you to plan better, make informed borrowing decisions, and ensure you're always in control of your debt and finances.

How to Check Your Credit Score (CIBIL) in India

Checking your credit score is simple and can be done online. You can access your score through official credit bureaus like CIBIL (TransUnion CIBIL Limited), Experian, or Equifax. Follow these steps:

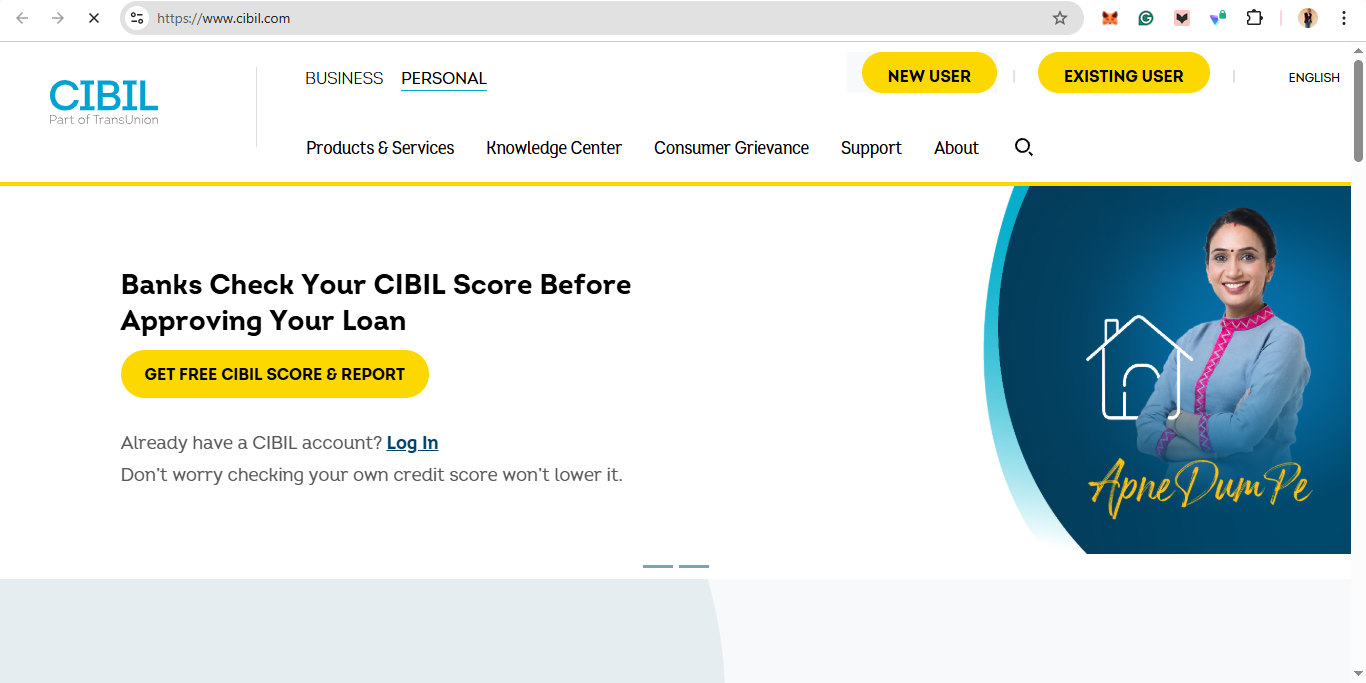

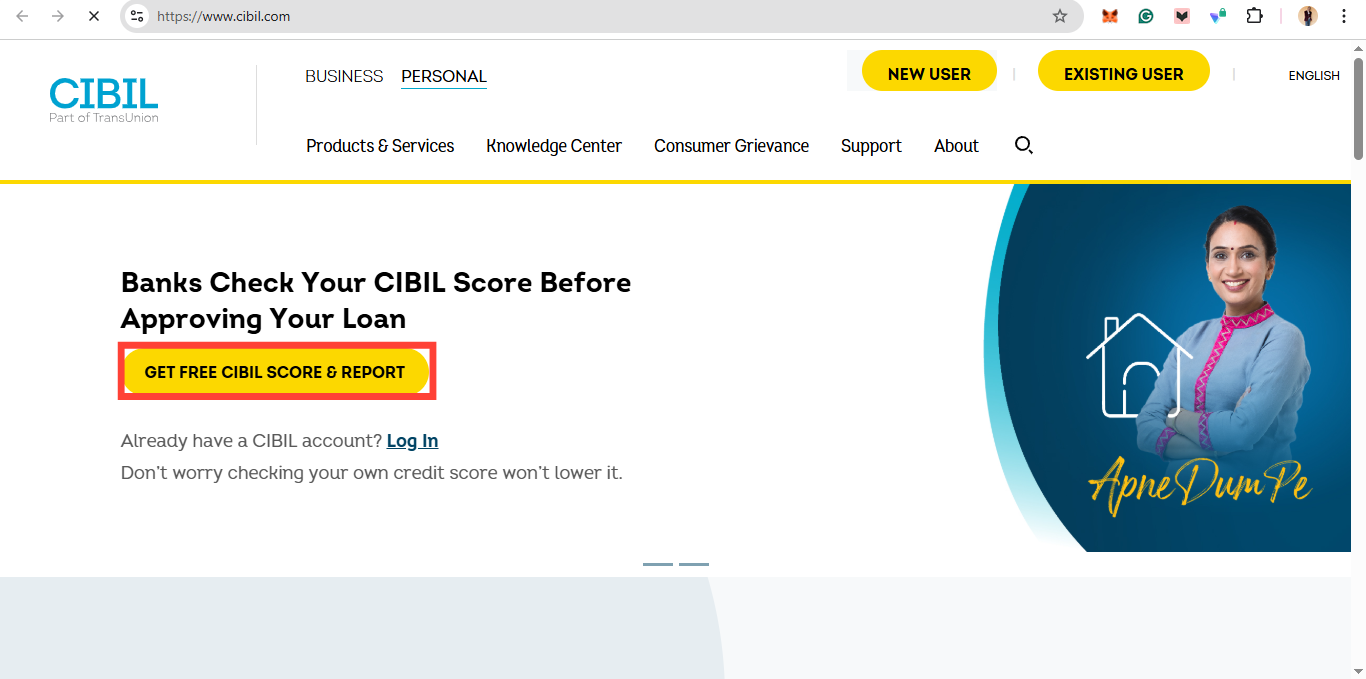

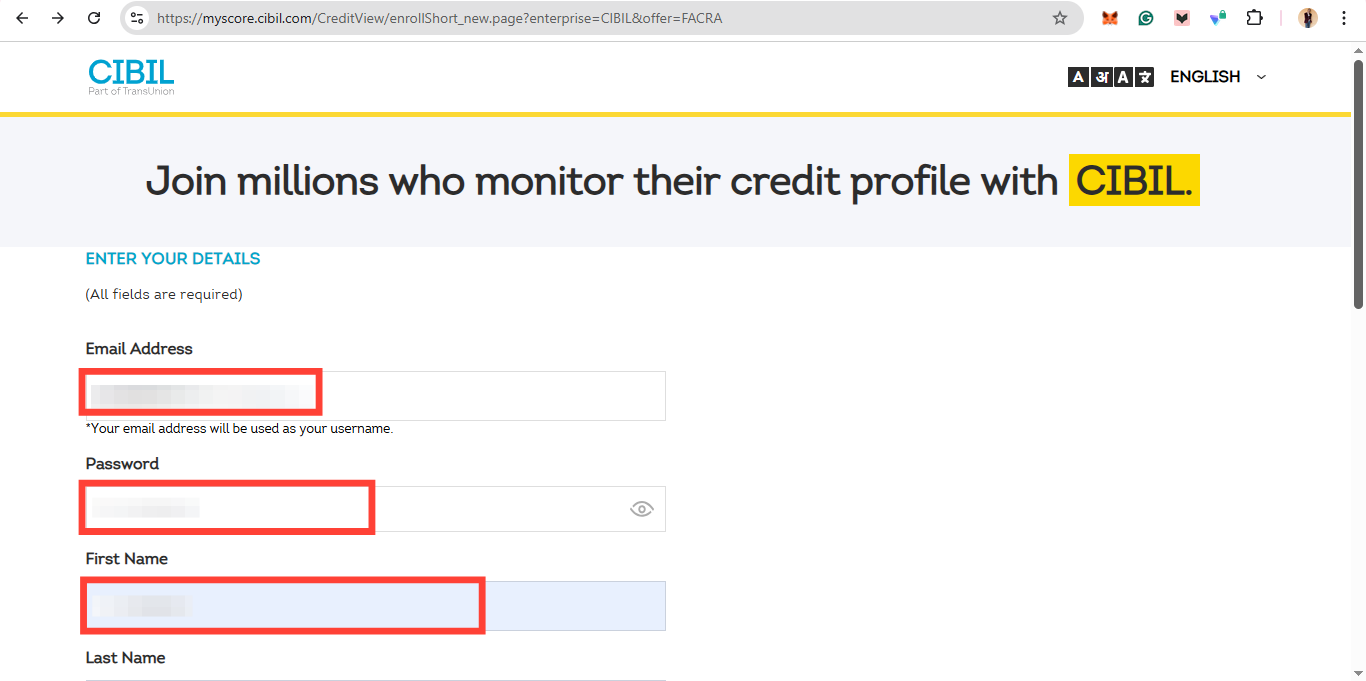

Step 1. Visit the official CIBIL website

Step 2. Click on "Get Free CIBIL Score & Report"

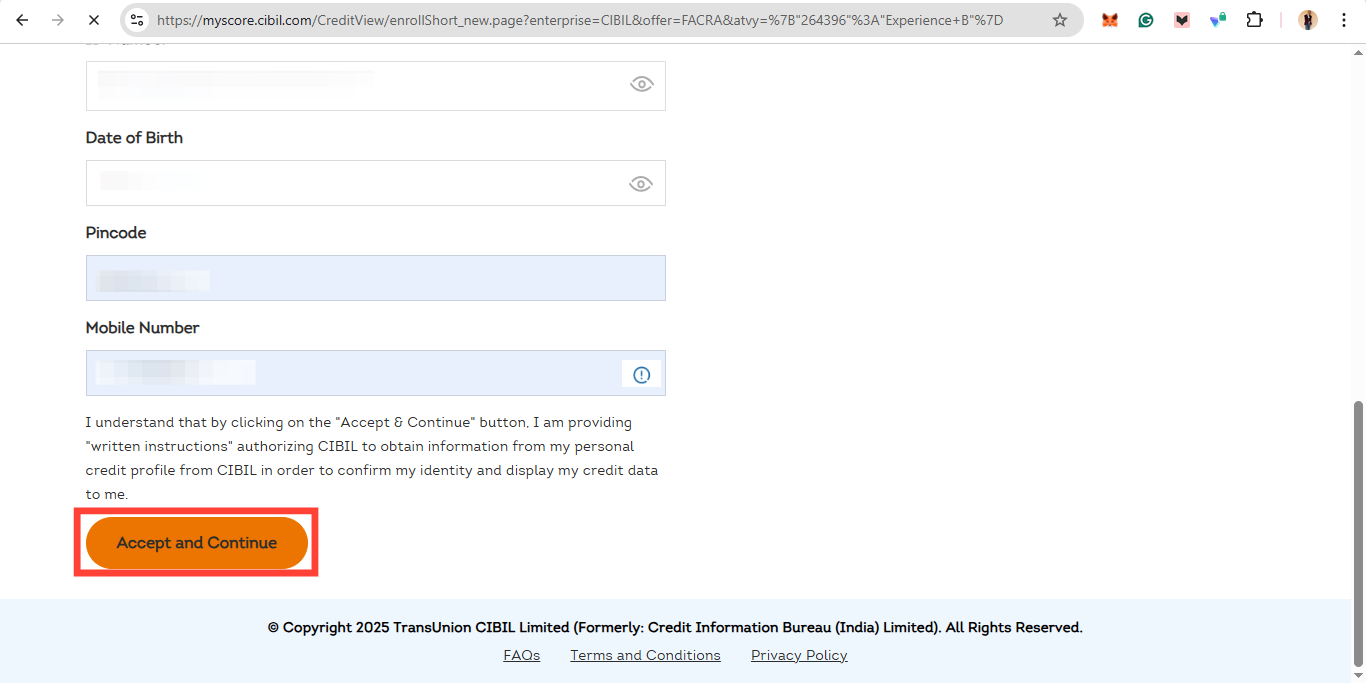

Step 3. If you already have an account log in with your details. If not, register your details then click "Accept and Continue" to access your score and report.

Conclusion

Your credit score is more than just a number—it tells the story of your financial habits and decisions. Keeping track of it isn’t about chasing perfection but about staying informed and avoiding surprises. A quick check now and then can help you spot errors, understand where you stand, and make adjustments before they become issues. It’s a small habit that can make a big difference in your financial journey.

Image credit: David Adubiina/Techloy.com